3-4% dividend would not be bad. Basically same as your average CD - when not in rock bottom APY times - except you also get growth as bonus. Maybe I’ll just start playing around with a small portfolio and see how it does until I know what I’m doing. With only one kid still in the house, I may have more time to look into that. Thanks for the tips on your sources in any case.

You won’t get much growth, but there are some preferred stocks that pay those levels or higher. While dividend stocks have market risks, preferred stocks, most of which are perpetual and fixed coupon, have interest rate risks, ie a 5% fixed coupon might not be so hot if interest rates rise.

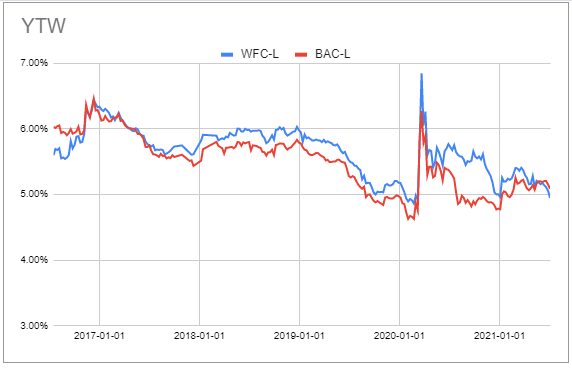

Here are two bank ones, for BAC and WFC, that pay around 5% yields.

Like anything in the market, you can do a lot better if you actively follow a sector, due your research, etc. but these two are in my fairly well informed opinion decent choices for a lazy income investor. Not sure if you can see this article, but both are good authors on these topics and covers both of these preferreds.

https://seekingalpha.com/article/4374721-5-comparisons-prove-this-preferred-from-wells-fargo-is-undervalued-least-10-percent

https://seekingalpha.com/article/4438666-preferreds-market-weekly-review

If you care and can’t access the articles, lmk.

Preferred certainly have their place and if the company runs into issues, preferred are paid first in front of common stock on the list of creditors. The problem as I understand it is you encounter companies that CAN call them early if they choose then you are scrambling to put them somewhere.

I personally despise Wells Fargo so much I could not bring myself to buy their products. I was a customer of theirs and encountered several issues that made me question if they understood what customer service meant. I have similar issues with buying tobacco stocks but Altria is very popular with folks and seems to pay a high consistent dividend.

The most recent one moved to the top of my stock purchase list is CLPR which is currently paying a 4.53% dividend. (I already own it but it’s especially good if you get it for under $8 a share) Jussi is one of the analysts from High Yield Landlord and does provide good info however he tends to be very car salesman’ish in pushing their always on sale Marketplace service for $399 (funny how that price never really changes). It may be worth it to some lazy folk to use their service and just follow their buys and sells. I’ve considered their service for some time and at some point may subscribe since I’m using so many of their public articles which may be delayed up to a month from when the actual buy/sells occured.

Yes, this is generally true that the preferred shareholder is short a call option and consequently when rates fall, as they have in recent years, the older higher coupon preferreds are redeemed at par and the company issues a new one with a lower, market coupon rate. Many many issues have been redeemed in the last year or so. This limits the price appreciation you can expect for most preferred to only slightly above (typically $25) par.

The two issues I mention above do not have a call feature which account for why they’re trading at 40-50% premiums to their $1000 par. They can redeemed for stock in the respective bank, but only if the bank stocks rise dramatically from current levels.