TIPS and treasury yields recently.

TIPS and treasury yields recently.

Mrs. Lincoln and Mrs, Kennedy, among others, disagree. ![]()

Surely I’m not the only one seeing this math fluke? I have an I bond issued 10/21, and another issued 1/22. For the past couple months, TD has showed them both with the exact same current value, despite one being three months older and earning a different rate for 3 out of every 6 months.

You’ve got to account for the Canadian math. ![]()

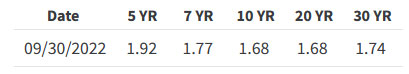

Argues that the fixed rate should increase to 1% or so, given the real TIPS yields around around 1.75% currently. Guess we find out in Nov.

TIPS yields

Right now, the common thinking in the I Bond community is this: “Demand for I Bonds is unusually strong and the Treasury doesn’t need to raise the fixed rate.” And, yes, this is true. But as a matter of fairness , the Treasury should raise the fixed rate, to reinforce the idea that an I Bond is a quality long-term holding for small-scale investors.

Ha Ha! The first Ha is for the fairness comment. Fairness is only talking point. The only fairness that everyone gets is of opportunity. The second Ha is for the idea that the Treasury, or any part of government, is going to think long term, which I believe this requires. If government thought long term, it wouldn’t be so much in debt and the budget would be a lot smaller. ![]()

OPM= Why buy one when you can get two for twice the money ![]()

The Treasury has no incentive to increase the fixed rate. More people are buying them than normal because of the high variable rate.

Yeah, unless there is some legal mandate/criteria that forces the fixed rate to increase, I don’t see why they would.

Purely a guess, but I have to think that there is a general formula they use as guidance, and it’s as much a calculation as it is a decision.

Just did some googling and by way of this landed on the following:

One might hope the Secretary has more guidance than “just do it”.

With the new CPI out, it looks like the next 6mo will pay a hair less than 6.5% annualized, after the 9.6% rate expires.

Buying this month will be the last chance to get that old higher rate, although you’ll also get a 0% base. Unclear if they’ll raise the base for Nov.

Investors can still purchase I Bonds in October and receive a full six months of the current rate, 9.62%, and then six months of 6.48%. That creates an annual return of 8%+ for a very safe investment.

Another writeup. In short, you can expect to make about a 7% or a bit less IRR guaranteed by buying at the end of this month and holding for 11-14 months (11 because you get Oct for free despite buying at the end, 14 if you wait 3 months more to forfeit the new, unknown rate that follows the just determined one).

https://www.depositaccounts.com/blog/inflation-treasury-series-i-savings-bonds/

So based on this and the above numbers, if you buy an I Bond on October 31, 2022, the value of the I Bond on October 1, 2023 would be about 6.43% higher. For 11 months, this comes out to an annualized yield of about 7.01%.

Below is an estimated annualized return for I Bond redemptions from October 1, 2023 to January 1, 2024. It is assumed you will buy the I Bond at the end of October 2022 which gives you almost an extra month of interest. This effectively reduces the 3-month penalty to 2 months.

The highest guaranteed rate would be an annualized return of 7.01% for about 11 months .

Note, it’s best not to wait until the last day of the month to buy I Bonds at Treasury Direct… make sure the purchase is no later than the second to last business day of the month. For this month, make sure you purchase I Bonds no later than Friday, October 28th.

Of course you don’t need to plan whether to cash out in 11-14 months now - you can wait and see how CD or TIPS rates are doing compared to the next 6 month rate and decide then.

Also, in the comments, there’s some glitch on TD.gov that’s making it hard to buy certain types of gifts, so if you have an issue, it’s technical but may not be resolved in time, because it’s the government.

I am maxed out for wife and me in 2022. I was going to gift bonds before end of month for wife and vice versa for delivery in 2023. Unfortunately, because of some kind of glitch, it isn’t going to happen. Too bad.

![]()

Fingers crossed, maybe they’ll fix it in time. Crazier things have happened.

Tips Watch makes a good case for buying now, not for Nov, even if they might raise the base rate. The old higher 9.6% rate you lose is worth too much.

Starting off with a rate of 9.62% gives the October buyer a huge head start over the buyer in November, especially if the fixed rate stays at 0.0%. That’s interest of $481 in the first six months, which will continue to compound higher as long as you hold the I Bond. Keep in mind that a fixed rate of 0.5% equates to $50 a year on a $10,000 investment, before compounding. It will take 8 years to catch up with the October buyer, even if the fixed rate rises to 0.5%. If the fixed rate stays at 0.0%, the buyer in October is the eternal winner, because the November buyer can never catch up.

The key takeaway from this chart is that after 5 years, when you can sell the I Bond with zero penalty, the October buyer would have built up $12,370 versus $12,277 for the buyer in November with a 0.5% fixed rate, and $11,979 for the buyer in November with a 0.0% fixed rate.

Looks like the gift purchase problem has been fixed.

TIPS looking like 1.75-1.80% real yield for 5 year term. Auction coming soon, commentary.

This will not be a reissue so the purchase price will be close to par, which reduces the possible decrease in case of prolonged deflation. Recall that, in case of deflation, you always get back the par price at maturity.