That’s a worthy clarification. Thanks.

Thank you also for this thread. I consult it from time to time, and get value from the discussion… even when I’m just sitting here silent and grateful.

That’s a worthy clarification. Thanks.

Thank you also for this thread. I consult it from time to time, and get value from the discussion… even when I’m just sitting here silent and grateful.

Citizen’s Access Savingsup to 2.35%

You might as well use the Vanguard Treasury Money Market, it’s exempt from state tax.

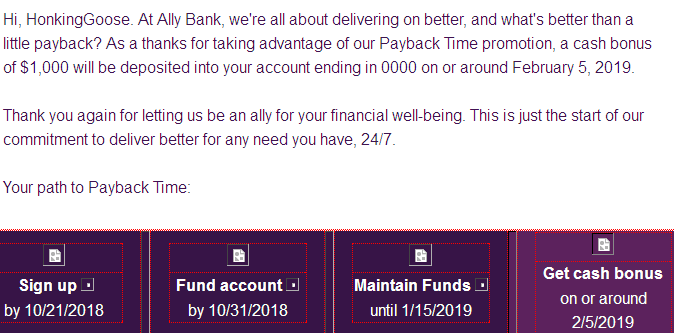

The Ally 1% bonus payments are secure, although they want be paid out until February. Funds are now liquid without endangering the bonus.

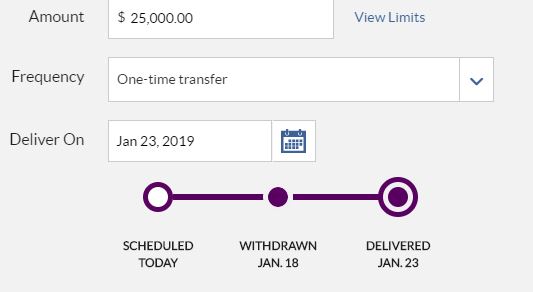

I assume that was email … I look forward to seeing mine show up soon. I’ve scheduled a transfer out for next Tuesday. Any time before that and there were as many as five days without any interest from anyone. I didn’t see any better way to play that.

Dang, I didn’t think about a pull from external being better than a push from Ally. I was going by the Ally timeline which shows that the debit at Ally would occur as many as five days before the funds are actually deposited elsewhere.

Update: I was able to enable pull from my external account instantly (i.e. no trial deposits) and initiate a pull for tomorrow. Thanks for the wakeup call, Shinobi!

Sure no bigee. I actually posted that several day ago.

The beauty using PurePoint, of course, is four days of DOUBLE interest. I’m a huge fan of double interest, aka, free money.![]()

The PurePoint policy of paying interest on money before they even have the money is so darn sweet. But never more so than when you have a Federal holiday to boost your joy.

Ally Online Savings now at 2.20%. But they are a couple of tenths short and two days late to keep my money. That’s their Ally oops, I guess.

Humor in the BNAHAPYLA. Starting 2019 off right.

For the Vanguard idea, if you use the brokerage account do you have an option of sweep account? The advantage of the brokerage account as I see it is that you get to have no minimum (and use as a de facto checking account as well as brokerage) but I think you are made to be in VMFXX.

This seems like a good option for those that are already in the Vanguard ecosystem.

earn bank up to 2.41%

Ken is featuring a High Yield Savings account on his blog that I haven’t heard of before. Tab Bank High Yield Savings 2.30%

Ken is featuring the Leader Money Market account from Mutual Bank. 2.43% on deposits up to 250k. Minimum opening deposit is 1k new money. What’s interesting is they promise to automatically match the Fed Fund Rate on the 15th of each month. Thoughts on this one?

@zzz Thanks for sharing about mymutualbank. It has me intrigued. Thinking about using it for a cd that Matures on Friday.

I found the Ally 1% bonus deal so much fun, that I am doing a similar Capital One deal. There is $500 on $50,000 on deposit for 90-100 days or a different deal to get $600 on $100,000. The latter is not available if you’ve ever had savings at Capital One (and presumably ING DIrect). Ever. But the first deal only looks back to 2016.

True they are only paying 2%, but the effective rate for the 100 days on $50,000 is 5.65%. I’ll take it.

Do you have a link to this promotion?

All America Bank and Redneck Bank both up to 2.5%

I believe those are capped at 50K FYI.

Yes, sorry.