While that was no doubt a positive side effect for the conservative news outlets in the US writing about those stories, there was also a LOT of critical international coverage by folks that are otherwise supportive of socialized medicine.

Regardless of administration/Congressional sabotage, the ACA markets are stablilizing:

Nope.

They’re healthier than us and live longer.

Read much ?

My apologies. I misstated your position in my summary. You didn’t claim that the French were more unhealthy. In response to Corndogg saying other countries have healthier living habits than us, you claimed that the French eat more unhealthy food than us yet are healthier and live longer, implying that is because they have socialized medicine.

My underlying point remains the same. While it is possible that socialized medicine does contribute to the French being healthier and living longer, your reasoning that it has to be their healthcare because they have a worse diet than us is bunk. The French diet is no where near as unhealthy as ours. My reasoning behind that is the OECD obesity numbers.

Here’s a play I heard about, although some insurers are shutting it down. Some expensive drugs have copay assistance programs, and some insurers allow the list price to count against the deductible. So if you happen to be on one of them, a high-deductible plan could end up being a zero deductible. The program I’m thinking of covers up the the ACA max deductible of ~7200.

Of course, you’d have to need the drug in the first place. The example was a drug taken proactively to prevent HIV, Truvada.

My plan still allows that, though I don’t use any drug expensive enough to hit the max. The copay cards are legalized (except for federal programs like Medicare, where they are prohibited) insurance fraud, IMO.

I’ve also heard that some manufacturers will let you submit the receipt to them after the purchase and get reimbursed. If you did it that way, the insurer wouldn’t know about the rebate and would still consider you to have met your deductible. However, that seems quite sketchy to me – I’d think this is actually insurance fraud and would not be inclined to do it without some kind of legal opinion saying it’s OK.

Given the numerous occasions you’ve done so, ya think it might be a good idea to actually read what others have posted prior to replying ?

Where did I imply that ? I merely mentioned the ‘French Paradox’.

Don’t be dishonest. This is a thread about socialized medicine. You have been outspoken about your support for socialized medicine. You brought up the French Paradox specifically to contradict someone that said better diets are the reason other countries have healthier populations, not socialized medicine. It was in your contradiction that you implied it.

Don’t make false charges.

Which I was not addressing.

Exactly.

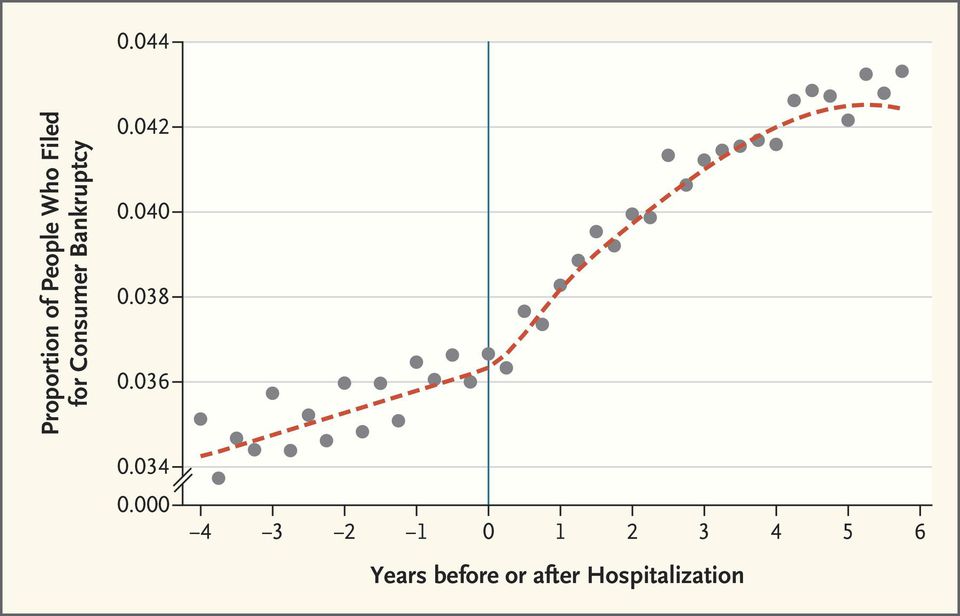

A quick followup on medical bankruptcies. A proper analysis shows the rate is maybe around 4% of all bankruptcies, not the 60%+ some politicians like to claim.

Forbes is just being anti-native-ite ![]()

Looks like 2019 Obamacare rates, in some sort of average sense, are going to be flattish. WSJ is reporting -1.5%, other sources I saw were +3-4%.

That said, there is a LOT of variability at the state level - yours is probly up 10-20%, small consolation that elsewhere is down. You can see the average requested premium hikes by state here, most of which are finalized at this point.

2019 Rate Hikes | ACA Signups (see the larger column on the right)

Still, this suggests that the risk pool is stabilizing, even the face of the various Trump initiatives to give more freedom of choice back to consumers (no mandate penalty, better short term plan alternatives, etc).

FTFY

And now I read that McConnell may revisit a repeal attempt if R’s hold onto Congress after the midterms, which strikes me as a very dumb thing to talk about revisiting when HC is the #1 polling issue for the midterms. If you accept that pre-existing conditions are off the table for reform I have no idea what would be feasible for a ‘replacement’ anyway. Not that there ever was one…

You say potato, I say potaahto. Speaking of which, HHS under the new admin is willing to offer waivers to states to offer somewhat less comprehensive healthcare plans which will be considerably more affordable.

https://www.wsj.com/articles/states-are-cleared-to-allow-less-comprehensive-health-plans-1540247171

States will be allowed to offer less-comprehensive health plans yet still qualify for federal subsidies under a new Trump administration policy that will let them skirt key regulations under the Affordable Care Act. Under the guidelines, the administration will consider state ACA waiver requests that would allow federal subsidies to cover skimpier, less-expensive plans that don’t meet the law’s requirements. Such plans can be cheaper for consumers and might be preferable for younger and healthier American…

The Obama administration also allowed states to submit proposals to waive ACA requirements, but with far more limitations.Obama officials required that under any waivers, individuals still must have health plans that were at least as expansive and affordable as those required by the health law. The current administration will instead require that those plans simply be available, along with the less-regulated options.

Separately, the administration will propose a new rule on Tuesday allowing employers to allot their workers money to purchase health plans on the individual market, according to a senior administration official… Under the new rule, employers wouldn’t be able to choose which workers to offer money rather than an employer-sponsored health plan…

Which, again, is just more sabotage.

Yes, subsidizing junk(ier) plans is sabotage. But, this part is theoretically good:

If we’re not going full M4A, we need to decouple healthcare from employment. I have seen that coupling healthcare with employment especially punishes low-wage workers (of course!) with health issues. That’s because much of the time, the only way for those workers to get any kind of a reasonable raise is to switch jobs (and frequently). With employer-provided insurance, that also means a mid-year reset of deductibles and out-of-pocket maximums. And the insurance available to those workers is usually not very good, so it’s even worse: they stand to lose the deductible credit in the middle of the year when they may have already paid a few thousand dollars towards their deductible, and will have to start again with another plan that probably isn’t any better.

The only problem is, for reasons discussed earlier in this thread, most of the current marketplace plans are still narrow-network junk HMOs. Many employer plans are broad-network nationwide PPO plans where you can pretty much get away with never checking if a provider is in network (not advisable, of course). On the other hand, I don’t believe there is a single broad PPO plan on the marketplace in any county in my fairly populous state. (Actually, the only BCBS nationwide PPO plan I know of on the marketplace is on the DC exchange – which is where members of Congress get their insurance from.)

I’m surprised we haven’t seen more employers try to cut costs with junky narrow networks. This may be due to the prevalence of BCBS plans and BCBS’s “association of independent companies” structure. Employers that operate in multiple states usually set up their plans with the local BCBS where the employer is headquartered. That BCBS entity can offer narrow networks within their own service area, but AFAIK, the only out-of-area coverage they can offer is the BCBS national PPO. Still, I’m surprised (and glad) the nationwide insurers (like Aetna, Cigna, etc.) haven’t tried to offer nationwide narrow networks (meaning narrow within each metro area, but nationwide coverage) – or maybe they have but haven’t gotten employers to go along with it.

No they aren’t.

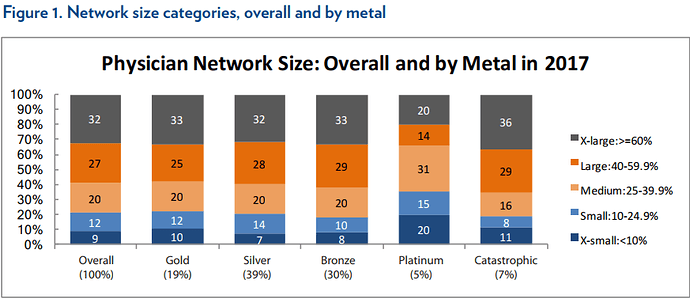

Most plans are HMO’s but most plans are not small network.

The large majority of marketplace plans have medium or larger networks.

https://ldi.upenn.edu/brief/narrow-networks-individual-marketplace-2017

And of course the total # of plans in an individual market matters a lot here. Its going to vary based on location. If your’e in a rural market with just 2 options then you’re pretty bad off. But if I’m in a major metro and there are literally dozens of plans then I don’t really care if >70% of them are junk, at least not as long as there are 1-3 good options.

I think its more useful to look at the # of plan options available to people.

Number of clinics in the ghetto (“large”) is still not a plan I want. It’s not just size, it’s quality that’s usually lacking in these marketplace HMOs.

I’m not quite sure about anotheruser’s point about decoupling employment and health coverage (seems like the poorer workers are probably using marketplace coverage for the subsidies so things like changing employer coverage, deductibles, etc don’t matter much), but it seems fine to move in that direction generally to get a larger more efficient market rather than underwriting every businesses employee group annually.

Doctor offices do not congregate in poor neighborhoods. For fairly obvious reasons.

So no, thats not whats going on.

How do you measure that?

That seems likely to be purely anecdotal. I can see that people are unhappy with the coverage options in a plan if their doctor isn’t in network. But that doesn’t mean the plan lacks in quality or options.

This was my experience. Lots of Medicaid style plans with clinics in all the bad areas, but not something you’d want if you had any choice. Likewise, many of the doctors listed wouldn’t actually take the HMO, despite being listed in the network directory, or didn’t even pick up the phone at all. They or their hospital had changed their mind about contracting for whatever increasingly lowball reimbursement the marketplace plans were offering.

More generally, quality of care available (“adequacy”) is a separate dimension than how wide a region is covered (“narrowness”). Both tend to be bad, but the former is much more of an issue with cut rate HMO plans.