You’re supposed to figure it out from context ![]()

Buffett had a few choice words for the Democrat ignorance on display in these latest tax policies.

When you are told that all repurchases are harmful to shareholders or to the country, or particularly beneficial to CEOs, you are listening to either an economic illiterate or a silver-tongued demagogue (characters that are not mutually exclusive)”.

Better watch out Wizard of Omaha. Many more honest comments like that and you will be 2023’s Elon Musk.

Biden’s pitch to spend more on rising drug costs, by jacking up the Obamacare NIIT tax rate.

The White House’s proposal would raise the net investment income tax, created by the Affordable Care Act, from 3.8 percent to 5 percent for all Americans earning more than $400,000 per year… the tax applies to capital gains and investment income. The plan also would expand this tax by applying it to more kinds of income from pass-through firms — businesses in which the owners pay taxes on their personal income taxes. Currently, these kinds of business owners do not pay this tax.

this guy never saw a tax he didn’t like.

- BIDEN PROPOSES TAX ON INCOME OVER $400,000 AT 39.6% IN BUDGET.

- BIDEN PROPOSES RAISING CORPORATION TAX FROM 21% TO 28%.

- BIDEN WANTS A 25% BILLIONAIRE TAX AND LARGE LEVIES ON RICH INVESTORS.

- BUDGET WOULD NEARLY DOUBLE CAPITAL GAINS RATE FROM 20% TO 39.6%

- THE LIKE-KIND EXCHANGE SUBSIDY FOR REAL ESTATE WILL BE ELIMINATED IN THE BIDEN BUDGET

and for our affordable energy costs during the Great Green Transition,

- BIDEN’S BUDGET WILL ELIMINATE OIL AND GAS TAX BREAKS

We’re from the government, and your latest worry should be becoming a victim of “fair enforcement”.

- US TREASURY SECRETARY YELLEN: THE IRS WILL RELEASE IT’S STRATEGIC OPERATING PLAN FOR SPENDING $80 BLN IN NEW 10-YEAR FUNDING

- THE IRS INVESTMENTS IN ‘FAIR ENFORCEMENT’ ARE EXPECTED TO REDUCE DEFICITS BY HUNDREDS OF BILLIONS OF DOLLARS OVER THE NEXT DECADE.

This could prove true - lawyers and CPAs generally pay their income taxes, and this enforcement initiative is going to increase what CPAs and lawyers earn from defending taxpayers in audits and against bogus assessments.

The key word here is “plan”. Will Ms. Yellen put her head on the chopping block if the money is spent according to plan? There are no metaphors in the previous statement. :))

What your federal tax money doesn’t buy - infrastructure among other things, especially in liberal states.

Rhode Island and California are already among the nation’s biggest spenders on roads and bridges—while ranking near the bottom on quality. And they’re not alone. According to a new study, states with the worst roads in America also spend the most per mile on their roads. The contrast between these and other states is so striking that the authors of the study proclaim, “how much each state spends on roads has no correlation with road quality.”

Corruption mostly, mixed in with union wages, government waste, and handouts to favored minorities.

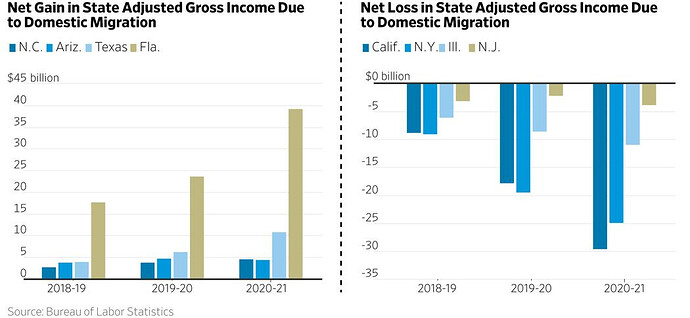

Much of this spending produces so little at such high cost that one wonders why citizens don’t vote out the politicians who approve them. One explanation may be that, in places like California and New York, the political culture has become so monolithic that virtually everyone in office shares some of the blame. Still, what comes through even in a study like the one on roads is how states with the worst records are also among those with the highest rates of outmigration. More and more people, it turns out, are taking those lousy, expensive roads to somewhere else.

Unrelated I’m sure

Here in California a lot of the roads money is siphoned off to pay for public transit that is mostly unused. Huge amounts are spent on so-called light rail that doesn’t go where people want and there is no way to get to it. And then, of course, there’s the “bullet train” to nowhere.

Some are more equal than others when it comes to the IRS.

Don’t think any of these will be needed for Hunters IRS difficulties.

Unfortunately, it’s not that simple. Lots of those who are fleeing are just going to try to do to their destination what they did to the place they left. It isnt a vote for Red over Blue, it is more a Blue spread.

That is the usual pessimistic take on the move from democrat to republican states, but the results in the 2022 election in Florida show that is untrue. If the Republican leaders of the target states show good results like DeSantis, the voters will respond. If they lead like lambs like Ducey in Arizona, they lose. Ducey allowed rinos in the Arizona legislature to stymie election reform. That allowed the Democrats to steal the election like they did in 2022.

I was just saying that it’s a mistake to assume that the exodus is from people abandoning Blue principles/agendas, it’s isnt a de facto vote. Very few of such people are willing to accept that their ideology is what created most of the issues they’re fleeing from, let alone acknowledge they were wrong.

There’s no showing it to be untrue because it’s something that is continuously in progress. It initially dilutes their effect, but takes time to collect a critical mass of different-thinking individuals and for them to worm their way into the social fabric where they can start pushing new agendas. In any given area it may or may not ever reach the point of having a tangible effect, they could remain diluted into obscurity, but it is an ongoing risk and concern everywhere. Most of these people arent changing to Red.

Nah, it’s all Red. Poor and middle class Red because they can’t afford to stay, and wealthy Red because with remote work being more acceptable they just don’t want to pay state income taxes.

Boy howdy! I see it regularly, as tons of yankees are moving into the Charlotte area. I heard some lady complain that the county should offer a compost pickup service, like her town in MA. I suggested she start a business doing the same, since she thought it was an unfulfilled need.

This ones for you Goose,

According to an in-depth report on “The Militarization of the U.S. Executive Agencies,” the Social Security Administration secured 800,000 rounds of ammunition for their special agents, as well as armor and guns.

The Environmental Protection Agency owns 600 guns. The Smithsonian now employs 620-armed “special agents.”

Even agencies such as Amtrak and NASA have their own SWAT teams.

Ask yourselves: why are government agencies being turned into military outposts?

What’s with the buildup of SWAT teams within non-security-related federal agencies? Even the Department of Agriculture, the Railroad Retirement Board, the Tennessee Valley Authority, the Office of Personnel Management, the Consumer Product Safety Commission, the U.S. Fish and Wildlife Service and the Education Department have their own SWAT teams. Most of those officers are under the command of either the Department of Homeland Security or the Department of Justice.

Why does the Department of Agriculture need .40 caliber semiautomatic submachine guns and hollow point bullets? For that matter, why do its agents need ballistic vests and body armor?

For that matter, why do IRS agents need AR-15 rifles?

I’d say it’s because of this guy, even though his beef is with the BLM (Department of the Interior).

Didn’t Al Capone get caught for tax evasion? You need guns to collect from criminals. DUH. ![]()