10 for you, 10 for hubby, 10 for trust, 5 on paper as tax refund.

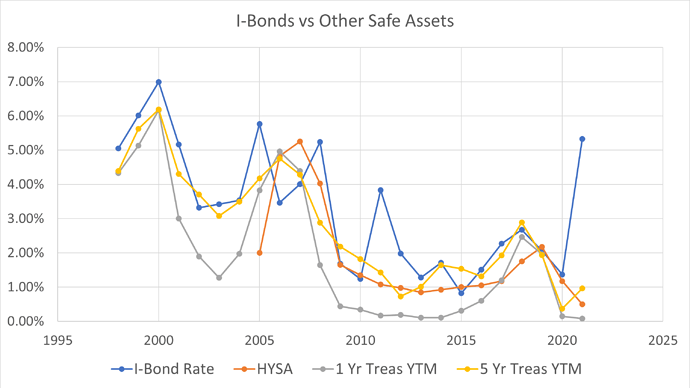

Nice chart of how much better I bonds are right now than the alternatives.

https://www.bogleheads.org/forum/viewtopic.php?p=6276906#p6276906

That chart makes it look like I bonds have always been very competitive, and all the talk about a “one year CD equivalent” should be squashed in favor of just holding all you can buy.

Agreed. This chart is definitely a good lense into just how good I-bonds are.

So are we all going to go for these I bonds?

Other savings are in the doldrums.

I’m thinking of my case. Stash $35K in bonds or keep funds at Keesler HIMMA Plus 1.4%.

I’m definitely maxing for me and my wife, and then planning to do it again on 1 January 2022.

(and I’ve been telling everyone in my family that will listen that this is a good move for their spare cash)

Since you can only buy $10k per person, per year, directly (not considering the $5k paper bonds you can get via tax returns) – and the true lock-up is only 1 year – this is my new favorite place to stick an emergency fund.

If the money is something you might need to repair your car, then keep it at Keesler. Don’t want to lock up emergency funds for a full year.

But if the money is chilling at Keesler because you don’t have anywhere better to stash it…well, this is somewhere better to stash it.

I suspect that in a couple years, we’re going to be glad about (or regret not) buying and holding all the I bonds we can.

Playing devil’s advocate, only the 10 for you and 10 for spouse makes sense to me. The others are a lot of trouble for very little extra return.

I do not have a trust and it does not make sense to set one up just for this purpose. Even if I had one I don’t know whether this would result in more hassles like extra tax returns.

That leaves the $5K refund gambit. The IRS is backed up for months and the gambit requires trusting the IRS, the US mail from the IRS and to the treasury direct. You have to prepare the paperwork and possibly go to the post office to send it certified mail. One screwup and it’s a lot of hassle.

So let’s take this for what it is: some fun. The real energy should be put into figuring out what will happen with the tsunami of inflation that has been unleashed by the reckless spending in Washington DC and in the unfunded liabilities in the entitlement programs on the federal level and in the states like my California.

I agree. If you have one and already have to do the paperwork due to other holdings, then it’s a no-brainer. If you fully intend to hold for the next decade, and add another $10k each year, then that changes things too. But for a standalone $10k, it’s a lot of hassle.

I’m buying some in my niece’s and nephew’s names. Yes, there’s a small risk that my sister will pull the “it now belongs to the kids” technicality and prevent me from eventually reclaiming the funds. It’ll require filing a tax return for each of them, exercising the option to pay income tax on the accrued interest each year, but beyond that there is no added hassle since they dont meet the requirements to have to file a return each year (and wont for another decade). So in this case, the interest will effectively be tax free as well.

’m buying some in my niece’s and nephew’s names. Yes, there’s a small risk that my sister will pull the “it now belongs to the kids” technicality and prevent me from eventually reclaiming the funds.

Maybe you see that as a “technicality” – but that is NOT “just” a technicality.

Legally, you have gifted the money to the kids in order to do what you are suggesting.

Even with your own children, this is an iffy thing to do. But with nieces and nephews, this sounds like a terrible idea.

Or I’ve provided a loan they’ll eventually have to repay. It’s a gray issue, and only an issue if someone decides to make it an issue. I am prepared for the consequences if that does happen, and would just consider it an early inheritance/college fund/whatever.

I have 5-figures churning through accounts in my sister’s name at any given time anyways. If there are issues with technicalities, a few savings bonds will be the least of my worries. ![]()

Haven’t you heard – California had a record surplus last fiscal year. What unfunded liabilities?

It’s only a “surplus” because far too many people think the government should live paycheck to paycheck. If there’s extra cash flow you can afford to blow it on anything you want, instead of using today’s excess to reduce what you need for tomorrow.

I have no idea what you’re talking about. California has a sizable “emergency fund” too, to cover future surprises / downturns. And they didn’t “spend” the surplus – they used some of it to issue tax refunds to low income working families.

See this

“the state has significant unfunded liabilities associated with retirement benefits for state employees and teachers,” said a (California) Senate Budget and Fiscal Review subcommittee report last week.

It said that at the end of fiscal 2019, the state had $186 billion in unfunded liabilities for state workers and teachers. The breakdown: $92 billion for state retiree health benefits, $61 billion for state employee pension benefits administered by the California Public Employees’ Retirement System and $33 billion for teacher pension benefits, which is the state’s share of the teachers’ system’s unfunded liability.

The figures Palmer and the Senate subcommittee described do not encompass local government or local school district retiree obligations

Edit. The exact liability numbers depend strongly on the assumed rate of return on the trust fund assets. If you’d like to debate this, let’s switch the discussion to the politics thread

I’ve come up with another additional $10K that might work for me. How about Self Employment?

Here’s my new plan, you show $30K above. We’re self employed, so I’m adding $20K more. So probably we’re eligible for $50K+ 5 on paper as tax refund.

Workable?

I don’t think so. Who may own an I bond?

But I could be wrong. You can open an account as a sole prop, so perhaps there’s no difference between how a trust or a sole prop would be treated. The confusing part is that FAQ says the limit is $10K per recipient SSN.

I’m not computer savvy (like you guys), so I don’t know how post articles.

But on Kens Depost Accounts, he posted from “Finance Buff”. I bonds.

$10k person A, $10 p B, $10 p A rev liv tr, $10 pB lv tr, $10k per A busines, $10 pB bus +$5k tax ref

I could only use 1 rev liv trust

Who is right?

This may be helpful:

- You can open a second TreasuryDirect account for your business with its separate business name and EIN. This allow you to purchase an additional $10,000 in I Bonds each calendar year.

The thing is there’s no limit to the number of businesses an individual can own. In fact, there’s no limit to the number of sole proprietorships one can have. And a sole proprietorship can use the SSN, though if you wanted to do more than one you’d need either EIN (free) or DBA (cheap one-time registration fee with your local govt, AFAIK).

This makes the $10K limit arbitrary / unenforceable.