I think it’s a similar. I thought FairTax was just a flat national sales tax, but I guess the “prebate” makes it a little progressive.

Yes this system would seem very similar to FairTax which also had a monthly prebate included.

There are lots of things that’d need to be addressed.In a FairTax system, vehicles like Roth IRA or Roth 401k have already paid tax on earnings and income compared to traditional IRAs and 401k. So would you get an additional rebate on withdrawals from Roth accounts to avoid double taxation (once on income the second time on consumption)?

In any case, you’re right that it was debated a lot several times previously but the complexity of the issues involved in determining how progressive it’d be, how it’d impact various systems,etc is much more complicated to convey to masses for campaigning purposes than just throwing around terms like separate wealth tax or advocating the creation of a 70% bracket.

Proposals to raise the age for RMDs as well as allow more types of IRA moves, like rolling Roth IRAs into Roth 401ks and the like.

Overall those sound like good initiatives but they’re a bit of a drop in the bucket.

The RMD change really does not change the fact that you still may be required to take distributions in down markets even if you don’t need the income. Pushing the limit by 2 or 5 years helps only if you’re still working and cannot rollover to a Roth IRA by age 70.5. Otherwise, you’ll probably have rolled your Roth 401k money into a Roth IRA to avoid those RMDs forever while also giving you much broader investment options.

The only reason not to rollover from 401k/403b to IRA would actually be on the other side of the retirement age, for early retirement, since you can use the rule of 55 for a 401k/403b but not for an IRA somehow.

Really, it feels like they should just take the best of each of these accounts and extend it to the other types of retirement accounts.

Interesting news story. Supposedly the law change is start to have an effect on charity donation. This food bank has seen their cash donation drop off drastically.

You can take your distributions in kind, at least for IRAs, so it’s not like you have to sell your positions in a down market; even from a 401k if you had to take cash, you could just buy back the same thing or a similar investment in your taxable account. I guess you will owe taxes on the distribution either way, but you knew that was coming either way so presumably should have your asset allocation and liquidity such that you can manage paying whatever taxes are due in a year when they come due.

Pushing the RMD age limit out does help in that it’s a free option. Maybe you have a low income year in 71 and take some out anyway, but then don’t in a high income year for year 73. More flexibility is always a good thing. Also, if you were still working, you probably could avoid RMDs by moving your IRA money into the company 401k plan - there’s an RMD exception for those still working (and not owning too much of the company) after the normal RMD age.

Broadly, the main reason to roll assets out of an old 401k is for more control, choice of investments, and lower costs. Yes, the 401k could let you access the funds sooner, but you can get some of that with a 72T distribution from an IRA in the early retirement scenario anyway.

Anyway, I didn’t see anything obviously bad and there were some marginal additional options for when to take your RMDs or how to move around your retirement accounts and those seemed like good things.

I agree that the proposal has no obviously bad effects by increasing options but I just thought the changes are a bit too incrementally small compared to what I’d hope for. But this RMD age extension could still help a few people so it’s not a bad thing.

IMO they’re seeing about 15-20% less in cash donations because of tax change. Corporate donations are steady because corporations are still getting the same deductions for charity donations. But some people now donate less because their donations are effectively no longer deductible (because they take the standard deduction vs. itemizing before).

I’ve seen it first hand with church donations but it’s very disheartening to see that it also impacts food banks.

I didn’t want this to get lost in our favorite arguing thread, so here’s a short piece on Biden’s tax proposals.

https://www.wsj.com/articles/bidens-tax-whopper-11602888777

backup link

Joe Biden got a pass from the media for the myriad whoppers he told about his policies in Thursday night’s town hall. But one that we can’t let slide was his claim that he only intends to make people earning more than $400,000 “pay what they did in the Bush Administration—39.6%.”

Bush tax cuts [returned] the top rate to 39.6% for those earning more than $400,000, plus the 0.9% Medicare surtax imposed by ObamaCare. Republicans in 2017 lowered the top rate to 37%, and Mr. Biden says he would merely return the rate to where it was before the GOP tax cuts. But that’s before add-ons. He would also restore the Pease deduction limitation for high earners, which tacks on the equivalent of 1.2% [in addition to the Obamacare/ Medicare surtax].

He also wants to extend the Social Security 12.4% payroll tax to income over $400,000. The current cap is $137,700… The top marginal rate would rise to 57% including 3.8% in Medicare taxes, and that’s before state taxes that run as high as 13.3% in California.

he’d also raise the tax on the capital gains of high earners to the same rate as wage income, increasing the rate to 43.4% (39.6% plus Medicare 3.8% investment tax) from 23.8%.

so get ready for 57% marginal on wages and 43% marginal on investments if you’re part of the Evil Rich. Also worth noting that repealing the trump tax cuts would also raise taxes on lots of ordinary people too, since their brackets were lowered and many benefited from the higher standard deduction (those in high tax states and/or with lots of itemized deductions were closer to breakeven or sometimes worse in edge cases).

By “also worth noting” do you mean that the article did not mention this? I haven’t investigated his plan, but he explicitly said multiple times that the repeal would be partial so that it does not affect anyone below $400K.

Trump talking point, spout nonsense at rallies, repeat it and insist its true.

This is 100% believable

Any credence you give this does harm to your carefully cultivated image here as being a wise and thoughtful person.

Nonsense, all analysis (revenue calculations, etc), have taken into account that it’s only changing the rates over $400k. Only Trump, Pence, and Faux News have claimed otherwise.

Ok, ok. This ones my thread and we’re supposed to try to keep the political haggling to a minimum and stick to taxes and tax proposals and planning.

I think I can summarize this part of the under $400k as follows -

-

Biden’s campaign platform says he wouldn’t raise taxes on these people, but contrarily

-

Biden has said several times that the first thing he would do if elected would be repeal Trumps tax cuts (which helped many such people, nearly everyone actually paying income taxes)

It’s also not clear that the best thing to do in a post-covid recovering economy is jack up taxes a lot, so this may or may not come to pass or in the form currently envisioned under a Biden presidency. I think if you’re in the taxpaying-but-under-$400k crowd, you will just need to wait and see. If the Biden plan really is to raise taxes on say those making $100-400k as well, don’t expect confirmation of that prior to the end of the election in any event. Meanwhile, definitely expect the corporate tax rate to be increased from Trump’s 21% to Biden’s 28% if he wins. There has been no inconsistency on that.

Sorry

I shall desist forthwith.

I sure hope we don’t see this account come to pass.

First thing Biden does (if elected) is drop the Trumps tax cuts. Then he raises our taxes to take care of his “free health for Illegal Immigrants” & other promises made by Bernie.

How obscene??

you have an odd tagline you have attached to Medicare, which Trump has defunded by suspending medicare funding from payroll and needs to be re- funded.

I guess it’s just like police departments McConnell and Trump have defunded. In a bizzaro worldview, just pretend everything’s the opposite.

To me, it’s clear that Biden is gonna raise taxes for us even though we’re not earning over $400k/yr. Repealing the Trump tax cuts alone is not compatible with leaving taxation levels as is on any of the tax brackets. There was analysis way back that the tax cuts lowered taxes for everyone but less on the lower tax brackets than on the top ones. Still repealing those cuts would effectively increase taxes unless something else was implemented.

The other question is what he’d do with the extra revenues. As someone concerned about ever growing deficit and the inevitable inflation coming our way from these, I’d hope that the extra tax revenues would be use to lower deficits. BUT it did not even happen with GOP controlling both chambers and the presidency so with Dems in control, it’s not more likely to happen either.

I think you’re correct in guessing that Biden will likely push for social welfare spending instead, which would benefit more those on the lower end of the income scale. So even if their taxes slightly increased, it might be mitigated by more handouts.

Of course, all is in the details of the actual law. I agree that implementing such changes in the midst of a recovering economy does not sound like the best course of action. But it all depends on how frivolous they get with hando… I mean stimulus packages. I’d rather not see them raid yet again my kids future prosperity but I have very little hope from whoever wins to keep a tight leash on deficits unfortunately.

They could repeal parts of TCJA that deal with things other than personal income taxes, such as corporate taxes. They could then add new brackets for taxable personal income over $400K. That would satisfy the “partial repeal without affecting those who make < $400K” promise.

One could always find an excuse to not raise taxes. We’ve always been in a recovering economy, haven’t we? Besides, only those who make money pay taxes. I also believe (and I know it’s controversial) that Increasing corporate taxes could spur more hiring, because employee costs are tax deductible business expenses!

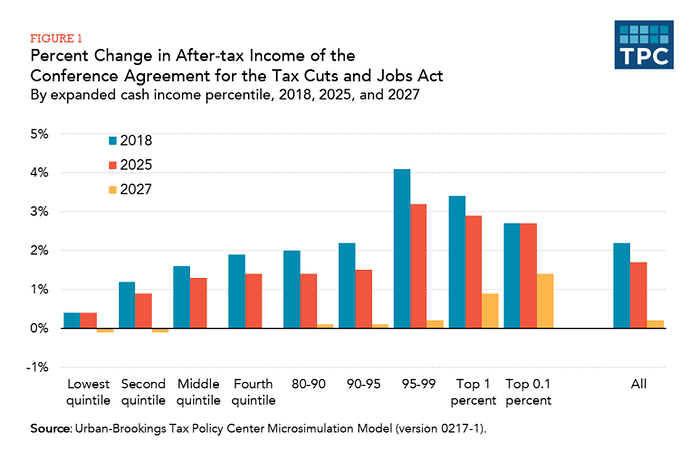

Not exactly. It lowered taxes for almost everyone in the very short term (even in the short term, though… the largest cuts were for the top 5%). But it raised taxes on the middle class long-term, while locking in long-term tax cuts to the rich.

https://joebiden.com/two-tax-policies/#

To help pay for his permanent tax giveaway to corporations, Trump imposed a secret tax hike on middle-class Americans. Trump and his allies needed to sacrifice something in order to satisfy congressional rules and pass their tax giveaway for large corporations and the wealthy. Their solution was to raise taxes on the middle class by slowing the rate of inflation in the tax code, which will push working families into higher and higher tax brackets over time and devalue the amount of their tax credits. The result is that by 2027, around 70% of middle-class families will have to pay higher taxes.

The short term and tiny benefits went to normal people. The longest term and largest benefits went directly to the top 0.1 percent.