I inherited a bunch of EEs and was looking for a method to transfer whilst living tax free …no joy

Anyone have a thought?

This had disappeared from the Internets, and I thought is was worth having about.

cut me off at 32000, so I imaged the footnotes

In his second submission to Gift Planner’s Digest, University of Missouri law professor Christopher R. Hoyt offers some practical advice regarding charitable gifts of U.S. Savings bonds with specific advice on how to maximize income and estate tax benefits of such transfers.

Series EE savings bonds (formerly Series E) are the most common variety of savings bonds. They are usually issued at a discount price of half of the bond’s stated maturity value (e.g., a savings bond with a stated maturity value of $100 usually is purchased at a discount price of $50). Each bond grows in value because of the accumulated interest. It can be redeemed at the maturity date for the stated value, but often the owner continues to hold the bonds and interest continues to accumulate. Series EE bonds accumulate interest for up to 30 years after the issue date (40 years for Series E bonds issued before November 1965).

Unless the owner filed a Sec. 454(a) election to recognize taxable income as the interest accrues (something rarely done), the owner of the bond is usually not taxed until he or she redeems the bond. The amount of interest income that the owner must eventually report is the difference between the bond’s redemption amount and the original purchase price.[1]

Series HH savings bonds (formerly Series H) are issued at their face amount (minimum $500 per bond) and pay interest twice each year. For owners of Series EE bonds with untaxed accumulated interest, a popular strategy is to swap the bonds in a tax-free exchange for Series HH bonds. This enables the owners to receive interest payments based on the full value of the Series EE bonds without having to recognize the accumulated interest. Series HH bonds pay interest for up to 20 years. The owner usually redeems the bonds for cash at that time. When Series HH bonds are redeemed, the owner will finally be taxed on all of the accumulated interest on the Series EE bonds.

Series EE and Series HH savings bonds are not particularly attractive sources of charitable gifts while the owner is alive. Any attempt to transfer ownership of the bonds will usually trigger all of the untaxed interest income that had accumulated. A living donor is generally better off making charitable contributions of appreciated stock or real estate since he or she can usually deduct the entire value of the gift without recognizing any long-term capital gain from the property’s appreciation in value.[2]

After an owner’s death, however, these bonds become very attractive sources for charitable bequests because so much of their value is attributable to untaxed interest income, which constitutes income in respect of a decedent (IRD). Unless there is a charitable gift, the government could receive over 76% of the bond’s interest income through a combination of estate and income taxes (Exhibit A). Since charitable bequests of IRD can provide both estate tax and income tax charitable deductions, a person who has charitable intent can apply 100% of the bond’s value to a specific charitable purpose.

Another alternative is to transfer the bonds at death to a tax-exempt charitable remainder trust. Such a transfer qualifies for a partial estate tax charitable deduction. Of greater importance, such a transfer can have the net effect of deferring taxation on all of the bond’s interest income in a manner similar to a rollover of a retirement plan distribution to an individual retirement account (IRA).

These favorable outcomes are possible, but they usually require specific instructions in the decedent’s will concerning the disposition of the savings bonds and other IRD assets. In the absence of such instructions, the estate could suffer adverse tax consequences. The worst case scenario is that the estate could be taxed on all of the bond’s interest income, but it could not claim an offsetting charitable income tax deduction for the payment to the charity.

Ownership Options

Bonds Registered Solely in the Owner’s Name

Any attempt to transfer ownership of savings bonds while the owner is alive will usually trigger the untaxed interest income[3] with the exception of a transfer to a revocable trust.[4] Since each bond is registered in the name of the owner, a transfer can usually be accomplished only by re-registering the title to the bond. Such a change of registration marks the point in time when the accumulated interest is taxed to the former owner. A similar result occurs when an owner tries to transfer ownership of the bonds at the time that Series EE bonds are converted into Series HH bonds. This is the case even if the new owner is a charity, although the original owner will be able to claim an offsetting charitable income tax deduction to reduce the tax burden of the gift.

Private Letter Ruling 8010082 (December 13, 1979) offers an illustration of a lifetime charitable gift of savings bonds. Under the facts in the ruling, the taxpayer owned Series E savings bonds with untaxed accumulated interest. Whereas the tax laws permit an owner to make a tax-free conversion of Series E bonds into Series H bonds, this individual attempted to have the Series H bonds registered in the name of a charity. The IRS concluded that this would trigger taxation of all of the deferred income from the Series E bonds. The taxpayer could claim an offsetting charitable income tax deduction for the full value of the Series H bonds given to charity. The net effect would be a charitable deduction equal to the original purchase price of the bonds.

The accumulated untaxed interest of savings bonds that are registered solely in the owner’s name will usually be taxed to the owner’s estate when the estate cashes the bonds. However, if the will contains instructions that the savings bonds should be transferred to a specific beneficiary, then the beneficiary will be taxed on the accumulated interest instead.[5]

Bonds Registered with a Co-Owner or a Surviving Beneficiary

A popular way for savings bond holders to avoid probate of bonds at death, and to make it easier for heirs to redeem the bonds, is to have the surviving beneficiary named on the bond. The two permissible methods are to have the bonds registered either with a co-owner or with a surviving beneficiary.[6]

If the bonds are registered in the names of co-owners (e.g., John Doe and Jane Roe), then the bond is deemed to have two owners. Either co-owner may cash the bonds without the knowledge or approval of the other. There are no adverse tax consequences to naming a co-owner when the bonds are first issued, but adding a co-owner to a bond that has untaxed accumulated interest will trigger taxable income to the owner at the time the co-owner’s name is registered.[7] If one co-owner dies, the surviving co-owner becomes the sole owner of the bonds and will be taxed on the accumulated interest when the bonds are redeemed.[8]

Instead of naming a co-owner, the owner of the bond can name a surviving beneficiary, e.g., Jane Roe P.O.D. (pay on death) John Doe. Only the owner can redeem the bond during her lifetime. The surviving beneficiary automatically becomes owner of the bond when the original owner dies and, like a co-owner, will be taxed on the accumulated interest when the bonds are redeemed and the estate will not recognize any taxable income.[9]

If it would be possible to name a charity or a charitable remainder trust as a surviving beneficiary, much of the complexity of making charitable bequests of bonds at death would be eliminated. However, the federal government currently prohibits a charity from being named as a co-owner or a surviving beneficiary of a savings bond.[10] The eligibility to name a charitable remainder trust is less clear.

Transfers of Savings Bonds at Death

Who Recognizes the Interest Income?

General rule: The estate or the person who is entitled to receive the bonds recognizes the interest income.

The untaxed accumulated interest of Series EE bonds at the time of a decedent’s death constitutes IRD. It is not recognized until the bonds are disposed, redeemed, or have reached final maturity, whichever is earlier.[11]

Under Section 691(a), the income will be taxed to either:

- the estate of the decedent, if the right to receive the amount is acquired by the decedent’s estate from the decedent;

- the person who acquires the right to receive the amount by reason of the death of the decedent, such as a co-owner or a surviving beneficiary of a savings bond;[12] or

- the person who acquires from the decedent the right to receive the amount by bequest, devise or inheritance, if the amount is received after a distribution by the decedent’s estate.

Election to Report Interest Income on Decedent’s Final Income Tax Return

An exception to the rule that bonds produce IRD exists if the executor makes an election to report the interest on the decedent’s final income tax return. This irrevocable election[13] can be made by the executor of the estate or such other person responsible for filing the decedent’s income tax return.[14]

The election is often beneficial for non-charitable transfers of savings bonds since: 1) the decedent’s final return might be subject to a lower marginal tax rate than that of the estate or the beneficiaries; and 2) the decedent’s increased income tax liability will reduce the amount of estate tax. However, the election does not make sense for transfers to tax-exempt charities or charitable remainder trusts since these beneficiaries will be able to avoid or defer any income tax liability.

Transferring Savings Bonds to Charity

Since all of the untaxed savings bond interest constitutes IRD at death, it can easily be subject to an effective tax rate of 76% through a combination of estate and income taxes. Thus, if a person intends to make a charitable bequest, he or she should make the bequest with these and other IRD assets, thereby allowing larger amounts of non-IRD assets to be passed to family members.

There are, however, complications that may arise. In a worst case scenario, a charity or charitable remainder trust might receive the bonds, yet the donor’s estate would have to recognize the interest as taxable income and could not claim an offsetting charitable income tax deduction.[15] The best strategy is to transfer the bonds in such a way that the income is not recognized on the estate’s income tax return. The will should probably also contain contingent instructions to assure a charitable income tax deduction to the estate in the event that IRD might be recognized on the estate’s income tax return.

Avoiding Income Taxed to the Estate

There are two ways for bonds that are registered in just one person’s name to be kept off the income tax return of that person’s estate.[16]

- The will can specifically identify the individual, charity, or charitable remainder trust that has the right to receive the savings bonds as a distribution from the decedent’s estate.

For example, the will could contain a clause, such as “all of my savings bonds shall be given to the PGDC Demo Foundation (or the John Smith Charitable Remainder Trust).” In this case, the estate will distribute the bonds to the recipient and the recipient will report the interest income when the bonds are redeemed.[17] If the recipient is a tax-exempt public charity or charitable remainder trust, no tax will be due.[18] If the recipient is a private foundation, it will be liable for the 2% excise tax on the interest income.[19]

- If the will or state law gives a fiduciary discretion to make non-pro rata cash or in-kind distributions, then the estate might not have to recognize income when the fiduciary distributes all of a decedent’s savings bonds to tax-exempt charitable beneficiaries.

The IRS concluded in a private letter ruling that an estate would not recognize income when a fiduciary distributed all of a decedent’s savings bonds to a charity if the fiduciary had discretion under either the will or state law to make non-pro rata cash or in-kind distributions to beneficiaries.[20] However, income tax problems could arise if a fiduciary makes a non-pro rata allocation without such authority or pursuant to a post-mortem agreement among the beneficiaries.

Require all charitable bequests to be made with IRD

An estate with IRD that makes a charitable bequest will usually obtain the greatest income tax advantages if the bequest is made with IRD and qualifies for an income tax charitable deduction. Since an estate planner might not know at the time a will is drafted whether a particular estate will eventually have IRD, it might be wise to include instructions in the will that charitable bequests should be made with IRD assets.

In addition to the unexpected IRD asset that an estate might collect, the estate might also recognize interest income from savings bonds because of transactions involving the bonds. First, the estate will have taxable income if it redeems the savings bonds, even though the estate planner might have originally contemplated that the bonds would be distributed to the beneficiaries.[21]

Second, an estate will usually recognize taxable income if the fiduciary uses savings bonds or other appreciated property of the estate to satisfy a specific pecuniary bequest, including a charitable bequest.[22] An exception can apply if the will or local law gives the fiduciary the power to make non-pro rata distributions, but generally the fiduciary’s unilateral decision to make a non-pro rata distribution of savings bonds will trigger income to the estate.[23] Unless the will contains instructions that charitable contributions be paid with the estate’s income, there will be no offsetting charitable income tax deduction.[24]

Similarly, a non-pro rata distribution might occur pursuant to a mutual agreement of all of the beneficiaries after a decedent’s death but without authority under the will or local law. For example, all of the estate’s beneficiaries might agree that the decedent’s family will receive the cash and stock of the estate and that the charitable beneficiaries will receive all of the estate’s savings bonds. In this case, the beneficiaries, as opposed to the estate, will usually have taxable income from such a non-pro rata distribution. For income tax purposes, the transaction is usually treated as a pro-rata distribution followed by taxable exchange among the beneficiaries.[25]

It may be advisable for every will that provides a charitable bequest to contain instructions that such gifts should be made with IRD in order to allow the estate a possible income tax deduction. In order for a charitable contribution to be deducted on a trust’s or estate’s income tax return, the gift must be traced to an income source.[26]Therefore, a typical charitable bequest of a stated amount of money will usually produce only an estate tax charitable deduction and not an income tax charitable deduction. This is very different from the distributable net income rules that allow trusts and estates to deduct on their income tax returns the distributions that were made to any beneficiary.[27]

To satisfy the income tax requirement that a trust’s or estate’s gifts be made with the entity’s income, the will or trust could have a clause similar to the following: "I instruct that all my charitable gifts shall be made, to the extent possible, from property that constitutes ‘income in respect of a decedent’ as that term is defined in The Internal Revenue Code.

With such a provision, the estate may be able to claim both an estate tax and an income tax charitable deduction for every charitable gift of IRD. To date, there is no court case that affirms this result. The law is clear, however, that in the absence of such a provision, the estate cannot claim a charitable income tax deduction.[28]

To facilitate the tracing requirement, it may be wise for the fiduciary to establish a separate checking account that will hold deposits of IRD (savings bond proceeds, retirement plan distributions, installment sale payments, etc.). The payments to charities should be written with checks from this account to demonstrate that IRD was indeed the source of the charitable gifts.

Assuming this strategy works, it will eliminate the estate’s income tax liability for an outright charitable gift since the estate will be able to deduct 100% of the gift paid to a charity. However, this tactic does not work as well for a transfer to a deferred giving arrangement, such as a charitable remainder trust, since such a gift only qualifies for a partial offsetting charitable income tax deduction.[29] It is best to keep the IRD off of the estate’s income tax return by having the IRD recognized on the charitable remainder trust’s income tax return instead.[30]

Transfers to a Charitable Remainder Trust

A charitable remainder trust makes a stream of payments to one or more individuals either for life, or for a term of years, and then terminates and pays the remaining trust assets to a charity.[31](The beneficiaries of an estate obtain two advantages when savings bonds and other IRD assets are transferred to a tax-exempt charitable remainder trust. First, the estate can claim a charitable estate tax deduction for the charitable portion of the trust, which will lessen the estate tax.[32]

Second, and usually of greater importance, a charitable remainder trust is tax-exempt. It will not incur any income tax liability when it redeems the savings bonds or receives the other IRD assets.[33] The trust can reinvest the proceeds of these assets without any diminution for income taxes, which permits the income beneficiaries to receive larger payments than they would have if the IRD assets had been subject to income tax. This has a net effect similar to a rollover of a retirement plan distribution into an IRA.

EXAMPLE: Grandmother owns Series EE and HH savings bonds with $100,000 of untaxed interest. She intends to establish a testamentary charitable remainder unitrust with a seven-percent payout rate for her 60-year-old son. Assume that her estate will not be subject to estate tax because her total wealth is under $625,000.

As she chooses the assets to put in the trust, she should probably contribute the savings bonds. Had she transferred the bonds directly to her son, he would have to recognize all $100,000 as ordinary income and pay income tax on the entire amount. The original purchase price, by comparison, would be a tax-free return of capital. After paying as much as $39,600 of income tax (39.6% of the interest income), the son would have only $60,400 left to invest.

If, instead, the bonds were transferred to a charitable remainder trust, the trust could redeem the bonds without paying income tax because it is tax-exempt. The proceeds could then be reinvested on a total return basis to accomplish the seven percent payout target. Assuming the trust includes a standard payout format, if it earned less than seven percent, then the son would receive the differential from the corpus. The net result is significant income tax deferral since:

-

the entire $100,000 could be invested to produce investment income, whereas the son might have only had the $60,400 of after-tax proceeds to invest; and

-

much of the taxable $100,000 amount would be gradually distributed to the son over his lifetime rather than in one lump sum, which could lessen the tax liability.

Avoiding IRD on the Estate’s Income Tax Return

For gifts to charitable remainder trusts, it is important to avoid having any income reported on the estate’s income tax return. If IRD is recognized on the estate’s income tax return, and is transferred to a charitable remainder trust, what is the appropriate tax treatment for the charitable and the non-charitable portions of the transfer? At best, such trusts only afford a fractional charitable deduction. There is absolutely no legal authority that shows whether and how an estate can claim a DNI (distributable net income) or charitable income tax deduction for a distribution to a tax-exempt charitable remainder trust, although there is ample legal authority for estate tax charitable deductions for such gifts. [34] All of these issues can be avoided if the IRD does not appear on the estate’s income tax return.[35]

There is currently no legal precedent involving a charitable remainder trust that redeemed savings bonds, but probably the treatment would be similar to the rules that apply to a charitable remainder trust that receives other sources of IRD. The trust should not have any income tax liability when it redeems the bonds because it is tax-exempt.[36] Under the four-tier structure of taxing beneficiaries for distributions from charitable remainder trusts,[37] the savings bond interest would probably be treated as first-tier U.S. government interest and the original purchase price would probably be fourth-tier corpus.[38]

Still unknown at this time, is how the applicable federal estate tax can be deducted when the charitable remainder trust distributes the IRD to the income beneficiary. Recipients of IRD can usually claim an itemized deduction for the federal estate tax attributable to the IRD.[39]

For example, suppose that savings bonds with $100,000 of untaxed accumulated interest are transferred to a charitable remainder trust for the benefit of an individual who has a remaining life expectancy of 20 years. Assume that the transfer is deemed to be 30% charitable and 70% non-charitable. The estate could then claim a $30,000 estate tax charitable deduction and would have to pay $38,500 of estate tax on the non-deductible portion (55% times $70,000). The question is whether and how the non-charitable beneficiary can deduct the federal estate tax attributable to income in respect of a decedent as he or she receives distributions from the charitable remainder trust? Perhaps some or all of it can be deducted ratably over the expected life of the trust.[40]

Other Gift Planning Tools

There are two other forms of deferred charitable gifts that could receive savings bond interest, but they are not as attractive as a charitable remainder trust. The first is a pooled income fund, which operates much like a mutual fund that distributes interest and dividends to each donor for life, and then distributes the account balance to a charity at the donor’s death. Unlike a charitable remainder trust, a pooled income fund is not tax-exempt.[41] A contribution of savings bonds will cause problems for the fund since the interest will probably constitute income that must be distributed, perhaps even to the other account holders of the fund.

The second deferred charitable gift is a charitable gift annuity that is issued by a charity.[42] These are popular instruments for many charities and can usually be established for much smaller amounts-----often as little as $5,000-----compared to the amount required to justify the costs of a charitable remainder trust. If the transaction could be done tax-free, many people would welcome the opportunity to use their savings bonds to acquire such annuities for a family member or friend after their death. The lower cost of the annuities is especially attractive for the moderate amount of untaxed interest income most people have from savings bonds-----usually well under $100,000. The risk, however, is that a transfer of savings bonds to a charity to acquire a charitable gift annuity might be viewed as a taxable exchange of the bonds for an annuity contract. There is no legal authority at this time that explains the tax consequences of such a transaction.

Finally, a charitable lead trust is the inverse of a charitable remainder trust: Payments are made to a charity for a number of years and then the remainder interest is distributed to non-charitable beneficiaries, typically children. Such a trust is not an attractive recipient of savings bonds since it is not tax-exempt.

Conclusion

For an individual who has substantial accumulations of untaxed interest on savings bonds, a transfer at death to a charity provides a way to achieve specific charitable purposes that were important to the individual at the lowest tax cost. A testamentary transfer to a charitable remainder trust can do the same and also provide greater income to non-charitable beneficiaries. To accomplish these objectives, the will should have provisions to avoid having the interest income taxed to the estate, or in the alternative, assure that the estate will be entitled to claim an income tax deduction for the charitable use of the bonds.

Similar results apply for all other sources of IRD, such as retirement plan distributions,[43] installment sale obligations, and payment streams from inherited lottery winnings. These are the best assets to transfer at death to a charity or a charitable remainder trust so that greater amounts of non-IRD assets can pass to family members.

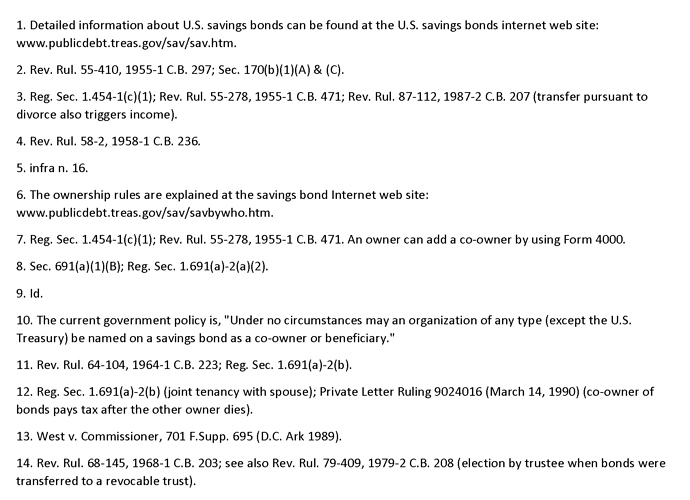

EXHIBIT A

Combination of estate and income taxes on income in respect of a decedent

EXAMPLE: Assume that a decedent’s total taxable estate is $3,200,000 and that the estate redeems U.S. savings bonds that generate $100,000 of interest income. The combined estate and income taxes on the $100,000 of interest would be $76,622, leaving the estate with only $23,378. The amount is calculated as follows:

| U.S. Savings Bonds Interest Subject to Estate Tax | $100,000 |

|---|---|

| Minus: Total Estate Tax (55%) | (55,000) |

| Minus: Income Tax on Distribution | |

| Gross Taxable Income to Estate | $100,000 |

| Reduced By §691© Deduction for Federal Estate Tax | |

| Total Estate Tax | $55,000 |

| State Tax Credit* | (9,600) |

| Deduction for Applicable Estate Tax | (45,400) |

| Net Taxable Income | $54,600 |

| Times Income Tax Rate | x 39.6% |

| Net Income Tax on Income In Respect Of Decedent | (21,622) |

| NET AFTER-TAX AMOUNT TO ESTATE | $23,378 |

*The deduction for estate tax attributable to income in respect of a decedent is only for the federal estate tax; the Section 2011 state tax credit (9.6% for an estate over $3,100,000) has, therefore, been eliminated. Reg. Sec. 1.691©-1(a).

Footnotes

as amounts of income (other than capital gains) to the extent of such income for that year and undistributed income of the trust for all prior years;

as a capital gain to the extent of the capital gain for the year and the undistributed capital gain of the trust for all prior years;

as other income (such as tax-exempt municipal bond interest) to the extent of such income for the year and such undistributed income of the trust for all prior years; and

as a distribution of trust corpus.

“Transfers From Retirement Plans to Charities and Charitable Remainder Trusts: Laws, Issues and Opportunities,” 13 Virginia Tax Review 641, Spring 1994, Hoyt, Christopher.

“When to Give Retirement Plan Assets to Charity,” Estate Planning, Nov./Dec. 1994, Freeman, Douglas. “Using an IRA for Charitable Giving,” Probate and Property, March/April 1995, Mezzulo, Louis.

“Strategies for Transferring Retirement Plan Death Benefits to Charity”, 19 ACTEC Notes 162, at 165, 1993, Shumaker and Riley.

“Charitable Gifts of Retirement Plan Assets,” 9 The Exempt Organization Tax Review, 1301, June, 1994, Newman, David and Cafferata, Reynolds.