Bloomberg is out there this morning with a rather negative projection for bonds generally:

This Is Now The Worst Drawdown on Record for Global Fixed Income

(Bloomberg) – Global bond markets have suffered unprecedented losses since peaking last year, as central banks including the Federal Reserve look to tighten policy to combat surging inflation.

The Bloomberg Global Aggregate Index, a benchmark for government and corporate debt total returns, has fallen 11% from a high in January 2021. That’s the biggest decline from a peak in data stretching back to 1990, surpassing a 10.8% drawdown during the financial crisis in 2008. It equates to a drop in the index market value of about $2.6 trillion, worse than about $2 trillion in 2008.

While there were signs the brutal selloff was easing on Wednesday, rising inflationary pressure around the world is fueling concerns about the ability of the global economy to weather any sustained period of higher financing costs. For investors, it means the allure of holding debt – even safe government bonds – is diminishing given how sensitive valuations are to interest rates, a measure referred to as duration.

“The safe haven attributes of Treasuries have been undermined when one adds duration risk to the equation,” said Winson Phoon, head of fixed income research at Maybank Securites Pte. Ltd.

That’s a blow to money managers accustomed to years of consistent gains, backstopped by loose monetary policy. The slump also poses a particular threat to the expanding elderly population in many major economies, given retirees are often heavily reliant on fixed-income investments.

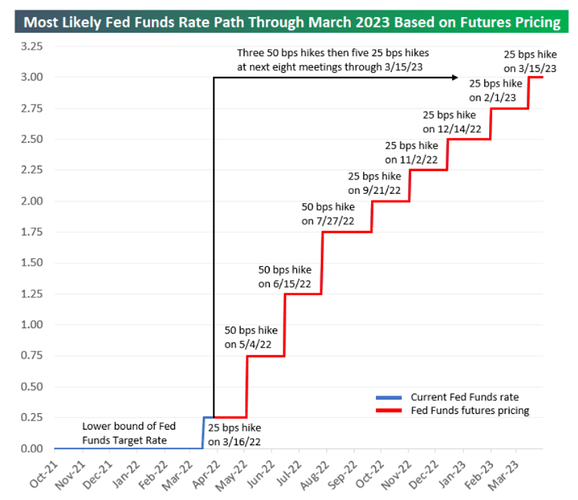

The Fed raised interest rates by 25 basis points last week, and Chair Jerome Powell said this week it is prepared to increase them by a half percentage-point at its next meeting if needed. His hawkish tone prompted traders to rapidly ratchet up estimates for how aggressively the Fed will tighten monetary policy this year, with money markets pricing in the equivalent of seven more quarter-point hikes by the end of 2022.

“The headwinds for fixed income remain heavy,” said Todd Schubert, head of fixed-income research at Bank of Singapore. “Investors will need to recalibrate return expectations and be nimble to exploit market dislocations.”

The yield on 10-year Treasuries slipped two basis points to 2.36% as of 6:28 a.m. in New York on Wednesday, after surging to the highest level since 2019. Spanish and Italian bonds led the advance in Europe, with their benchmark rates falling three basis points.

Credit Risk

Higher borrowing costs risk further damping the return on debt, eroded by the fastest pace of consumer-price increases in decades. Soaring commodity prices following Russia’s invasion of Ukraine could worsen the outlook. Corporate bonds are particularly vulnerable to mounting stagflation threats, as slowing economic growth also raises credit risks.

Companies in the U.S. and Europe are set to avoid defaults thanks to healthy balance sheets and a manageable debt maturity schedule, Amanda Lynam, an analyst at Goldman Sachs Group Inc., wrote in a note to clients on Tuesday. Still, she sees the euro-denominated market as slightly more exposed if geopolitical tensions stay elevated for longer.

Global equities, meanwhile, are nursing losses of about 6% this year, even as stocks have bounced back in recent days as more investors bet they will help hedge against inflation. The retreat in both fixed-income and stock markets in 2022 is upending the dynamics of a classic 60/40 portfolio that is meant to balance out any losses from riskier share markets with the more stable cash flow of bonds.

The meltdown in global debt markets is a reminder of the Fed’s tightening cycle in 2018, though the broad global bond index wound up losing only 1.2% for that full year. But unlike four years ago, price pressures are now much stronger and the global supply chain is beleaguered.

For emerging Asia, the threat of stagnant growth and accelerating inflation adds to the upside risk for yields, according to Australia & New Zealand Banking Group Ltd.

“We are likely to continue seeing upward pressure on yields as we expect monetary tightening in a number of Asian economies to start in” the second half of the year, said Jennifer Kusuma, a senior Asia rates strategist at the bank.

Data on the Bloomberg Global Aggregate Index before 1999 is monthly rather than daily and the constituents and duration of aggregate indexes fluctuate. Fixed-income investors can still make money by betting against bonds.

Bonds are not looking all that great right now

Of course for every rule there is an exception ![]() :

:

I hope! ![]()

- with the next call on 06/28/2022.

- with the next call on 06/28/2022.