Got this offer from Spark Business which gives a $1,000 bonus with a 6-month average daily balance of $250,000 in a savings account that earns 1.10% APY. This would be instead of keeping the money in a 1.40% account at Dollar Savings. The raw numbers say I would come out ahead by $625 after 6 months at Capital One. What are the pitfalls of this deal? What does “average” daily balance mean? If just one day my balance drops to $249,999, I’m out the $1,000 bonus?

3 Likes

If it drops to 249,999 for one day, then you’ll want it to be 250,001 for one day. That’s usually what “average daily balance” means (as opposed to “minimum daily balance”).

3 Likes

As scripta said main pitfall is keeping your daily average balance over the threshold. If your only getting the account for the bonus, its probably best in 99% of the cases to just leave the account untouched after making the deposit.

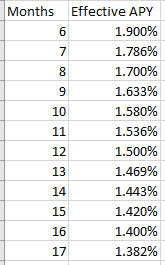

Also note most banks do take their sweet time granting bonuses so this will drag your returns down, that said for the most part you will do better than your current 1.40%

1 Like