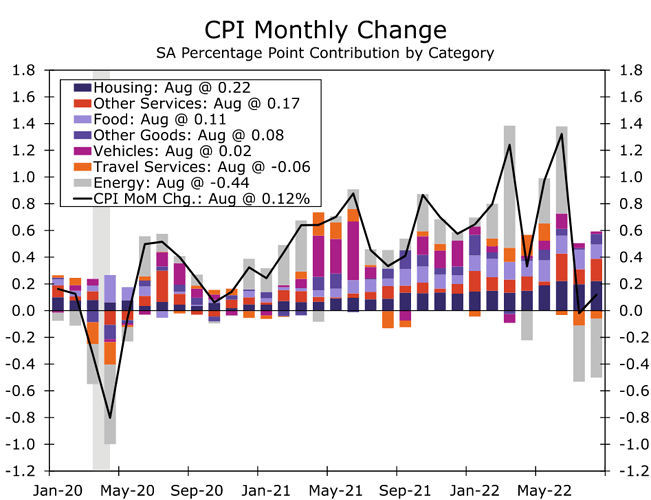

Here’s the component breakdown of the CPI in the last year or two:

Now imagine how the last two “almost flat” inflation monthly numbers look without crashing energy prices (see gray bars above). They’re around 0.5%/month or 6% annually. Biden said he was thinking about buying back oil for the SPR at $80, so there’s a floor on the oil price which is only 10% lower than currently. Mind you these falling energy prices have also been included in all sorts of other consumer goods that involve transportation, production, etc, and still those are rising.

Over the past three months, the core CPI has advanced at a 6.5% annualized pace, more than triple the 2% target.

Odds are now 2:1 for +0.75% vs +1.00% for the next Fed hike. previously it was about those odds in favor of 75bp vs 50bp.