UK vs Eu energy dependence

Heavy reliance on gas is behind price surge

No. The reason is that the UK government has refused to support fracking to extract their abundant natural gas resources.

I did not spend much time on it, but a brief scan showed nothing about his comments in 2021. I mean if he was right then, wouldn’t he be breaking his arm to pat himself on the back?

I anticipate this is the beginning of a long string of articles that will slowly convince the willing fed to back down on hikes, possibly in November, but probably in January.

Energy woes. When you owe someone $1.5T, it’s not your problem.

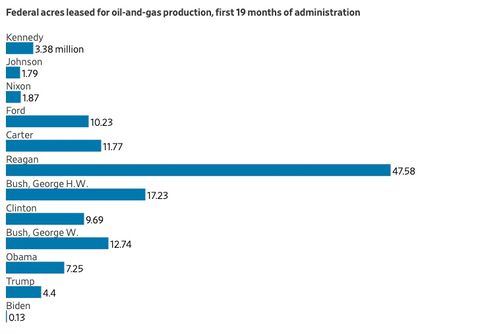

Biden’s leasing of federal lands for oil and gas, compared to priors.

I didn’t understand the chart at first. Biden’s leases were missing. I then switched from computer glasses to reading glasses. Aha! President Joseph Robinette Biden has issued more in executive orders argued for more abortions than oil leases. How truly sad is that. ![]()

Comment from elsewhere

Remember when the role of the Treasury Secretary was to oversee crucial functions that help keep the government running, including paying all U.S. bills, collecting taxes, and managing federal finances?

But now we have this wealth redistribution fanatic, tax increase activitst, climate change activist, and lover of more ‘big government’ regulation - ideologue

Fed watch, part 1

- Fed’s George: Case for More Rate Hikes Remains Clear Cut – WSJ

- George: Unclear on Outlook for Rate Hike Sizes, Terminal Rate Setting – WSJ

- George: Offering a Terminal Rate Forecast Is Just ‘Speculation’ Right Now – WSJ

- FED’S GEORGE: WOULD LIKE TO SEE A SOFT LANDING BUT THERE COULD BE A MORE DIFFICULT PATH TO BRINGING INFLATION UNDER CONTROL

part 2, different guy

- Fed’s Waller Backs `Another Significant’ Rate Hike in September

- Waller: September Fed Rate Decision Will Be Straightforward --WSJ

- Waller: Current Policy Rate Stance “Is Not Good Enough”

- Waller: Rate Rises Will Likely Be Needed Through Early 2023

- Waller: If Inflation Rises Further This Year, Fed May Need to Lift Rates “Well Above” 4% --WSJ

- FED’S WALLER: THIS IS STRANGEST LABOR MARKET I’VE SEEN IN MY CAREER

- FED’S WALLER: IF UNEMPLOYMENT STAYS UNDER 5% CAN BE REALLY AGGRESSIVE ON INFLATION

- Fed’s Waller Says If We Don’t Get Inflation Down We’re in Trouble

We will know more Tuesday.

Hardship . . . Straight Up

If these Americans are hurting, just think how tough things are for those less fortunate!

In other words, for approximately 23% of respondents who identify as Republicans, the financial hardship is perceived (i.e., in their head), not actual. ![]()

I mean, someone lost $6T in Q2, but I’m guessing most of it wasn’t owned by the kind of people who pick up the phone and answer polls.

Likely because Democrats were more likely to already be struggling, and once you feel buried in a hole it really doesnt matter how deep that hole becomes. When you have $100 but need to buy $500 of stuff, you go without. When that $500 of stuff now costs $800, you still go without. Inflation isnt much of a factor in your life, because you are going without regardless.

Conversely, when you have $500 and are buying $200 of stuff, when that stuff now costs $400 you are facing more of a financial hardship even though you can still easily cover the expense (it isnt just “in their head”). Financial security isnt about being able to afford what you need, it’s about what you have left after buying what you need. And having less left leaves you less secure and facing more of a hardship tomorrow.

Why would you say this is likely? The survey included households earning $48K-$90K. There’s no indication of the distribution of income across party preference within the poll.

Ok, I didnt quote you, but it was an indirect response to you regarding 23% of Republicans being dillusional. It’s just as likely that 23% of Democrats have already accepted hardship as the norm (or cant do math to know they’re experiencing additional hardship ![]() ).

).

Besides, $48k-90k is a huge range when there’s no consideration for household size - one extra child (Republicans tend to have larger families) could make a family feel more hardship than those with smaller family size. And to my own point, Democrats tend to live in urban areas where dollars dont go as far, where income being equal they were already struggling relative to their Conservative rural counterparts.

So true and takes me back:

Maybe 20 or 25 years ago I ran into some numbers comparing my own cost of living with that of a close SoCal relative. They were looking at costs 1.4 times those I face. And that might be low because the analysis was comparing only cities. I had to select the small city closest (but not all that close) to where I live as my point of comparison. But my own rural costs, as you point out, are likely lower even than in that small city.

As a retiree, and in particular now with this horrendous inflation, it’s a blessing to reside in a place where the cost of living is not through the roof.

You call it a blessing, others call it an unfair inequity that justifies the obvious need for additional handouts ![]() .

.

Wow! You stepping purty fer out on that limb, boy. You must be makin book. ![]()

Yeah, but it was in their head, and not actual … until they sell. ![]()

What the heck? What planet are you from? There are lots of options, most of which are ethical legal. You can apply for a multitude of federal welfare equity payments. In some cities, you don’t even have to pretend to look for work. In the worst case, apply for educational loans (no offense to @jesselivermore .)

Oops! I was wrong about the previous “in the worst case.” In the actual worst case, cut back on Kools, liquor, and other spending, especially of the recreational variety.