That’s good thinking and you took advantage of the quirks of brokered CDs. When the prevailing rates of brokered CDs are lower than their initial rates (in this case their coupon rates), they gain in value. So if you can get direct CDs now with rates higher than the brokered CDs, it is a good trade to sell the brokered CDs and swap them into direct CDs.

I am curious where you purchased and sold your brokered CDs? Were you able to view any bid/ask prices before selling? I have the Discover 4.9% 5-yr brokered CD at Fidelity but there were no bid/ask prices unless I request one (which I haven’t).

TDAmeritrade. “Sell” isnt actually selling it, it is requesting a bid. Then you need to accept the bid.

Not sure how the mechanics work, but in both cases when I first accepted the bid it declared it no longer the best offer, and then offered a better price. No idea where the bids come from, but it indicates it may be prudent to wait a few minutes before accepting. For one of my CDs, the bid was increased 4 times before it let me accept.

I suspect I have the same 4.9% CD you have, plus a couple others at 4.9 - 5%. I plan to sit on them, although I probably should be capturing that premium as well. I also have a 3% Cap1 CD I bought at a discount (yielding 5%), I need to figure out the math to determine that one’s premium as well.

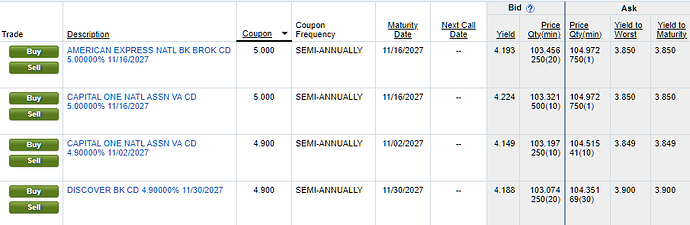

By going directly to the search for secondary CDs, I can look at the existing bid/ask prices at Fidelity. The spread is wide, but for those 4.9% ~ 5% 5yr CDs, the price is like $104, i.e. 4% above par.

I do have that same Discover CD. Right now (3:42PM) I requested a bid for it, and was offered 102.974. 8 minutes later I tried again, and was offered 103.716.

TDA also has 44 of those CDs for sale this afternoon at 104.451.

It almost seems stupid to not accept, since I bought at 100 and I’d only lose .2% in coupon rate. I’m just reluctant to put everything in one (GTE) basket.

That does seem compelling although it would have tax consequences for you in 2023.

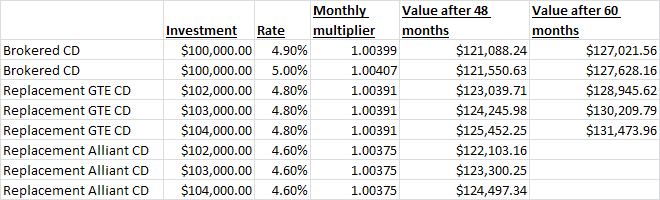

I created a spreadsheet to look at the “swap brokered CD for direct CD” scenarios. The brokered CDs considered have yields of 4.9% and 5%.

I then consider the cases where the brokered CD is sold for $102, $103 or $104, and then re-invested into either the GTE 5-yr CD @ 4.8% or Alliant 4-yr CD @ 4.6%. The values after 4 year or 5 years are shown.

Without taking taxes into consideration, the GTE replacement CDs provide a better return for every scenario. But that for the Alliant CD is less clear since it is for 4 years only.

Yeah, but the tax consequences are significant and could change this entire analysis. I think you need to deduct the additional taxes you would pay in 2023 due to selling the brokered CDs from the amounts you would use to purchase the direct CD before concluding this option is your best bet.

I have thought about the tax consequences a bit. If say you sell at $104. That’s a gain of $4. If 25% is taxed away ($1), then you will be reinvesting with $103. You can read from the table that you will end up with $130.2k.

Also, you’re not comparing apple to apples. For example, the 4.8% for the direct CD is the APY, whereas the 5% for the brokerage CDs is more like the APR if you can reinvest the dividends at a good rate elsewhere. Under the circumstances, I think you should use a 5.1% rate for the brokerage CD.

Do you have state taxes where you live?

According to the above chart, it looks like you can only sell for $103.

Yes, I have state taxes.

Yes, I should have used the rate instead of APY for the direct CDs. Good point.

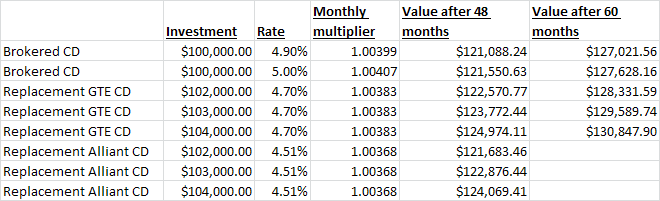

New table using the CD rates instead of APY.

So assuming you can sell the brokered CDs for $103 and you have $102 after taxes (it’s probably more depending on your state tax) then the direct CD gives you about $700 more over 5 years. That’s about $11 a month. Is it worth it for this amount of money? Also, don’t forget you’re going to be paying taxes on the additional $700.

Those may be your numbers but they are not mine. The brokered CD I have is 4.9% and my marginal tax rate (fed + state) is more like 15%.

Okay, but i thought you said in an earlier post your marginal rate was 25%. I also thought you said that you have a 5% brokered CD. Anyway, do what you want.

A marginal rate of 15% would mean you have less than $83,000 of taxable income if you’re married.

You’re also paying tax on the brokered CD interest. The premium is going to skew things a little, but the tax on the interest earnings is basically going to be a wash. You won’t pay tax on the extra $700, because you already backed out the tax on the premium at the beginning. The $700 difference will get bigger, because you’ll be paing tax on the extra .2% from the brokered CD each year.

All it boils down to is, is a 3% lump sum worth more than 0.2% over 5 years? It was a much easier question for what I did do, capturing the premium and getting a better ongoing rate ![]() .

.

Don’t understand the “wash” logic. The direct CD is going to generate $700 more interest than the brokered CD on a before tax basis. After taxes the difference is going to be less.