Uninsured motorists coverage covers more than health insurance. It covers what the insured is legally entitled to recover from the at fault party: things like excess medical expenses, lost wages, wheelchairs, vans, house modifications, yard service, pain and suffering and other damages.

Yes. I know I’m deliberately taking on risk here. I’m retired/unemployed, don’t drive much, and don’t have many mouths to feed. I’d probably keep it if I were 25 at the start of a career and drove a lot.

I probably should carry at least minimal UM coverage. At least enough to cover my deductibles and max out of pocket that would likely be incurred after a serious injury.

While I could afford the loss financially, it’s going HK make me very upset.

On FWF, UM/UIM coverage was one of the things everyone said to boost up, because it was often a very minimal premium increase. YMMV of course.

I don’t recall how much we saved by reducing the UM/UIM, but it wasn’t minimal. If my ultra-efficient wife hasn’t tossed last year’s paperwork, I’ll look it up. The coverage was 250/500 for each and we reduced it to 50/50. Here is my reasoning for the reduction (and I would greatly appreciate someone pointing out any flaws in my frequently flawed thoughts):

- We do not own a vehicle valued over $40k

- Our health insurance OOP max is $8k

- We put less than 200 miles per year on our vehicles with someone else in the vehicle.

Again, these were my thoughts solely on reducing the UM/UIM coverage.

@BrianGa, I can recall when it used to be cheap, but it doesn’t seem so minimal to me anymore.

Regarding “things like excess medical expenses, lost wages, wheelchairs, vans, house modifications, yard service, pain and suffering and other damages” means you would have to request payment from “your insurance company”, the one you pay. You are pitting yourself against the company that in general you would want to go to bat for you. This likely would require legal representation and a soured relationship in the future. Basically kiss you most favored low rates status good-bye.

Here is some comments from NOLO.COM

[Potential For Bad Faith

If you make an uninsured/underinsured motorist claim, you can expect your insurance company will investigate your medical treatment, the nature of your injuries, etc. In some states, these investigations can turn an uninsured/underinsured motorist claim into a bad faith claim against your insurance company.

Every insurance company has a duty to handle claims in good faith. If your insurance company takes an overly adversarial approach to your uninsured/underinsured motorist claim, it may have violated its duty to handle your claim in good faith. Learn more about Insurers and “Bad Faith” in Injury Cases.](How Underinsured and Uninsured Motorist Coverages Work | Nolo)

It is for this reasoning and my use of older vehicles that I reduce my UI coverage to state minimums whereas my own liability limits are well above the state minimums.

It’s minimal af low limits, but substantial at 100/300. Might vary by state. In Louisiana it was easily $100/mo.

There are also different flavors of it. Some cover medical or property damage or lost income, all three or individually.

@topnotcher articulated my rationale much better than I did.

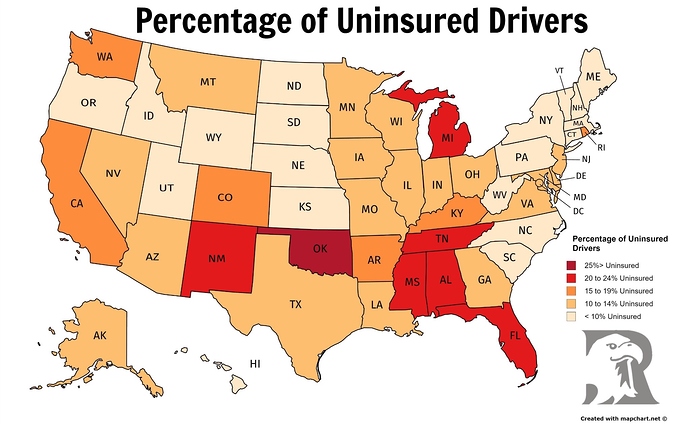

I suspect the pricing is realistic. If you live somewhere with a lot of uninsured drivers or unidentifiable hit and runs, the coverage is going to be $$$.

That’s a logical explanation, along with lots of drinkers and Nascar wannabes.

What happens if they are taking you to an out-of network hospital?

You have to be really careful about this. Most Obamacare plans only have in network benefits coverage, with the exception of emergencies (and only then up to their in network reimbursement level, with any excess on you). Other plans may have out of network benefits, but even there the fine print is important in terms of what they will cover.

For example, my non-ACA plan with out of network benefits covers 140% of Medicare’s rate for a procedure (subject to OON deductibles and coinsurances first). So even after you pay your (higher) out of network deductible and then 30-40% coinsurance up to your (higher) out of network maximum out of pocket amount, you can still be on the hook from the medical provider if their rate was higher than 140% of the Medicare reimbursement for that procedure and all of that excess is not covered. A much more expensive plan that offered any doctor regardless of network would pay (after deductibles, etc) 80% of the Usual & Customary rate. Again, you would have to pay or negotiate for any overage.

For reference, Medicare reimbursements are something like 75-80% of the national average private costs, or said the other way private rates are 125-130% of the Medicare rate. In that case, a plan with 140% Medicare coverage would cover an average or slightly above average private doctor’s bill, but of course some areas (HCOL) or some doctors may be more expensive. UCR-based plans are much rarer now, but it’s worth noting that usual & customary is a local average, not a national one like Medicare, so if you live somewhere expensive, this may provide a higher benefit than the straight percentages might reflect.

If your reimbursements are paid by Medicaid, the rates they pay are even lower, around 70% of the Medicare rate, so only 55% of the average private rate. Don’t expect the good doctors to be willing to take half their regular rate, but I guess beggars can’t be choosers.

Some reading on these topics:

I hate tattoos, but a “take me to an in-network facility” might be a decent choice for a chest tattoo.

It is a pretty real scenario with ACA plans. You’re basically always out of network if you travel a lot, and I couldn’t find a single travel insurer that would cover a US resident while traveling in the US.

Medical repatriation coverage like Medjet might work, but I suspect they’ll try to get out of transport if a perfectly good local hospital is available, despite being out of network.

It definitely sucks. Not the kind of thing to want to worry about if you suddenly get seriously ill.

My Uninsured motorists coverage is very cheap with Progressive.

I pay $5 for a 6 month term for Medical, and $5/term for Property damage.

Uninsured/Underinsured Motorist:

$100,000 each person / $300,000 each accident

- $5.00

Uninsured Motorist Property Damage:

$100,000 each accident

$0 deductible

- $5.00

Seems pretty cheap to me…

“Uninsured Motorist Property Damage:

$100,000 each accident…”

If your car is not worth $100,000, you don’t need to pay for a limit this high; you can probably reduce it to the lowest limit offered. With my insurer it’s $15,000.

With my insurer it’s either $0 or $3500.

My state requires at least $15,000 in property damage coverage.

Once again: Oklahoma, get your act together. Things are not OK.

For Uninsured Motorist Property Damage? If the state requires insurance, I don’t think it can also require uninsured coverage. I was replying specifically about Uninsured Motorist Property Damage.

My car is not worth $100k, but the premium is the same, whether I insure for 100k, or 15k, it is still only $5/term. Anything more than 100k and the costs go up. So I figure I might as well insure for the maximum amount without incurring any additional costs.