Wow FP on SD.

OT but surprised FWF didn’t just move to SD

Wow FP on SD.

OT but surprised FWF didn’t just move to SD

Am I the only one noticing that nowhere in that post does it state that the 7.12% is only for the first 6 months, and that there is a 1-year minimum holding period? That’s a pretty key detail to omit when pimping ibonds.

The SD Finance forum is suck.

![]()

I hear ya. SIS Mostly amateurs compared. Moderators are terrible too.

Can you decode? I know what SD is…

Front page on slickdeals

rules for thee but not for me…

It sort of worked out that the finance oriented people came here, and the deals people went there. I do miss the one big community though. Lots more epic threads about fallen trees, car accidents, and the world’s worst tenants complaining about evictions.

I think we’ve had plenty here. What’s more epic than “a deer ran into my car and killed itself” ? ![]()

And you can always decide to lose the last 3 months of interest when/if the rate crashes.

This was in reference to buying multiple lots of bonds now as gifts, then delivering the maximum $10k per year over the next few years. Until the gift is delivered, it cannot be redeemed. So if you buy $100k now, you are stuck with the prevailing interest rates - for a full 10 years for that last tranche of $10k.

Beyond 2-3 years, there is much more risk that the ongoing rate fluctuations will negate the benefit of capturing the high initial rate.

Good for tracking how the I bond rates are progressing.

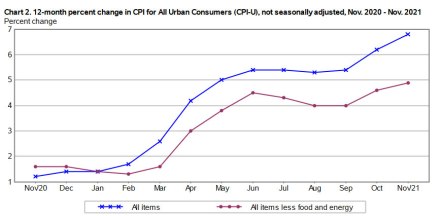

By David Enna, Tipswatch.com This time, the economists just about got it right. The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.8% in November on a seasonally adjusted basis, t…

I’m about to buy for DW and son to meet the year end 10k ea. deadline, but can’t figure out why I bought mine in oct @3% vs now at 7%

I know it’s hedge that the rate will go lower than 3% in 5/22, but not likely IMO

I bought mine in oct @3% vs now at 7%

Not to worry. The inflation adjustment on your bonds will reset after six-months with the higher inflation rate.

but can’t figure out why I bought mine in oct @3% vs now at 7%

Because you are getting the 3.5% for 6 months, then the 7% for another 6 months. By buying in Oct, you locked in an additional 6 months of earning a favorable rate. Every ibond holder gets the 7% rate for 6 months, but it varies what 6 month period you earn it depending on when the bond was purchased.

By buying in Oct, you are now ensured of getting a high rate for 6 months longer after inflation goes down. Every 6month period of high inflation will just get tacked onto the end of your bond too. Had you waited until november, once inflation decreases the rate you earn would also decrease almost immediately. Yet if other rates do happen to spike, you can still get out after 1 year.

Anyone here also buy EE 0.10 % *

*Regardless of interest rate, we guarantee these EE bonds will double in value if you hold them 20 years.

Purchase Limits: Within TreasuryDirect, you can purchase $10,000 per calendar year per Savings Bond series

Any tax advantages etc?

Roughly a 3.5% rate for 20 years? That’s…ok, I guess. But if you need to redeem it after 19 years 8 months, you’ll have earned virtually nothing the entire time since pretty much the entire interest earnings don’t kick in until exactly 20 years.

I don’t know - it sounds like a decent option, but also an option with a lot of room for a lot of regrets down the road.

3.5 % would have been a good rate for the last 20, not so sure about the next “at the rate” we’re going now. Good for college savings/safe retirement type investment I guess

Its the 20 years all or nothing part that causes the most hesitation. That precludes it as college savings for all but the youngest of kids.

agreed… isn’t the double a floor though? You do get nominal interest on top too?