I completely agree here, one roadblock I see is college scholarship programs are focused on incoming freshman. If they recognized incoming juniors in these programs, I think this would be a much more popular plan. Of course students only attending their college two years instead of four is not in their best interest financially.

They could simply not lend them at all or for smaller amounts too. Just like they do for mortgages if you ask for a loan that they consider too large for your income or if your credit history is too poor for their risk tolerance. Getting a loan is not a right but a privilege.

Truth is a lot of kids going to college are not college material. If you have low GPA and low test scores out of high-school, why would one expect you to change course magically in college? Sure some do, but it’s a matter of statistics. Some colleges I know around here that take kids with ultra low academic records have 6-yr graduation rates around 30%. That’s a lot of money flush down the toilet that the private sector would not lend as flippantly as the government and I’d agree with that.

Maybe go to community college. After proven record for 2 years, then sure transfer to a regular university and get your bachelor. If you fail at that level, at least you won’t be out much money. Even less if they make community college free for low incomes.

Another way of looking at it is, they are going to penalize people that choose less employable majors because they are a bigger risk. That’s how credit works. If you don’t want the higher rate, change your behavior - don’t major in english. If you can’t afford to get an english degree without your parents money, you won’t be able to afford to pay for your english degree loans back when you are a barista with a 4 year english degree. Maybe just become a barista now and go get your english degree when you’ve saved up enough money.

The person being penalized is the taxpayer funding the federal governments backing of these loans. The average college student isn’t going to make a different decision based on their student loan interest being 2% or 4% or 10%. I would guess less than a quarter of college students currently in school even know what the interest rate of their student loan is, let alone high school seniors choosing a major.

The two parts to credit is interest rate and credit limit. I think credit limit is where the reform needs to happen. No one should be getting a government backed student loan to go to private or out of state schools. If you make that choice the extra should be on your own dime. Cap the loans at the cost of an in-state college in your state. I am talking the D2 or D3 state colleges, not the D1 public universities that have gotten almost as expensive as private schools. That way no one is coming out of school with more than $15k / yr in loans. This still gives everyone access to a 4 year degree. But just like cars, not everyone qualifies for a loan for the Porsche.

Agree with your arguments in general but this one is not true. All D1 schools in-state tuition was pretty affordable ($6-15k/yr before scholarships), nothing like private schools at $50k+/yr. Now, if you meant out-of-state tuition for these same D1 schools, your statement is valid as we looked - very briefly - at what that public school up north would cost in Ann Arbor and more than the ivy league private school our first kid eventually went to. Pretty absurd in these conditions to go out of state unless you get a merit scholarship waiving out-of-state tuition.

Telling the Supreme Court how to do their job.

https://www.wsj.com/articles/biden-administration-urges-supreme-court-to-pass-on-student-loan-bankruptcy-case-11620681713

Backup link

Acting Solicitor General Elizabeth Prelogar said in Friday’s filing that the appeal is premature because the Department of Education is evaluating whether to relax the government’s stance on when borrowers should be able to discharge student loans. That review was started in 2018 by the Trump administration.

The Education Department “may revise its regulations and related policies in the future,” the Justice Department filing said.

The Justice Department also said the woman’s case wouldn’t be appropriate for considering a nationwide standard for student-debt discharge because of procedural problems in her appeal unrelated to her student-loan issues.

Kory DeClark, a lawyer representing Ms. McCoy, said Monday that he and his client were disappointed in the government’s decision to oppose a Supreme Court review of her case in light of the longstanding split between federal appeals courts on what bankruptcy test to apply when determining if a borrower can discharge their loans.

Personal circumstances of the case aside, I’m still puzzled how someone in their 40s thought that piling on nearly $200k debt for a social work degree, was a reasonable investment at this stage in her career.

That said, it’s also clear that the undue hardship test should be normalized across all Circuits. It makes little common sense to have wildly different statistical outcomes depending if you file for Chapter 7 bankruptcy in the First Circuit (54% discharged student loans) or in the Third Circuit (24% discharged student loans).

Recent actions along these lines

The Education Department has approved another $500 million in loan-forgiveness requests from former ITT Technical Institute students who say they were swindled by the now-defunct chain of schools, as the Biden administration expands its use of debt-relief programs.

In March, the Education Department forgave roughly $1 billion in loans for another 72,000 borrowers by revising the methodology for how debt relief was calculated, issuing full rather than partial discharges. Also in March, the Biden administration suspended collections for 1.1 million borrowers who had defaulted on debt that was part of an older loan program.

I seem to remember certain amount of debt forgiven to University of Phoenix students enrolled around 2012-2014 because of false advertisement. I wonder who has to make up those losses. Did Phoenix pay for said forgiven debt?

Many of those for-profit schools went bust when the Feds cracked down on lenient loan standards to these schools, but it looks like U of Phoenix had enough to lay out $50M in cash and forgive 3x in debts. But they had been bought by Apollo so they had some deep pockets to go after.

I know laws don’t matter much with all the executive actions these days, but the Supreme Court isn’t making it easier to use bankruptcy to wipe out student loans.

The U.S. Supreme Court declined to review the legal standards for borrowers to eliminate student-loan debt through bankruptcy, a setback for consumer advocates who are pressing the Biden administration, Congress and the courts to find ways to alleviate the student-debt crisis.

The standard that borrowers must meet to discharge educa-tional loans in bankruptcy is applied inconsistently across the U.S. and is an impossibly high bar to meet in many jurisdictions, Ms. Jankowski [the borrower’s lawyer] said Monday.

Odd comment from her lawyer. To hear the loan annulment advocates tell it, the standard is too consistently applied and too high all across the country.

Actually, I think they argue the opposite. That the unclear definition of the standard for discharge has lead to inconsistent application between the different circuits based on discharge rates variations and that was the main reason for their SC appeal on.

Personally, I agree that there should be a more specific definition for what constitute undue hardship. Should burden be to prove inability to ever repay most of the debt or something less? It should not be left to each circuit to define what that means, especially when you see the resulting differences the vague language lead to.

But it also strikes me as not something the SC needs to rule on since they don’t have much standing to decide what was the original intent (threshold for discharge) of the law. To me, it means the law needs to be changed to provide a more explicitly-defined standard.

Widening Biden debt cancellation, more schools covered under the “fraud” umbrella.

Roughly 1,800 students — at Westwood College, Marinello Schools of Beauty and the Court Reporting Institute — will have all of their debts discharged as part of the so-called borrower defense program, which allows loan holders to file claims to have their debt forgiven if they believe they have been scammed. The Biden administration has now canceled more than $1.5 billion in loans for more than 92,000 borrowers under the program

Those who graduated from the same schools but got useful degrees and jobs and paid off their loans get nothing.

Count me in that group (well, my wife). Paid off $70k in loans for her degree from Westwood…

I wonder if the same process for debt forgiveness could, should her account still be open, generate a credit balance available refund in the amount of her original loan. Probably not, but maybe worth a quick look.

I had the same thought. Signed up for the necessary account yesterday and waiting for the ID verification to complete.

Saw that article this weekend and immediately thought of this thread.

I thought you had to be smart to get into these schools?

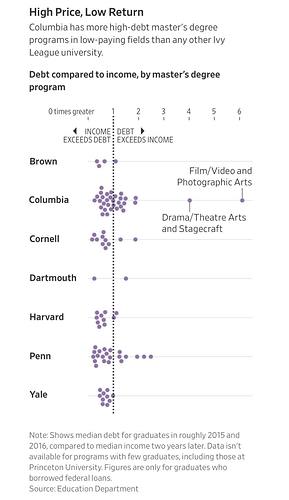

The analysis is even worse IMO when you compare what the MS in these fields get you compared to a Bachelor. It’s bad enough to pay high prices for a degree in a major that’s not gonna pay off. But spending another 2 years going for MS in the same fields is mind-numbingly throwing good money after bad. I really hope there’s no bailout for simply being stupid but I wouldn’t put it past this administration.

ETA: Sorry, but your views are old enough to be of the Shinobiwon’s generation.

LMAO … mortgage bailout … previous educ bailouts … flood bailouts … (should be lottery bailouts), lack of education bailouts, permanent or au courant victim bailouts.

If you’re stupid, the govt’s got your back … and maybe they should. Since no one takes responsibility for anything, and the govt has not only exacerbated, but encouraged that viewpoint, it’s only natural that hard working taxpayers take care of the problem. We cannot expect non-working, un-educated peaceful protesters to pay for anything. They’ve got too much angst to earn a living (and pay taxes).