There will be plenty of ugly days ahead. Two down days amidst so many up days hardly makes a difference though. A painful correction is what you are looking for and whether that comes this year or next is anybody’s guess. Only thing more painful than a correction is sitting on the sidelines in cash with a long time horizon watching the market go to the moon.

Fixed that for you ;). #BitcoinBillionaire

Politics aside, does anyone here understand the favored tax status they’re putting on passthroughs?

Am I looking at the “23% deduction on passthrough income” too simplistically (maybe it doesn’t apply to all passthroughs, etc) by assuming:

1)Throw taxable investments into a passthrough entity

2)Short and long term gains flow back as they currently do, to the individual return

3)You then get to deduct 23% (or whatever they end up at) off of regular income

Net effect: Tax on STCG is reduced 23%. Tax on LTCG is reduced ~50% (deductions come off regular income rates while the taxed income is at lower LTCG rates). Pass through investment accounts may now be more favorable than retirement accounts (not sure, would need more investigation) ???

I’m not digging into the details of that part of the bill until they actually pass it, since there’s still a lot in flux.

This is never going to be the case. Retirement accounts have an internal tax rate of 0% (i.e. Ignoring the withdraw tax, if any, which is separate than the investment gain tax), and you’re never getting your taxable account investment tax below zero in practice. You’d need a very fortuitous combination of tax loss harvesting and holding every winner until you die just to have a chance, and even then the dividends will probably get you over zero.

You’re right

edit:I was forgetting to account that with taxable account you must pay regular income rate on the starting funds, which basically starts it out on par with both roth and traditional, and any additional taxes at all later puts the taxable account behind in comparison.

Good point that it’s all just a thought experiment they haven’t passed anything yet

Personally, I believe anybody who is in bitcoin for the long term is being a bit foolish. It is a medium of exchange. It should not appreciate in value but for the speculative bubble we are in, which is going to burst, in all likelihood before we approach anything considered “long term”

I doubled down at $21

So tempted to sell a GOOG/L put. But I should sell something else before adding risk. You’re now in for ~$12k on your call bet expiring Friday? And you need GOOGL to be at $1030 on Friday to break-even, or slightly less If before Friday?

It’s weird I thought the cash rich companies (goog/aapl/msft) would benefit the most from the tax changes. But it’s my other stocks going up (will F hit $13 tomorrow?) because techs are still flat.

In for 2x GOOGL DEC 8 1000 Calls, @ $21.50.

$4300.08 including commission. It’s been a while since I’ve gambled on short term calls.

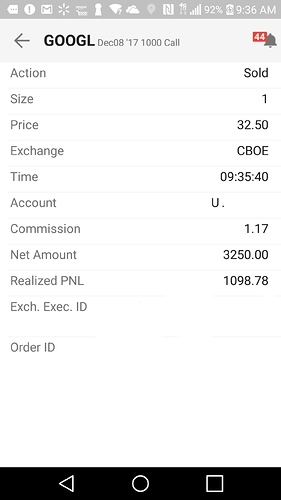

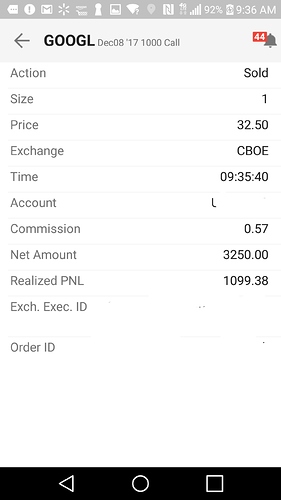

$32.50 sell order open.

To make me feel better sell 1 of them.

Hopefully I will sell both in a couple minutes. Getting close!

sell 1 now and remove the other sell order

I just did this:

Sell to Close 2 Contracts GOOGL Dec 08 2017 1,000 Calls Limit at $30.90 (Day)

Took some risk off the table. I could actually sell all 4 and make just a smidge but I want to see this run to 1040 this week. We will see.

Grats good idea. Now you’re about break even with just 2 options and ~$6k basis right? I’m holding on. I had changed the order to 1 @$31 but then changed it back to both at 32.50. I want to stick to original plan.

I should have done the same as you prolly.

1% change in value to portfolio either way from +60% ytd won’t be a big deal and make me go sell my house or buy a yacht.

Basis is now $5800 (29.10) for the 2. At current prices I would be up about $500. Not what I like to see with that big of a bet, but much better than down $12,000. I looks like you hit your exit. Congrats.

Sold! 2@ 32.50. 1.74 commission. $2198.16 profit (~51%). Not bad for under 24hrs. TY umcsom for post a couple days ago.

I think I’m still net $500 short term loss this year. So I shouldn’t have to pay 25% taxes on this.

Throwing my profits all on Red for another spin.

Buy to open 1 contract GOOGL DEC 8 1000 Call @ $21.50 limit executed ten minutes before close. $2151.09 including commission. If I lose it all, I’ll still be up fifty bucks.

I haven’t decided exit strategy for this call yet.

Bought 75 EIX shares @$70.11

Lately I’ve been targeting large caps in an uptrend that happen to have had one day dips over 5% on some over played news. Hope I don’t catch a falling knife but it seems to be working ok for now.

I’ve had a $37 sell limit since open. Probably too greedy. 32.50 would have sold already.

Good find. I’ll join you:

5 Contracts EIX Jul 20 2018 60 Calls Filled at $10.20

I bought 2 more at 25 yesterday and sold them at 32 today. GOOGL is very range bound this week, so this is working great right now, but there is still significant risk. I still own 2. I have about $4400 in these after profits from selling the others. So currently up around $1800. I wish it was more profit at this point for risk taken.

If I hadn’t bought the extras and stayed with my initial 2 I would be down about $1800.

ETA: Out at 33 on the last 2. I will try to pick them back up sub 25.