Yes, that’s part of the message sent by Dr. Jackson. I’m however most concerned about the funding of this charity, since clearly they don’t have an endowment large enough to make good on all these promised scholarships.

More details and commentary.

hmmm

Can’t access the paywall for WP. Do they have any actual details or just general " student loans"

The pot farmer, duh!

But yeah, he’s making really bold gifts given him and his partner have only seeded the fund with $25M of the expected $1B price tag. That’s a lot of fundraising, and not much time to do it.

I half wonder if the plan is to just co-sign student loans, with the expectation they’ll eventually be forgiven.

Regardless of Biden’s announcement on student loan forgiveness, pay close attention to the end of the student loan payment pause. Ideally, you should have a game plan in place before student loan payments restart. Consider these popular options for student loan repayment:

- Student loan refinancing (lower interest rate + lower payment)

- Income-driven repayment (lower payment)

- Student loan forgiveness (federal student loans)

How 'bout the game plan be simply to pay your debts?

The White House’s latest plans called for limiting debt forgiveness to Americans who earned less than $150,000 in the previous year, or less than $300,000 for married couples filing jointly, two of the people said. It was unclear whether the administration will simultaneously require interest and payments to resume at the end of August, when the current pause is scheduled to lapse.

The people, who spoke on the condition of anonymity because they were not authorized to discuss the deliberations, cautioned that some details of these plans could change before the White House makes the decision official.

Good problems fo worry about - owing some taxes when they wipe out your debt,

Of course I’m sure the progressives will demand that income be non taxable too, but normally debt cancelation is taxable income if you’re not insolvent (in which case it isn’t).

Crazy to consider individuals making $150K/year as disadvantaged.

Depends on where you live, I guess. That’s a packet outside of NY/SF.

Only $10k in free money? These folks are protesting that’s not nearly enough. Of course if they had good jobs from their college degrees, they wouldn’t have student debt or time to spend hanging around with dumb protest posters, so we know where these folks stand.

“ only half a trillion in free taxpayer money? You suck Biden!” - Some advocate like AOC probably

From what’s in that article, I actually [surprisingly] agree with a lot of what she said. It’s going to piss off just about everybody - those who oppose it, and those who want more. Politically speaking, if he’s going to [try to] to do anything at all, he really should dive much deeper. Those who are against it are going to object no matter what number is used.

However, to play her typical game of “the majority should win no matter how ridiculous or self-serving they are acting”, there are way more people with no student loans than there are people struggling with significantly more than $10k…

I don’t know how much of a bump the Dobbs decision (to discard Roe v. Wade) will have on democrat turnout in the midterms, but if Biden goes through with student loan cancellation, even just $10k, he will completely wipe out that bump and then some by turning out so many more working class voters for republicans that can blatantly see that upper middle class rich young adults (and middle age adults) are getting a $10k bonus while they and their kids are getting bupkis.

So far, there has been one event in my lifetime that has made me willing to crawl over broken glass to show up and vote republican, and that was the Brett Kavanaugh confirmation hearing. This debt forgiveness will make two. Republican politicians didn’t really have to do anything for the first one. The democrats did that themselves. But in this case, the republicans will actually have to work hard to bring this to the forefront of people’s minds. But there is so much political capital there if they can do it. Especially with working class families hurting so much right now because of inflation. “They can give you and the Zoom class the same stimulus during covid. But now, after they exacerbated inflation that is hurting you so much more than the Zoom class, the Zoom class’s kids are the ones getting $10k and they aren’t giving you anything! They are literally buying their votes. How does that make you feel?”

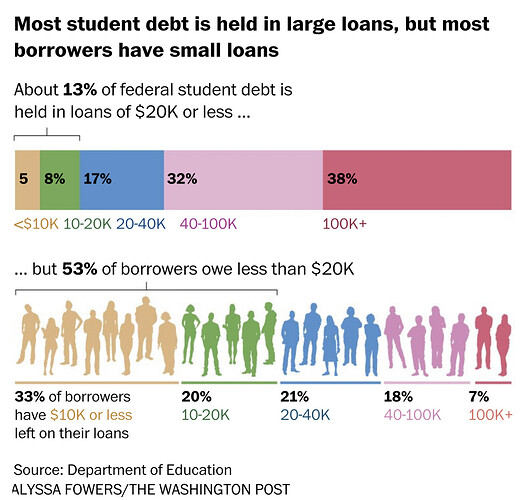

I was a bit confused by this chart … Is it saying that on the high end, 7% of borrows hold 38+% of total student debt ?!? Since 38% of loans are 100k+ and only 7% owe 100k+.

It definitely seems to indicate a large diminishing return ( in # of people helped ) after the $10-20k range.

yes, that’s right.

And from today’s headlines

WHITE HOUSE ECONOMIC ADVISER DEESE SAYS BIDEN HAS NOT MADE A DECISION ON STUDENT LOAN DEBT RELIEF

So apparently we’ve got only enough media focus for one “get out the vote” issue and they’re trying to decide if that’s student loans, gun bans, or abortion. Stay tuned.

Oh come on…

At age 34, Janell Tryon owes $250,000 in student debt.

She only took out $150,000 of it — $100,000 for an undergraduate degree at New York University, and $50,000 for a masters degree in public health.

In the 13 years since she graduated from NYU, Tryon has been making payments on her loans, while feeling unequipped to handle the debt load. After graduating, she made $23,000 a year as a manager at a bookstore cafe, and was paying $700 a month on her loans — the same amount as her rent. After graduate school, she spent five years doing research for the San Francisco and New York City health departments, talking to residents about their experiences with addiction and homelessness. Now, she’s a full-time PhD student at the University of Massachusetts Amherst.

She seems to have forgotten the part where you need to use your degree to get a better job. $100k education to work a $23k/yr job that only requires a highschool diploma, if that. And she’s still a full time student today, to boot.

Tryon’s story is similar to that of many Americans

No. No, it most certainly is not.

Is it just me, or do these mainstream reports keep getting more and more ridiculous?

I saw this too. Absurd!

Seems she has bought into the education ‘treadmill’ lie. Wonder what she’ll do after the PhD… Medical school? Maybe a cosmetology degree!

I didn’t see her contact info, so could someone let her know that the Goose School of Curation is taking applications for idiots appropriately gullible intelligent life-long learners. We help with student loan applications and guarantee a job after graduation.

$5B in loans canceled for students from a bankrupt, for profit college.

Those who were students when it failed had already been bailed out. This round is for anyone who ever went there from 1995 to 2015 and still had loans. It pays to be a Deadbeat.

Around 100,000 former Corinthian students have successfully applied for relief under Education Department rules for defrauded borrowers and students who attend schools that close while they are attending them or shortly afterward.

Now, the remaining 560,000 borrowers will be eligible for automatic discharges of their remaining Corinthian federal student-loan debt. All remaining federal loans held by anyone who attended a Corinthian school between its founding in 1995 and its 2015 closure are eligible.

What’s next? Cancellation of all loans for people who bought cars with rich, Corinthian leather?

Good joke, but we really should go after these “goose” school owners as well. Claw back money and pay off loans forgiveness debt.