I appied for the Smiley USbank credit card and was declined in spite of a 800+ credit rating. Their letter noted small usage of their checking account, and high balances on cards (I presume a couple of cards at limit, since total usage was low).

After comment above that they would do product exchanges, I called. It appeared possible, so I offered a Go card to be exchanged, and was told it would happen.

I now have a letter saying my new Go card (the new card should be a Smiley) is in the mail. I will have to see what arrives.

The rep. was courteous but obviously new, and spent much time on being sure I did not lose accumulated points, but was trapped by the $25 redemption limit. I eventually discovered they could be used at Amazon for a $23 addition to my gift card balance.

I will wait to see what card I receive before putting funds into their investment side, and whether a requested line increase will go through (made after the transfer request had been approved).

![]()

I did get a credit limit increase to $25,000, so now issue is whether the card that arrives is the correct one.

![]() It took me a while to realize this had to be the new US Bank Smartly credit card.

It took me a while to realize this had to be the new US Bank Smartly credit card.

pls keep us posted. I’d love that card w/o a hard pull . USB has some great CCs

Yes, when the card arrived it was the right card, and the credit limit had been raised. It is worth exchanging another card for it, if you have $100,000 in assets to deposit and do much credit card spending in categories where you cannot earn more than 4% (taxes, tuition, medical, insurance, etc.)

My only issue with that card is the savings account interest rate for the linked smartly savings account needed to unlock the 4% cashback is losing 0.75% APY on T-bills.

It wasn’t clear whether self-directed investment accounts would count towards the $100k relationship requirement. I guess if you could move some of your investments there, that could make sense.

Otherwise the amount of everyday spending required to make up the difference over BoA Plat Honors 2.625% cashback is quite significant.

Yes, assets in the self-directed brokerage account count. I moved some assets (which I am holding anyway) to the brokerage account to qualify for the 4% cashback.

You’re of course correct, but the average Joe isn’t buying t-bill ladders. The target demographic of this card likely has some money in a HYSA that earns pretty close to 4%. I think this is a play on USB’s part to be a primary financial institution for 20-to-30 somethings that have some savings stockpiled but might not yet have the $100k needed to earn the full 4%. It gives them something to chase while still earning solid CC rewards that beat out 2% cards like the Citi Double Cash.

For someone looking for simplification this is not a bad card at all. For us here… I think there are better options, especially if you travel. That said, do not underestimate the fact that interest is taxable while credit card rewards are generally tax free as they are “rebates”. For me, being in the 35% marginal federal bracket… that indeed has an impact so the calculation is a bit more nuanced.

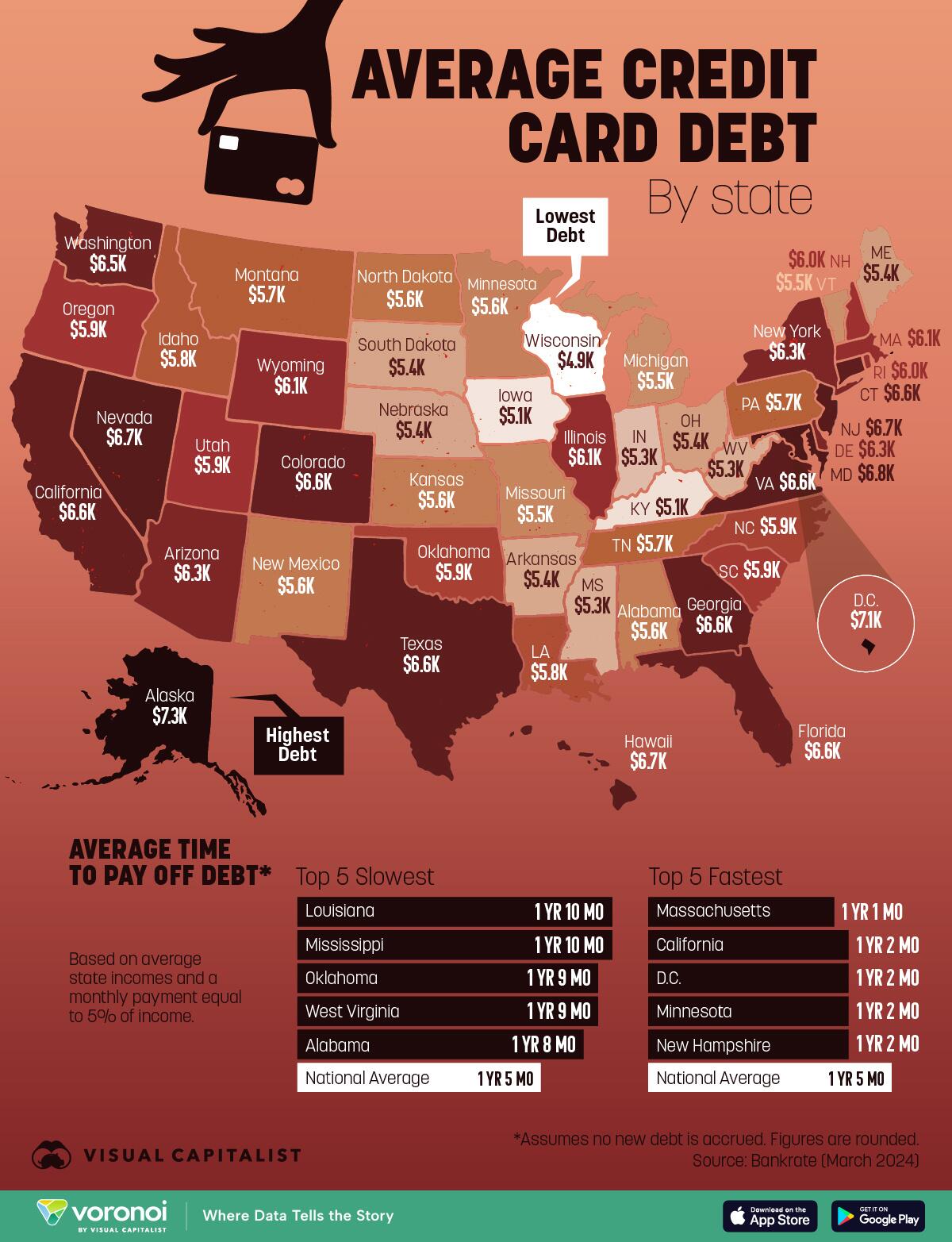

Interesting to see MN and KY lowest??

I agree. Especially if like scanchain mentioned, you have $100k in a taxable or IRA account (ideally a bit more to account for market fluctuation dipping below $100k balance) that you can port to USB self-directed investment account. Then you don’t need to worry about the interest rate on the smartly savings account vs. other fixed income options.

Even with other travel cards, moving the baseline of cashback to 4% from 2.625% seems like all it takes is:

- Open Brokerage/IRA account and transfer over $100k of ETF (not sure if $50 AF is waived for balances under $250k in brokerage but seems waived for $30k+ in IRA)

- Open USBank Smartly Credit Card (no AF but 3% foreign transaction fee, 4% cashback if $100k+ in brokerage/IRA accounts)

- Open USBank Checking (no monthly fee with credit card, used to get 100 free trades/year - may skip if not trading)

- Open USBank Smartly Savings (no monthly fee with checking account)

US Bank Checking enrolled in Smart Rewards is what gets people some easy cashback offers.

“Great deals are now available on the Cash Back section. 15% cash back on Dining. 15% cash back on Groceries. 10% cash back on Best Buy. Just log on to activate.”

https://www.bogleheads.org/forum/viewtopic.php?p=8185881#p8185881

FWIW - I’m now using Smartly Savings for all my auto-pays. Can also use for bill pay. Does not seem to have a monthly transaction limit. The 3.44% might not be as good as other savings accounts, but its certainly better than most checking accounts.

Are you saying you need the checking account to get the cashback offers? I only have the savings account. ![]()

That’s exactly what I’m saying. Having just the savings account is silly.

You may want to wait for a $500+ bonus offer for opening a US Bank checking account.

There is a button on one of my cards that offers to convert to a Smarty card (which would be my second Smarty card and increase my spending power to cover large tuition and tax expenses).

I am transferring in $100,000 plus in IRA assets to take advantage of this offer, and have over $40,000 in their savings account now (at about 3.99% interest (intended to speed up my qualifying for the 4% given the averaging periods).

Incidentally, they have only a limited ability to remove funds from their bank accounts via ACH transfers ($5,000 or less per week). I was told there were not such limits on transfers from their brokerage accounts.

A new offer just started: U.S. Bank $450 Checking Bonus - Doctor Of Credit

Interesting that they added buttons. saves a phone call.

Hmmm. Got the Smartly card approved and opened the brokerage account, but my application for the savings account was denied. I’ll have to call them later. If I cannot open the savings account, the whole process would be a useless exercise.