Weeee!

With treasury rates at new record lows (1.65% on 30yr??), I wonder what the odds are AAPL (and MSFT, etc) might sell $100Bs of long term bonds at absurdly low interest rates and retire even more shares?

Seems like they could issue 30yr for below 2% based on the past rounds vs tbill (2.99% last year when 30yr tbill @~2.5). If I could borrow at 30yr fixed rates of 2%, I’d leverage up as much as possible.

I’d wonder how much the market would actually buy? But it’s almost a no-brainer, especially for companies where the 2% interest cost would eliminate a 3% dividend payout.

But, those bonds would eventually mature and need paid, and there would be a lot of uncertainty over reissuing the shares, issuing new bonds, etc. So the merits would need to consider the fully amortized annual bond cost, not just the interest cost, to ensure they don’t end up stuck in a pretty deep hole.

I didn’t catch this last year, but apparently they already sold some 6yr/0% and 12yr/0.5% bonds in Europe… https://www.google.com/amp/s/www.barrons.com/amp/articles/apple-is-paying-less-than-ever-to-borrow-in-europe-51573993800

Edit:paywall article ![]()

I was hoping for just one more “up” day for lower IV to exchange my LEAPs for higher strike prices and longer terms. Shoulda swapped out yesterday…

I was hoping for just one more “up” day for lower IV to exchange my LEAPs for higher strike prices and longer terms. Shoulda swapped out yesterday…

The bottom is officially “in”. (Because of course I would wait and only get out at the bottom).

I sold 11% of my AAPL exposure when AAPL was ~$290.

Today I sold 2/3 of my remaining exposure, >$130k of LEAPS (received ~$265-$270 AAPL equivalent price including the option premiums since IV is so high and was near $0 before if I had sold in Jan) .

I’m down to 92% long market exposure now. (Since the LEAPS are deep ITM, I am multiplying them out to assume I “own” all of those shares to get what Im calling market exposure. Whereas my new TSLA puts are counted in at the market value instead, ~6% of my account value. ). It feels rather weird having positive cash balances…

All things considered, <20% off of AAPL high seems OK. IB accounts value ($269k) about 1/3 off of the January high. Still up >200% from the Jan 2019 low.

Current holdings are 25% Ford, 61% AAPL, 6% 7.8% 8.6% 9.1% $500 1-2 wk and $400 3wk (added today) TSLA puts. Wow those puts went up ~50% from a couple minutes ago. I should have bought more of them this morning than the 3 I added to 3 existing…

Edit:How to decide when to sell the TSLA puts though… Seems like we have some risk of market closure next week…

Edit2:

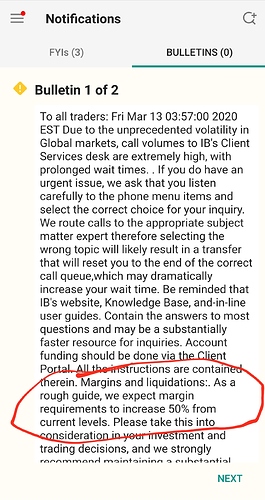

Also, IB sent out notice this morning of expecting to increase margin requirements, “as a rough guide, we expect margin requirements to increase 50% from the current levels”.

Market closure would be very unlikely, Mnuchin said as much recently.

BDCs and mortgage REITs sure got hit hard… I will be SLOOOOWLY increasing my positions.

I’m sure we should all have high confidence in Mnuchin’s assessment.

Every day this year has also been “a great time to buy” from his public statements. The article you link from Munchkin is also only a couple days after his bosses’ claim that US cases will soon go from 15 to close to zero… I think I am being objective by placing Mnuchin’s public statements very close to Trump’s off the wall nonsense statements (that I think no one including supporters can deny happen). There are other members of the administration who intentionally deflect rather than give patently false statements. I could be incorrect putting him in that category, though.

I don’t think many people are prepared for the official cases and death numbers to balloon, and that there will be more widespread panic that will affect stocks. (median ~ 18 days for deaths means it lags even more than the reported “cases”). I guess time will tell. Even if strict measures were enforced across the board (They’re not yet), across the entire country (also not), the numbers from onset and confirmation/severity lag by such an extent that they would keep increasing exponentially with no change in trajectory evident for several daysweeks.

Edit: made a little more concise

If this behave like the crash before (yet to be determined) then the strategy would be to sell on the bounce.

Which one?

Do you think its not — just theoretically, pretend we’re in similar condition to Italy in 2 1/2 weeks. (We have less hospital capacity per capita, and on similar trajectory on officially reported cases (with less testing).

Additionally, we have a president who is … let’s say “sensitive” to market movements, as a campaigning tool.

Sorry, chain of comments. I am guessing there is some chance of it occurring. I don’t know for a fact either way. After more research, I’m thinking probably after next week is more likely. The deaths will start piling up after next week.

I don’t like this line of speculation, but i’d guess 1k by 3/25.

Friday I unsuccessfully tried to buy more tsla puts right a minute before close as tsla prices were spiking up. I think now I should have used a market order for the first time instead of limit order :(.

Looking like another -10% day shaping up

Anyone know a single place to figure out any scheduled/ announced WH briefings? Thought there’s one for today that was mentioned yesterday, can’t find the time…

All my stonks were down 11% today. But account only down 1.5% overall because of the TSLA puts.

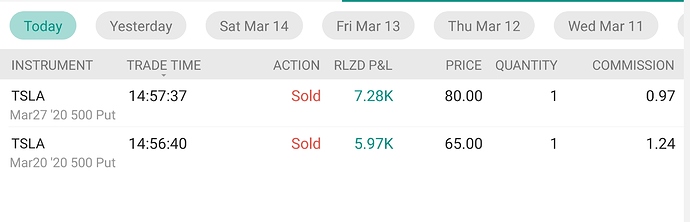

TSLA was off 18% near close. I sold a third of my options. Now I just have one 3/27 $500 and 3 4/9 $400.

If tomorrow gaps down, i plan to sell the 3/27 one. If it gaps up maybe buy more.

It sucks making money/offseting losses as the world burns :(.

I haven’t logged into my 40x(k) account or made changes. Probably should have moved that all into cash, but I think I’ll leave it as is at this point.

Edit: also if we’re up tomorrow I might buy some higher strike and shorter dated puts against my AAPL. The coming weeks is just looking more and more bleak.

I’m picking up small amount of GE and USO. I’m not even touching TSLA since I was never an Musk fan.

Also keep adjusting my limit order down but it seems I couldn’t adjust fast enough

It was at 3:00 pm ET again, carried even on OTA TV.

Watched it. POTUS did a little better today than he has in the past; he was somewhat less cocky, more sober and subdued. That’s a tough act for a Queens boy like Trump. Cocky is in his DNA.