Yeah I think with energy prices likely to push higher by then, and not much improvements likely soon on supply chain issues, it’s hard to not see anything less than 0.5% bump in rates in March. Especially when you look at what other central banks have already implemented. Honestly, that makes the delay of not starting the rate hikes in February by 0.25% all the more infuriating.

Yes, one must be intelligent enough to realize that nothing in recent history has been as destructive to America as Trump’s horrible personality and sheer incompetence on every issue. Not to mention his real, documented attempts to subvert our democracy.

ETA: But also, can you keep your political commentary to your other political threads? This is not a thread for that.

Why so low? Why not give it a little jolt with 3%? ![]()

OK maybe 3% is too high, but is 1% so crazy?

I kind of like the idea of ripping the band-aid off at once.

Pretty weak job admitting you read @shandril wrong on illegal immigration. And made wrong assumptions about me along the way too.

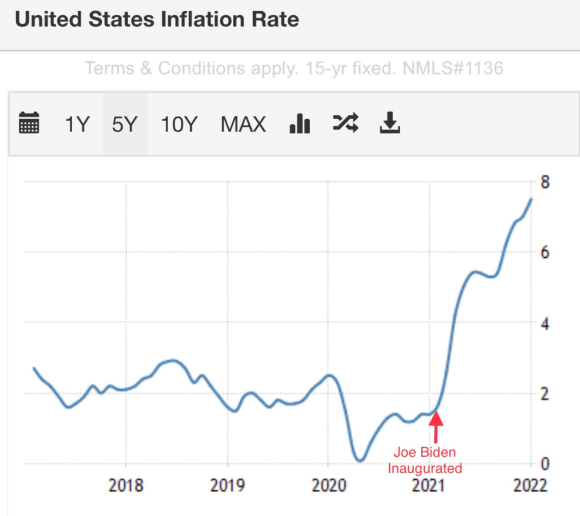

what unadulterated hogwash. An example: Trump versus Biden on inflation, the topic of this thread. inflation was under control during President Trump’s term but skyrocketed in Biden’s term

Hemingway is not liking how this is shaping up

Hogwash indeed. As if presidents have anything to do with inflation.

they have everything to do with inflation. A few examples from many. Biden and his administration have injected trillions of dollars into the economy. Basic economic theory tells you this causes inflation. In addition Biden shut down large amounts of US oil and natural gas production thus Increasing the worldwide shortages and causing increases in energy prices.

Biden and his administration have injected trillions of dollars into the economy.

Actually that’s Congress. And which trillions are we talking about, exactly? Has that money been allocated, printed, and spent/injected already? Or just earmarked?

What about the trillions that were injected and earmarked before Biden took office? Because I think those already have been spent/injected.

You really can’t blame any of the early 2021 inflation on the current administration, since nothing was yet spent. It doesn’t make any sense. It doesn’t make any sense to blame any inflation on the administration or Congress until money was allocated and spent. I don’t recall when that happened the first time in a significant amount, but it wasn’t that quick. And inflation would lag the spending anyway.

Actually that’s Congress.

A congress that is controlled by the political party of the president. Biden and his handlers have done nothing to restrain the spending. Indeed they have actively lobbyied for spending even more such as Biden’s build back bankrupt bill.

Build Back Better was never signed. Are you blaming inflation on something that never materialized?

Oil and gas “policy” don’t explain used cars, real estate, and rents skyrocketing last year. But the reopening of the economy and the money we’ve been showered with during the 2020 lockdowns do explain it.

Yes, one must be intelligent enough to realize that nothing in recent history has been as destructive to America as Trump’s horrible personality and sheer incompetence on every issue. Not to mention his real, documented attempts to subvert our democracy.

Except half the goverment was outright ignoring, if not actively working to undermine, everything Trump did. So we really have no idea what the effects of his policies would’ve been.

There’s been talk for years of the Fed needing to raise rates, if not for Trump’s hyper-focus on the stock market putting pressure on them to leave things as-is. So our current state may very well be his fault, preventing the Fed from getting ahead of this, but we’ll never know because we dont know how many “loyal career government employees” were hellbent on doing their own thing regardless of what policies were handed down.

And referencing your (“you” as in a publisher’s own) prior article claiming he attempted to subvert democracy is not real documentation of him attempting to subvert democracy.

OK maybe 3% is too high, but is 1% so crazy?

They’d have to be convinced that 1% rate hike would even work to make a dent into the causes of inflation. And at the same time, they’d have to believe that hitting the panic button like that would not disrupt markets too much. Considering how they’ve operated in recent years, it’s hard to imagine they’d go for a 1% increase.

And from a job performance standpoint, a 1% increase in March would also prove that they were sleeping at the wheel through the fall and early winter, misread a ton of macroeconomic data, and are incompetent at keeping inflation in check considering that we’ve done significantly worse in that department than other large economies in the world (eurozone averaging just a bit more than 5% over the same period).

And at the same time, they’d have to believe that hitting the panic button like that would not disrupt markets too much.

Oh it’d definitely disrupt the markets. But is one big temporary shock now any worse than a nonstop series of small shocks over the next year? I could see it in a lot of ways being better, get it over with at once instead of dragging the process out.

Build Back Better was never signed. Are you blaming inflation on something that never materialized?

build back bankrupt is still on the table. Inflation is in large part about expectations and this humongous amount of spending certainly leads to the expectation of inflation

I am also blaming inflation on the spending that Biden did nothing to slow down. Indeed as I mentioned he’s trying to spend even more.

Oil and gas “policy” don’t explain used cars, real estate, and rents skyrocketing last year. But the reopening of the economy and the money we’ve been showered with during the 2020 lockdowns do explain it.

The spending by Biden and his handlers has continued despite all those factors. We are well into the second year with Biden and his handlers in control. (edit and his political party in full control of Congress). When by your lights does he have to accept blame?

When by your lights does he have to accept blame?

Never. Politicians never do.

Trump pushed two massive handouts, Biden pushed one. I’d agree that the first stimulus would have been manageable if it stopped there. There was little time to have a targeted package with the shutdown. Fine. The second one from Trump was a mistake.The $600/pp he handed out (he pushed for $2000) was not more targeted and flooded the economy with cash including people who are now ready to spend it after the reopening. Biden only obliged by distributing the $1400/pp Trump could not get through Congress. IMO both are equally guilty of trying to buy votes regardless of longer term consequences for the economy.

But if you think either of them is gonna accept blame and apologize for flooding the economy with cheap money that’s partially causing the inflation spike we’re having, I’d recommend not holding your breath for it. They’ll claim all they did was support hard working Americans and that the resulting inflation is all the work of forces outside their control. As usual. Take credit when something works in their favor, deflect blame when it doesn’t.

But if you think either of them is gonna accept blame and apologize

I think he meant to ask “at what point does the current president become responsible for inflation” in my view. I think that’s a question for economists to argue for the rest of history. IMO a president can’t be blamed for inflation in his first year in office (at least), since inflation is a slow-moving train and he couldn’t have possibly done anything to have any effect on it, positive or negative.

Biden priorities are apparently domestic gas prices, not actually punishing Russia.

NEW U.S. SANCTIONS ON RUSSIA NOT EXPECTED TO SEVERELY TARGET ENERGY SECTOR - POLITICO

BIDEN SAYS OIL AND GAS COMPANIES SHOULD NOT EXPLOIT CRISIS, HIKE PRICES

BIDEN SAYS WILL RELEASE ADDITIONAL OIL FROM SPR AS WARRANTED

as for cutting them off of the financial system, which might matter more, nah…

BIDEN: SWIFT ALWAYS AN OPTION, RIGHT NOW NO PLAN TO USE

Germany wouldnt go along with Swift block anyway, so it’s not that we could do that even if we wanted without full EU buy in. Maybe Hunter still has some of his millions in Ukraine payments that need to get out? Market reaction was clear vote on Biden’s weak response.

VANECK RUSSIA ETF … NEAR SESSION HIGH AFTER BIDEN COMMENTS ABOUT RUSSIA AND UKRAINE

They cutting off the biggest banks and freezing those banks’ assets. He made it sound like that’s more impactful than SWIFT. Is it not?