This is a simplistic view of things. The government printed and distributed trillions during the pandemic. That was bound to produce inflation. You can’t keep the pace of recovery after those wild swings, plus inflation eventually leads to consumers cutting back on anything that isn’t “a need”.

Me thinks this is a desperate effort to keep control of Congress during the midterms. And you don’t want to go down in history as the one senator whose vote cost the party control of the House.

Biden and the Democrats have been in control of the White House and the Congress for 18 months now. Much of the pandemic spending and also non-pandemic spending that triggered the inflation was passed overwhelmingly with Democrat votes. So Biden has to take responsibility.

As an aside, if it were President Trump under which the recession occurred you can be sure the Democrats and their media allies would blame it all on him. Biden famously claimed in a debate that President Trump was personally responsible for all the deaths with Covid during his administration.

Possibly, but it would be less of a stretch if Joseph Robinette Biden and his sycophants, including most media, had not pounded the bell on “his” recovery. Okay, he want’s to claim credit for that? Fine, you can hide under the desk regarding inflation.

I’m not into politics but into looking at things objectively. If I wanted to follow (either) party lines I’d be spending my time at CNN, Fox, or MSNBC.

This article I just posted on the bonds thread is relevant here

The latest incarnation of Build Back Bigger, renamed and somewhat pared down under the rebranded Inflation Reduction Act (via climate change and Obamacare subsidies) is expected to do nothing of the sort according to a Wharton financial analysis.

- The Act would very slightly increase inflation until 2024 and decrease inflation thereafter. These point estimates are statistically indistinguishable from zero, thereby indicating low confidence that the legislation will have any impact on inflation.

I’m going to ask Manchin for my money back.

Bloomberg unveils the truth about lower gasoline prices

This is one heckuva way to mitigate inflation!

It was the summer of 2020. COVID-19 was ravaging America. People were perishing by the thousands. There was no vaccine. There were no effective therapeutics. Businesses were closed. Anxious Americans were remaining at home by the millions, when and wherever possible.

Bloomberg has just revealed Americans are driving less TODAY, this summer, than was the case two summers back:

A bearish government report dragged prices lower as crude stockpiles rose by more than 4 million barrels, while the four-week seasonal average for gasoline demand fell below the 2020 level.

Bottom line as a result of out-of-control inflation, Americans are driving less today than they were at the height of the pandemic. People are really hurting!

https://news.yahoo.com/oil-declines-opec-decision-production-005401603.html

All eyes are on Sinema now but she’s playing it cagey. As the political pundits are saying the Democrats will give her literally anything she wants. Sinema statues on every corner. National bisexual woman holiday. Let’s hope she uses her super powers for good.

By the way, have you noticed that nobody can figure out how to spell either her first or last name. Also she is in office because that moron Ducey kept appointing the unelectable Martha McSally to the Senate in Arizona. McSally was responsible for flipping both the Arizona Senate seats to Democrat.

The Arizona state GOP is garbage. They can’t figure out how to get a electable republican on the statewide ballot in a state where an electable republican would have a really good chance at winning in our current environment.

I’ve had a PO Box for a few years now (no commentary about the merits of other private PMBs instead of the Post office  ). My box renewal jumped from $76 last August to $182 this August. Needless to say, I no longer have a PO box.

). My box renewal jumped from $76 last August to $182 this August. Needless to say, I no longer have a PO box.

And I’ve noticed that Walmart brand ice cream, that has been $1.97 forever, is now $2.27. Yes, I consider a lot of Walmart brand items to be a good indication of actual inflation costs, because they try really hard to keep those products dirt cheap. I dont trust other brands, who tend to raise prices simply because all the headlines have caused consumers to expect an increase so there’s little objection.

Hedge fund commentary

https://s3.amazonaws.com/bireme/2Q22%20-%20FV.html

—-

We do think that headline inflation will probably moderate. Commodity prices are well off their highs, supply chain problems should ease, and demand for goods is dropping after the pandemic-driven surge. However, inflation “moderating” from a headline ~8% should be cold comfort. Furthermore, evidence indicates that what was once an inflationary surge driven by a few items – primarily food, energy and durable goods – has morphed into a far broader and stickier inflationary pressure.

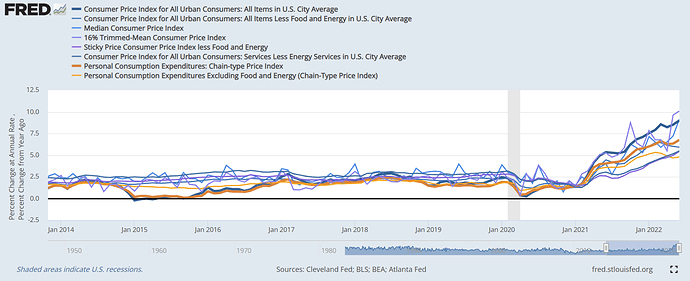

There are various ways to attempt to more reliably ascertain the underlying trend of inflation than the headline rate… All of these measures have their strengths and weaknesses, but it is not critical to differentiate between them today: they uniformly paint a dreadful picture.

Underlying inflation is running somewhere from 5-10%, price increases pervade the economy, and there’s no sign of an imminent decline. This is a radical departure from the post-financial crisis era of low and stable inflation.

Not only does the Fed project this elevated and pervasive inflation will rapidly moderate, they also project this will happen in an excellent economic environment. They expect trough real GDP growth of 1.7% in 2022 and 2023 – a very healthy growth rate not at all consistent with a dramatic slowdown in economic activity…

Frankly, these projections seem comically optimistic to us.

Yikes! What size box?

The smallest one.

Interesting numbers behind the numbers.

The large increase in the employment numbers touted by the Democrats this week is due to fewer people working but more people working multiple jobs

The second factoid is the drop in gasoline prices is due to a drop in gas usage and not from the Biden administration selling oil from the US oil reserves to the Chinese

Over the past four weeks, consumers bought about 8% less gasoline compared to the same period last year, when prices were lower than $3 a gallon, according to data released last week by the U.S. Energy Information Administration.

Using less gas caused supplies to grow, and that, combined with fears of an impending recession and the European Union’s easing of its sanctions against Russia’s oil industry, have caused oil and gas prices to plummet.

Fed watch

- Fed’s Bowman: There Are Almost No Concrete Indications Inflation Has Peaked

- Bowman: Need to See ‘Unambiguous Evidence’ of Inflation Decline Before Changing Outlook

- Bowman: Commodity Prices Have Declined but Are Historically High

- Bowman: Significant Risk Remains of High Inflation for Necessities Next Year

- Bowman: Expect Economic Output to Pick Up in Second Half of Year

- Bowman: 75-Basis-Point Rate Increases ‘Should Be on the Table’ Until Inflation Declines Meaningfully

July CPI will be out on Wed 8/10 this coming week.

more about the employment numbers

The most obvious issue concerns “seasonal adjustments.”

However, in reality these seasonal adjustments are just gimmick the BLS uses to fake the numbers… particularly at a time when the BLS is under tremendous political pressure to make the economy look better than it really is.

Times like today.

As Bill King notes, the seasonable adjustments for July 2021, were NEGATIVE 65,000. And yet, for some reason, the seasonable adjustments for July 2022, were POSITIVE 287,000.

Posting here because there isn’t a specific recession / employment / real estate market thread that is as active as this thread.

I’ve noticed an increase in cold calls from mortgage brokers that I reached out to for quotes over the past several years. What that tells me is that these brokerages who had plenty of work for all the brokers on staff now no longer have that volume and they are instructing their brokers, instead of sitting around twiddling their thumbs, to cold call everyone whose phone number they got in the past few years hoping for a nibble. Soon those folks will be laid off.