Received an email today from TD Ameritrade that an agreement has been reached for Schwab to acquire TDA. Their new name will be, “Charter Spectrum”.

TDA holiday promo, starting now and thru Jan 3rd. Cash or GC equivalent.

$50-100k $200

100-250k $300

250-500k $600

500k-1M $1,200

1-2M $2,500

2-5M $5,000

Over $5M $10,000

ACAT transfer of positions from another broker gets an extra $500 in addition to the above bonuses.

Thanks. Is there a link?

I found this but there is no mention of the extra $500.

That’s the offer. My rep described fhe bonuses / tiers, so I guess if you’re moving in positions from another broker instead of just cash, you might call about the ACAT bonus.

I went ahead and xferred ~100K from Schwab to TDAM for the $300 offer.

BTW, bloomberg radio said merger would not complete until late next (2020) year.

BBTW, let me be the first with a 2020 pun (at least on this thread). Nah even I can’t sink so low.

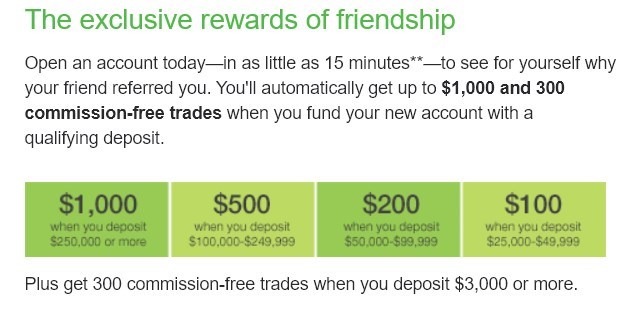

Just to note, TDA’s long standing offer of:

Offer valid for one new Individual, Joint or IRA TD Ameritrade account. To receive $100 bonus, account must be funded with $25,000-$49,999. To receive $200 bonus, account must be funded with $50,000-$99,999. To receive $500 bonus, account must be opened with $100,000-$249,999. To receive $1,000 bonus, account must be funded with $250,000 or more.

is still active. During the application process, just enter offer code 277. Or send me a PM and I’d be glad to provide a direct link via referral, as their old page promoting the offer seems to be down.

I found this link: https://www.tdameritrade.com/offer/300freetrades/ It shows the 277 code you mention, but it also shows that it expired in 2017. I will try to open an account and report back.

ETA: I opened an account and got this message:

"Offer successfully applied

We’ve applied offer code 277 to this account. Enjoy your new account opening bonus.

300 commission-free internet equity, ETF, or options trades valid for 90 days from account funding with a $3,000 minimum deposit.

Exercise and assignment fees still apply.

Fund with at least $25,000 and receive a $100 cash bonus.

Fund with at least $50,000 and receive a $200 cash bonus.

Fund with at least $100,000 and receive a $500 cash bonus.

Fund with at least $250,000 and receive a $1,000 cash bonus.

(Offer code: 277)."

ETA2: You have to keep the money there for 12 months.

ETA3: I will call to confirm the promo before I transfer any funds.

ETA4: Here is a current link, but it mentions TD Bank. It should also work: Online Stock Trading, Investing, Brokerage | TD Ameritrade

Nice work!

After you enter the offer code, there’s a pop up window which reiterates the offer details, along with an updated expiration date.

My family member opened an account last week and it indicated a January 20 expiration, for example – but that’s been renewed every quarter since before 2017.

Great thing about TDA is the offer is good for both cash accounts and IRAs, plus the bonus credits on the same day the assets are transferred

Those 300 free trades really make the deal…

(TDA offers free trades too…)

Funny story - I got one of those courtesy calls from a TDA account manager, “checking in” with me as they periodically do. I asked if he could get me a few free trades, so I could clean up some random odd lots in my accounts. He called back later, proud to have gotten me 5 free trades per account, as a courtesy since I’m “a valued customer”. Literally the very next day, TDA announced commission free trading.

From the Money Hustler blog I learn of WeBull promotions payable in Amazon Gift Card with the scale below. See Brokerage Bonuses Archives - Hustler Money Blog.

There is also an offer of a free stock (worth at least $5.00) with account opening and a second on funding the account with over $100. There are also bonuses for referrals.

The dollar value of the promotions appears to be a bit higher than most firms offer, especially for small accounts, going down to $2,000. The minimum holding period is a short 6 months, Since they pay out the gift cards in monthly installments, there is some reward even if you withdraw quicker.

They appear to be a new firm, and I have no knowledge regarding the quality of their services, or any account closing fees they may have. There is a review (written before free trading became standard for the large discount brokers) at Webull Review [2022] | Better Than Robinhood? - Warrior Trading. I tried their customer service number and it tells you to use E-mails if you have questions (which is scary if you are going to put a substantial IRA there).

I tried clicking on buttons for the promotion and they eventually reveal that you only get the free shares though the phone application. I tried opening an account there but it somehow prefilled in some birth dates that were wrong and implied I was too young for an account. You then have to write to their support apparently.

"Offer valid for one new Individual account, or IRA account and funded within 45 days of registering.

To receive $30 gift card, account must be funded with $2,000-$10,000.

To receive $50 gift card, account must be funded with $10,000-$24,999.

To receive $250 gift card, account must be funded with $25,000-99,999.

To receive $350 gift card, account must be funded with $100,000-$249,999.

To receive $750 gift card, account must be funded with $250,000-$499,999. To receive $1,500 gift card, account must be funded with $500,000 or more.

Limit one offer per client. The total amount of Amazon Gift Card will be distributed over 5 months. In order to receive a full reward you cannot initiate a transfer or pull funds for 6 months."

I received an offer to bonuses for managed accounts which goes up to $5,000 for $750,000. There is a need to keep the money there for at least a year, and their managed accounts have substantial fees (at least .9%), so this offer and lower amounts for smaller deposits will probably be of use only to those who are in the market for a managed account.

" Invest

$25,000-$49,999

Get $125

Invest

$50,000-$99,999

Get $250

Invest

$100,000-$174,999

Get $500

Invest

$175,000-$249,999

Get $1,000

Invest

$250,000-$374,999

Get $1,500

Invest

$375,000-$499,999

Get $2,250

Invest

$500,000-$749,999

Get $3,250

Invest

$750,000 or more

Get $5,000

Get Started, Today

Simply talk to a PNC Investments (PNCI) Financial Advisor and fund a new or existing PNCI Managed Account. A new account must be funded within 30 days of opening and existing accounts must be funded by December 31, 2019."

I tried their customer service number and it tells you to use E-mails if you have questions (which is scary if you are going to put a substantial IRA there). Strike 1

I tried clicking on buttons for the promotion and they eventually reveal that you only get the free shares though the phone application. I tried opening an account there but it somehow prefilled in some birth dates that were wrong and implied I was too young for an account. You then have to write to their support apparently. strike 2

That is 2 strikes already. I would not give them 3. I definitely would not entrust my money to this company.

I eventually (with aid of son) figured out how to enter a right birthday and got the account open. They seem to answer E-mail questions promptly. This earned me a free share of Sprint (worth a little more than $5.00), and got a IRA account opened. It is somewhat inconvenient typing on a cell phone screen. Their holiday promotion promised another free share (worth at least $12) if I fund the account (which involves ACH set up and trial deposits).

A minor advantage to taking the promotions for free shares is that you would have a free account on your phone you could use to check prices etc. without having much money on deposit. This might be useful when traveling, or if power fails at your home.

Since they have SIPC insurance for $500,000 and a private policy for more there does not seem to be a great risk of losing your money (although I could imagine delays if these are to be used). Apex clearing would actually hold your securities. I don’t think the insurance would cover their promotions, but they pay out quickly, some every month.

To each his own level of caution but I am concerned that if they screw up the account signup software they may screw up other things like making my account disappear or issuing erroneous 1099s.

Just tried to apply for Ameritrade with offer code 277 and it said this offer code is no longer valid.

Thank you. I scored with this one for my IRA transfer.

The Terms and conditions for the offer says:

Offer valid for one new Individual, Joint, IRA account or a new account managed by TD Ameritrade Investment Management, LLC.

So you have to sign up for the investment advice? Do they charge a fee and if so how much?

So you have to sign up for the investment advice? Do they charge a fee and if so how much?

No, no need

Offer valid for one new Individual, Joint, IRA account or a new account managed by TD Ameritrade Investment Management, LLC.

See the “or”. Any type of account qualifies

I had a bad experience with the Chase. I decided to sign up for their $1,000 Sapphire offer which required a $75,000 relationship including the You Invest account.

To do this I had to go by a branch and open the bank account, (time consuming). I then transferred in about $140,000 in securities from PNC Investments, paying a fee to do so.

I soon afterwards got a form letter saying they had decided to close my account even giving the account number or a reason. It seemed to be something on the interbank reports, although I could what. not find out, whether a closed account somewhere possibly with a few dollars in fees they had never even tried to collect from me.

Possibly it was the dispute with CITIbank where when after several hours of discussion they were not satisfied with how I had accumulated the wealth I had reported at some time to CITI Investing. They froze my account with only a social security check in it (less than a thousand at the time), and did not execute my bill pay instructions to pay Discover card entered just after the social security payment was received (and accepted the next month’s payment).