The rep was mistaken.

Visa Signature Flagship Rewards. So far I’ve made two redemptions … neither in a 10K increment. One was > 10K, one was not.

Thanks. I found this in the Program Description:

"Visa Signature Flagship cardholders can redeem points for cash

(1 point is equal to $0.01). The minimum redemption level is 5,000

points for $50 cash back… "

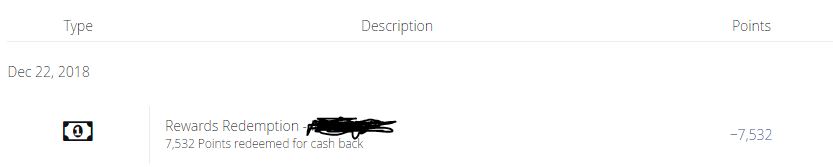

Finally got my 50k signup bonus from meeting the spend back at the end of 2018. So that’s 2 for 2 cards (mine and my wife’s).

Very well done. Congrats!

Your accomplishment surely eclipses my own by a WIDE margin. I spent five grand back at the end of last October, and made some other, much smaller, purchases as well back in that time frame.

They’ve not awarded me squat. Only thing they did give me is heartburn . . . . . and trouble.

Has it been 90 days since account opening, and another eight weeks after that? I’d say you need to wait that full time before you jump to conclusions.

Appreciate your tip and your counsel. I shall continue to await developments. But am not holding breath.

Anyway happy for you that you did so great. Well done!!

I appreciate the enthusiasm, but I didn’t do anything. I, like many others, across many other signup bonuses, simply met the conditions of the signup bonus and waited. I have been in your shoes before, waiting on rewards and all that. But I learned back in the day, very quickly, that hitting the minspend and then waiting the full time as mentioned in the offer T&C is best before worrying about it.

Agreed. And very well stated.

My case might be a teensy bit aberrant. You see they told me that, despite having made a purchase of the required size, I do not qualify for the bonus. I’m hoping they award the bonus anyway owing to:

-

The passage of time and the forgetful nature of some human beings and/or

-

Error on their part

Hope for success is faint . . . . . . at best.

Oh? Either I missed that key piece of information in our previous exchange, or this is a new development. I thought your issue was the normal 2% cash back not posting, not the bonus. I guess I should read more closely next time.

Yeah. The 2% was never paid, either. I got skunked. So far.

At NFCU, I am unworthy.

At that point, I’d CFPB it and move on with life.

How many days after opening and meeting the spend minimum did you get the bonus?

Yet again, another good edit from you. Your first reply was pretty rough around the edges.

I opened the account 10/1/18, met the spending requirement in one transaction on 10/13/18, and got my bonus 50k points 1/28/19.

I’m a bit bummed that I never signed up for NFCU back in the day when you could become a member by donating to their charity. Providing required veterans info for my deceased grandfather (which I thought I could do a bit upthread) has proved difficult. Any workable suggestions for now becoming a member?

Care to share what trouble you ran into, or what they required? I am planning to do that. I have gp’s SSN so I thought that was enough.

It was a couple weeks ago so don’t recall the exact form they need but in lieu of a current military ID, they needed a form from the VA with dates served, branch, etc. Details like that for my deceased grandfather would have to be collected from the VA and in my case the VA requires the deceased death certificate and proof of my relation. My father didn’t want to provide his birth certificate to obtain this proof of relation just for me to open a checking account so I seem to be at an impass.

YMMV. Call up NFCU and you may get lucky and get a different set of criteria though. The first time I called they said they would only need a SSN. When I got that and called again I was asked for additional VA paperwork.

“If one of your immediate family members serves or has served in the military but is not a Navy Federal member, you may still be eligible for membership.”

I asked if NFCU would honor this for non-online applications. They said they would for me.

This isn’t anything new (discussed upthread early on) but for those that only read recent posts, there are two things that need to be said about NFCU that are still true.

-

They don’t allow setting up recurring automated payments in full of credit card bills. You have to set up a single payment each month. I’ve got close to 25 credit cards and NFCU is the only one that won’t let you pay them off automatically each month. I hate to beg people to take my money.

-

Their share account is Hotel California. You can’t push an ACH out to an external institution, and you can’t pull ACH from another institution either (they allowed me to do this one time but sent me a strongly worded letter telling me not to try it again). As far as I can tell, the only ways to get money out is to pay for a wire transfer, use share money to pay the credit card, or set up a checking account for the sole purpose of routing ACHs.