Around here (Boston and near suburbs), very low inventory and a good job market for college/post-grad educated folks keeps prices high. Small changes in interest rates likely won’t change that much, but big changes could. Obviously, if the employment picture changes dramatically that will have a huge impact. Boston job market is buoyed by a base in healthcare and higher education where demand doesn’t change as much as other industries during recessions.

Our population is growing, while housing supply is not in many areas (particularly SFHs). There are a lot more people (in quantity) making more than average than 10 years ago. 2008 was preceded by a boom in housing development, but housing new starts are relatively low compared to then (~60% what it was at the peak of the bubble).

Boomers have invested tons of money into their houses but there is going to be no one there to buy all these over-inflated properties when boomers start to croak en mass. Millennial and gen X with their massive student loans and meager wages are not going to be able to buy the houses at over inflated prices. In fact there would have already been a massive correction if the US fed had not PRINTED trillions of dollars OUT OF THIN AIR to buy bad mortgages and over inflated houses back in 2008-2009 (quantitative easing)

TL:DR

Boomers all croak in 2020, tons of mcmansions in the cookiecutter suburbs flood the market from their children trying to get rid of the depreciating property tax liability. Houses lose 50% of their value in 6 months. It’s simple supply demand.

I really don’t know if such a statement is meant to be taken seriously at all or if your whole post is meant as some sort of poor humor.

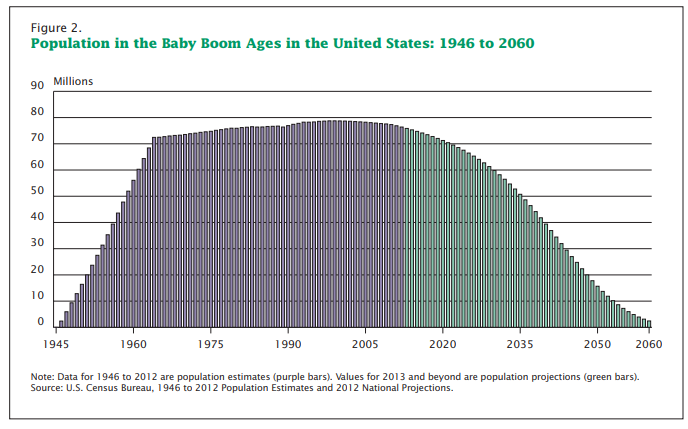

But in any case… Boomers were born between the years 1946 and 1964. That means they’re currently 54 to 72 years old. They’ll live another 14 to 28 years on average.

And Boomers don’t all own mcmansions in suburbs. Median value of homes owned by Boomers is ~$175k.

You beat me to it.

If only there were some way to get more people into the country and stimulate demand.

Why would we do that when liberal cities across the country are already trying to build an infinite amount of low cost housing for the lower - lower middle class I’m highly desirable areas?

If that were true, why would housing in those markets be appreciating faster than the national average?

The size of affordable housing budgets targeting housing for 80% AMI and below has grown in NYC, Boston and DC over the last 5 years, while at the same time housing costs for 81%+ AMI have also grown.

A caveat is obviously that chart shows ~1M a year are already dying. So it’s already starting and looks to near the fastest decline rate per year (the slope on your chart) in around 7 years from now based on your chart. Not 14-28. Sure, the decline continues for 30 years after that.

On top of that, many will sell (or gift to a kid) their house and move into a senior home or move in with their kid(s) several years before they die. Especially after a spouse is gone.

I would still think this effect would be small in growing cities. But maybe not in those 2hr commute suburbs and country real estate, or cities that are not growing… (Everyone I know at work that lives more than an hour commute are 50-60+)

I don’t see it accelerating in 7 years. Its a fairly smooth, gradual decline.

The current average lifespan of the boomer generation is ~20 years.

You can see in the chart that the boomers population will be about 1/2 in ~20 years.

The 2 hour commute suburb near you may be more boomers. Big expensive houses are more often owned by mature people with higher incomes and wealth so they’ll skew to older ages.

There are no 2 hour commute suburbs anywhere near me nor near most Americans AFAIK.

You also have to look at the Millenial population and their home buying. The Millenials are now the largest population group and they’re buying homes at a faster pace now than any other age group. They’ll likely to consume the housing left by Boomers in general.

They’re not so much suburbs as “small towns” / lakes etc, ~20 mi outside the city, sometimes on the other side of the city. (And the city is 20+ mi across).

This seems logical but if you look at Net Worth vs age sans primary residence, it seems less likely to be an accurate assumption. Most old people likely only have “more expensive” houses because they first bought a house a long time time ago at a much lower price (relative to their income at the time) and it has “appreciated” over the years. By many measures the previous generations are poorer savers/spenders.

A growing affordable housing budget is not equivalent to “build[ing] an infinite amount of low cost housing for the lower - lower middle class”

Good point. Its some of both I’m sure.

If we’re talking McMansions then thats a relatively newer phenomenon and not a house that was cheap decades ago since most were built in the past 10-15 years.

You are right. It is hyperbole and not fact. Affordable housing advocates do seem to want anyone with <80% AMI to live in a neighborhood of their choosing for <30% of their income. It’s not a realistic outcome.

In Boston, I believe it’s a fixed percentage of housing stock that is targeted for affordability (20% I think) So, it grows linearly with housing stock and not available to anyone with <80% of AMI.

What happens when someone in that affordable stock wants to sell and move?

For anyone else wondering, AMI = area median income, a statistic generated by HUD.

We bought our first house last year and lucked out I think in an environment when some were going into escrow the same day.

I really dont see how there’s going to be a housing ‘pop’ any time soon.

It sounds like few here have perspective on rates. Even if they went up a few percent, I believe historically it’d still be very reasonable. I was going through paper in my parents’ basement last Christmas and came across an old mortgage statement from the 80s - interest rate like 15%… think about that.

The housing market is also not able to grow at nearly it’s ‘potential’ because inventory is so horrible - its slowing down the situation and ensuring it doesnt build too much pressure. I’m still curious why the building market hasn’t caught up when they’ve been aware of it for a couple years now.

Is housing in demand? sure! And it’s competitive. But I’m not seeing any crazy attitudes or hints that it’s out of control or about to fall apart.

I also hear that following '08, many more investors bought up properties - so that an even larger inventory is off-limits as rental only now…