Same numbers, out of 10.0! As institutions, they all suck. As credit cards I only have the DoubleCash, but it takes a back seat to Alliant’s 2.5%. I have never had a WF CC, because they’ve never had a competitive product – there’s not a single WF card in the wiki. Granted the wiki hasn’t been updated in a while, maybe this 2% card you mention should be in there.

Im still hooked on the Discover Miles. 1.5% on everything plus doubled to 3% after 12 months. it’s great if you do not have the Old Blue Cash or he BCP with the bonuses from Amex. Works on Vanillagift.com too. and all VGC purchases in CVS and grocery stores plus doctor copays etc. Im on my 3rd Disc Miles. They allow you 2 Discover cards. I cancel the Miles card after 1 year and wait about 7 weeks and reapply. Sucessful 3x!!! Im in my 8th month and have 655.00 already at 1.5 %. Four months to go!!. I withdraw the cashback every month and wait until my 12 months is done and then the other 1.5% reappears!!

You need to consider the hassle of getting a new card every year, and the fact that Discover is not as widely accepted as V/MC. But besides that, I agree this is one of the better non-category specific cards available.

debating b/t them and Venmo CC.

Besides the hassle glitch99 mentioned, you’re also using up two valuable 5/24 slots. You could probably earn more by signing up for cards with signup bonuses.

Earns 3% on your top spend category (Transportation, Travel, Grocery, Entertainment, Dining & Nightlife, Bills & Utilities, Health & Beauty, Gas). Which category are you going after?

l love the Nightlife. I like to boogey ![]()

Not sure if Venmo card allows % CB on cash payments.

Another try to lower the outrageous fees charged by credit card processor’s Visa and MasterCard. They claim they will have to stop giving rewards but I don’t think so. They make way too much money from the idiots who don’t pay off their balance.

They tried this before and it didn’t make any difference.

In 2010, lawmakers passed the Durbin amendment as part of the Dodd-Frank Act, which sought to tighten financial regulation in the wake of the 2008 economic crisis. The amendment was supposed to cause a trickle-down savings effect, where merchants would pass along debit card processing savings to customers in the form of lower prices for their goods and services.

But a 2015 survey conducted by the Richmond Federal Reserve found the Durbin amendment did little to lower costs for consumers and merchants. Just 1.2% of the surveyed merchants reduced prices, and 11.1% said their debit card processing costs declined. Nearly one-third of respondents reported even higher debit card swipe fees, according to the survey.

They did not try “this”. They capped debit card fees, and IIRC that only applied to the big banks. Now they’re trying to do something about credit cards, which (1) became more expensive to accept since then and (2) have been reducing or eliminating certain consumer protection benefits, like return protection, price match, extended warranty, etc.

I also doubt that much would happen to rewards. It’s just scaremongering by credit card co-s.

My use of “This” = reduce payment card processing fees by government regulation

If interchange fees are reduced… I have to think there will be downward pressure on credit card rewards and perhaps upwards pressure on annual fees.

This is one of those “protections” that is gonna bite people like us that chase rewards in the behind. No merchant is gonna reduce their prices by whatever savings they capture from interchange - the $4 loaf of bread is still going to sell for $4 and not $3.96 or whatever the difference is. They’ll just pocket the money as additional profit. Meanwhile the banks will be under pressure to maintain profits and they will cut rewards.

It did make a difference with debit cards. I used to earn points with debit card purchases with several banks and they all discontinued those rewards.

Well, to be honest, when I hear Durbin, Dodd-Frank, my first thought isn’t proper financial regulation. Consequently, it’s not surprising to me that something they claimed did not come to fruition.

That aside, both Visa and MC are incredibly profitable. They also have very high market saturation (close to monopolistic). Maintaining that saturation increases their overhead (operating costs among the greatest). To continue that saturation, they will not drop income (processing fees), without corresponding decreases in outlays (rewards).

ETA: If you look at some of the higher reward cards, you’ll see reduced ancillary rewards. For example, Discover (1.5 - 3%) offers almost zero rewards above cash back. Also Fidelity Visa (operating through Elan financial) offers no rewards above 2%, and from personal experience, lacks the customer service to which many (me) have become accustomed.

ETA2: I did not mean to imply that Visa/MC’s only source of income was processing fees. It’s the only source of income to which they will admit.

Their main source of income is interest paid on credit card debt.

I’m looking ![]() at Citi Card new offer that arrived in today’s mail. “Earn a cash bonus with new checking account. up to $2000”.

at Citi Card new offer that arrived in today’s mail. “Earn a cash bonus with new checking account. up to $2000”.

We have entered these bonuses before (some of us) and found that it’s an easy way to earn $$’s. To go for the big one ![]() takes your breath away for about 3 months. It is available until 1/9/24.

takes your breath away for about 3 months. It is available until 1/9/24.

Is it worth the effort?

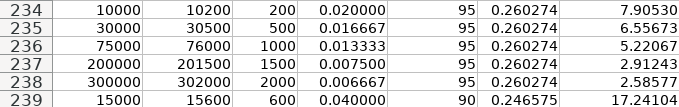

$10,000 deposit, $200 bonus = 2% bonus

$300,000 deposit, $2,000 bonus = 0.67% bonus

With 6% APY available elsewhere, I don’t think so.

Thanks 3c3.

I was wondering about how the %interest would figure. I have never ![]() heard of Citi bonuses asking such a high $$$ retainer. So I’m skipping this one.

heard of Citi bonuses asking such a high $$$ retainer. So I’m skipping this one. ![]()

But the $200 bonus, and the $1k for $75k deposit, could be worthwhile. That 6%APY is only paying you 1% for the 60 days your money is locked up to earn that bonus.

Where is 6% for 60-90 days available, anyways?

T-Bills, which do not have state tax.

While a little bit of work, that works our to an APY of around 7% Oddly ,they provide the best return for the lowest deposit …

ETA: Oops! It was closer to 8%. Please ignore the the last line. That was for a targeted Fifth Third bonus.