It’s not Hertz though. Barring any agreement to the contrary, the creditors will seize the collateral and they can sell them however they want. Typically this means just carefully enough to get their money back and not caring about any more since the surplus would go to Hertz. So they could well dump them.

Expect the resale value of the following cars to plummet:

- Nissan Altima

- Nissan Versa

- Nissan Sentra

- Chevrolet Cruze

- Chevrolet Malibu

- Chevrolet Impala

- Ford Fusion

- Toyota Corolla

- Toyota Camry

Actually, the whole sedan market is going to be interesting to watch. The rental companies have been propping it up for some time. Nissan and Ford in particular had percentages of fleet sales near 40%: Carmakers sell more to rental fleets as retail slips

I think Nissan in particular is going to be hurting. Ford has largely exited the sedan market - only the Focus and Mustang are left as “traditional cars”. The rest are SUVs and trucks.

During that time, “the leased vehicles lose value every day through depreciation at a material, predictable and ascertainable rate,” ranging from $225 million to $250 million every month, according to Deutsche Bank, which assessed about 500,000 of the cars in the Hertz fleet. The bank said creditors could miss out on $1 billion in payments through the 60-day deadline as the fleet depreciates by $900 million.

That headline is a bit misleading - the “rapid loss of value” (per the article itself) is just the standard depreciation from holding the cars. Hertz’s problem is that those cars are not bringing in any revenue while continuing to depreciate, not that the fleet’s value has suddenly tanked.

It’s both.

Good points, all.

Any tips on negotiating used car price with dealer? I haven’t bought a used car at dealer for a long while and the prospect doesn’t thrill me. I know used car got a lot more room but just how much? Here, this is one I been looking for example:

- Don’t trust book values. Many of the companies that produce book values also own car dealerships and have a vested interest to make them artifically high.

- Don’t let them know you are paying cash up until the very end. Most dealerships make their money off loan financing, not car sales. If they know there is no money to be made on financing or gap insurance then the price will be higher.

- Don’t let them know you are interested in the car.

- Give them a price that you are willing to pay and be willing to walk away. Sometimes after you walk away they will call you back later and reconsider the offer.

- Whoever cares less about the deal has the negotiating leverage.

Won’t they just ask whether you need financing?

“No, I’m not interested in the car. Yes, the blue one right there. I just came over to tell you that’s the one I’m not interested in buying.”

You’d better do that before stepping into the dealership.

Have you ever even bought a car? ![]()

I dont understand? Book values are also the basis for what they pay for cars, along with what they sell them for. They play the spread, and have the same margin regardless of how “accurate” the book value may or may not be. An artifically high book value only means they paid more for the car they’re trying to sell you.

I think you mean, dont indicate you are in love with that particular car. You need to show you are seriously interested or they arent going to take you seriously; as a tire kicker/casual browser, they’ll going to stick with the sticker price. You’ll only get their best price if they are confident that the price is the only thing preventing you from closing the deal; they dont like wasting their time any more than you do. It’s why “negotiating” online can often be a fruitless exercise, since there’s no way to establish the sincerity of your interest.

A dealer is going to establish what’s on the table early in the process. If they’re expecting some profit from financing, financing is going to be a contingency in the offer - switch to cash, and you effectively blow up the deal you’d negotiated. Cash offers it’s own leverage - hand them a pre-written check for a fair amount, and they’ll be hard-pressed to reject the “guaranteed” sale, even if it’s for a little less margin than they’d typically negotiate (and if they do reject it, you can be reasonably certain you shot too low).

Leverage comes from being firm with your price. Whoever caves gives up the upper hand. That’s where you need to be willing to walk away from a stalemate; if you concede just a little on price, you’ve told them that your “best” price really wasnt your best price.

Yeah, a lot of this advice works in a vacuum but not in the real world. They’re going to ask you about financing early on, and if you change your mind, the deal gets blown up.

The better angle here for cash buyers is to finance with terms that make the dealer salivate, and then pay it off a few days later. Make sure there’s no prepayment penalty. Disclaimer - I’ve never actually done this, I just pay cash and sacrifice getting the very best deal, but friends have and it has served them well.

I also disagree with the “don’t let them know you are interested in the car” advice. If you want to purchase something that costs thousands of dollars, you’re interested in it. They know that. Instead it is better to pit competing models against each other - say a RAV-4 vs a CR-V vs a CX-5. Just tell them you’re shopping around, looking for the best deal. If the price wows you, you might buy today, but otherwise you’ll collect prices and make the decision at home. This will incentivize them to offer their best deal right away, since you’ve established that you aren’t married to this model and will think about it. They don’t want you to think about it, they want you to jump. If you have a trade, have them appraise it and say you will be considering the entire package as part of the deal.

One thing to watch out for - many dealers will outfit cars with “mandatory” dealer-installed accessories. Things like door edge guards, floor mats, spoilers, etc. Don’t buy any of this in a new car transaction, and run away from dealers that do this. It’s a sneaky way to make a huge profit - they will charge you more for these accessories in a new car deal than they would had you just walked up to their parts counter and bought them yourself. Find a different dealer that offers you the option to either pick your accessories, or allows you to buy the car as-is from the manufacturer.

All good tips but the biggest unknown for me is just how much can I push the pricing? Take that car I linked above, for example. It’s asking for $9k and I think it’s about $5.5 k tradein and $6k at auction. Realistically, can I start offering at $7.5k?

The financing component is a little strange though. Only an incredibly shady dealer would blow up a deal for deciding against financing with them. And that’s a good reason to run away from that dealer. That’s because “tied financing” is highly illegal. Shady dealers may also require tied service contracts. At most respectable dealers, the finance office should just be a good (and possibly ‘pushy’) salesperson on add-on service contracts. But the finance office should come after agreeing to a sale price.

That said, there are sometimes manufacturer incentives that are tied to financing. They should be disclosed as such, so not a surprise if they go away. I say “sometimes”, because more recently it’s more often (as is logical) that the manufacturer actually has cash incentives for not using the manufacturer’s subsidized financing.

Using a dealer’s financing if they prefer or such and then just refinancing quickly is of course another option as pointed out.

Found this article on how much to offer for an used car. Seems logical.

What do yall think?

“News flash, the dealership is going to make money on your purchase.”

This is not entirely accurate. Generally, yes they’re in business to make money otherwise they wouldn’t do business.

But the dealership is also losing money on the car each day it’s staying on its lot. At some point, they could be willing to not make money to avoid bleeding money for a car that won’t sell soon. If you’re the first to inquire about a sedan that’s been on their lot for 3 weeks, that gives you a bit more bargaining power than if you’re the 3rd asking about it this SUV since yesterday.

The dealerships and sales reps also have month end/quarter end goals to meet. So the estimate dealer profit line of $1000 or 10% profit may be their usual target, but all the other factors may affect how much the dealer may be willing to lower that % just to move the car. That’s pretty hard to know because I don’t have a clue about their incentives, goals, etc… If I offer 10% profit and they would have agreed to 5%, I’ll never know. Which is why I prefer to do the opposite.

Once I identify a potential target car, I email 4-5 dealerships across town, asking what their best out of the door price (with and without financing conditions just in case of discounts for financing) would be for it. My policy is to not be the one to mention a price first. Let them decide what they have to offer to beat the competitors for my business. They’ll have to weight their own target profit with what other may be willing to go down to so I don’t have to guess how low they’re willing to go.

That works for new cars, but not used. Even in a market where there are multiple similar options, they’re not quite comparable and so this strategy doesn’t often work.

They get financial incentives from the manufacturer for meeting those goals for new cars, so even if they take a small loss on one car it may benefit them overall. For used cars, any profit target is internal. It doesn’t behoove them to take a loss unless they really can’t get rid of the car any other way, and if they do that on a regular basis they go out of business.

All that being said, the author of the article doesn’t seem like a sophisticated buyer. “I don’t have a clue why they charge a doc fee, but apparently all dealerships like to charge it and say it is non-negotiable.” It’s because numbskulls like the author will pay it without question. If the author wanted to include $1,000 dealer “profit” (really, mostly overhead), the “doc fee” should be subtracted from that number.

It depends on dealerships but some will trade used cars too. But you’re correct that it only works assuming there’s ample supply of the car you’re looking for so that there is an opportunity to trade. If there is no direct equivalent or almost identical cars, it’s going to be tough but that’s usually part of my decision on target car. Even then, it definitely works better for new cars since value is readily accessible whereas it varies between used cars, even between similar ones.

As far as incentives, again it works better on new cars since manufacturer will have incentives for dealers. But you can find out that manufacturer incentive with minimal research most of the times so you should be able to get close to the real cost the dealer has to cover to make a profit, regardless of what invoice price supposedly is. For used cars, you’re right that it’s internal based on what dealer paid for the car in the first place. They rarely take a loss though but on many models, they get stuck with a trade from a previous deal and car may stay on their lot for a while. On those, they’d rather take a modest profit to clear space for a more profitable car. I think sedans may be in that category right now with not many cars moving and more supply than demand.

My point was your advice is great for new cars, but isn’t relevant to the article Zennuts posted.

That’s where trading in a car can help score a better deal. If you give them cash, that’s their final revenue and profit; if you trade a car, they start to look at what they can flip that car for, too. Especially if your trade-in is a more marketable model, they may take the hit on your sale assuming they’ll be able to make it up selling your old car.

I dont know what standard practice is, but the one used car manager I use to know kept a log for each “chain” of sales showing the dealer’s net investment as it rolled through each trade-in/sale transaction. When considering offers, what they had in it was as important as the market value of the car being sold. I got a good deal on one car, basically because they’d screwed a couple people previously and thus had an an artificially low investment in it as it sat - he could take a lowball offer (in my case, he overinflated the trade-in value significantly) without sacrificing their ongoing target profit margin.

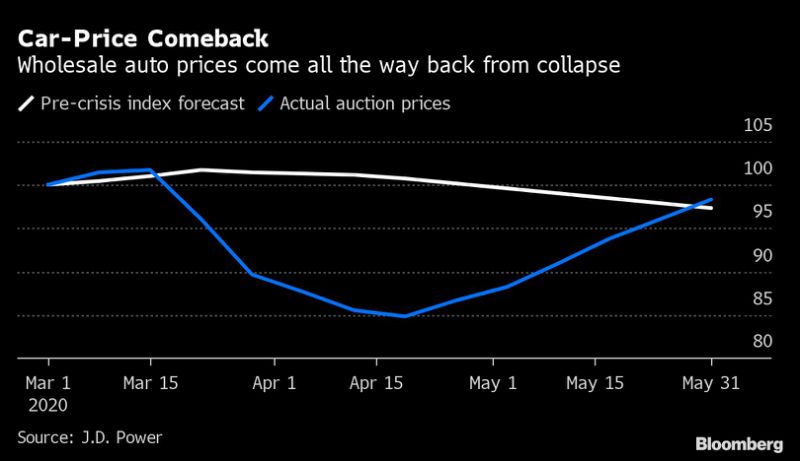

The bankrupt rental fleets haven’t hit the market yet. Plus, I suspect the effect/downward pressure will be more targeted than “the used car market”. When looking for a deal, you’ll have to focus on certain models, and even that may be limited to certain regions of the country.