Hey, you want to argue with the “Fiscal Service Bureau”, be my guest.

Income tax stats for 2016. The top 3% by income paid half of all income taxes, while the top half by income paid 95%.

You can also see the average tax rate paid by percentile for each of many recent years, which is uniformly increasing with income until you look at the top 0.001% which is only ~1000 returns and then it gets noisy (still high, but sometimes not quite as high as the top 1%, probably due to a higher mix of long term gains vs income)

The IRS just put out publication 5307 discussing changes for individuals as a result of the tcja. They’re also creating a new web page to provide some more/other(?) information, though not sure if it’s live yet.

IRA and 401k limits to go up for 2019, $6k and $19k respectively.

Defined Benefit Plan: $220,000 to $225,000

Defined Contribution Plan: $55,000 to $56,000

Elective Deferrals: $18,500 to $19,000

IRAs: $5,500 to $6,000

Budget woes at the IRS. Maybe it’s just me, but I’m having a hard time feeling sympathic. Their political scandals certainly didn’t help.

“This is a great time for not being compliant with paying taxes,” said Richard Schickel, a former IRS collection agent who now counsels taxpayers. “I have 11 clients who owe more than $1 million who are not being worked at all.”

As the IRS has fallen further and further behind on collecting the debts of those who filed a return but didn’t pay their taxes, many of those obligations have been allowed to surpass the 10-year statute of limitations. “For our customers,” said Jay Freeborne, a tax professional in Seattle who advises clients with tax debts, “those are touchdowns. When debts expire, we high-five them.”

Koskinen [IRS head 2014-2017] replied with a speech he’d given many times before and would give again. A collapse in tax compliance was really possible, he said. People will catch on. He worried about the U.S. becoming Italy or Greece. “What I don’t want to do is have somebody later on say, ‘You never warned us,’” he told Congress. “This is your warning.”

The last IRS report to assess what it calls the “tax gap,” issued in 2016, analyzed the period from 2008 to 2010. It found that taxpayers had paid about 82 percent of the taxes they truly owed.

I never thought about filing and not paying. Isn’t there like a 6% APR penalty? An expensive gamble…

Yes, the late penalty is 0.5% per month, up to 25% maximum in about 4 years. After that, it stops getting bigger from penalties. Interest, currently 5% or so, accrues in addition to this.

It does seem an expensive gamble, but I guess it all depends on your odds.

It’s not about being sympathetic. Their job is to collect money for the rest of the government. If they can’t do their job, other parts of the government suffer.

Hmmm. Tax Evasion for Fun and Profit?

I think I’ll stick to the honest route. I don’t have that much to gain, honestly. Make sure the juice is worth the squeeze. But for others…

You’d think though that an income producing or at least income fetching part of the government would be of interest to be able to do their job and commit proper resources to. The suspicious side of me wonders if this isn’t intentional right now. GOP FTW?

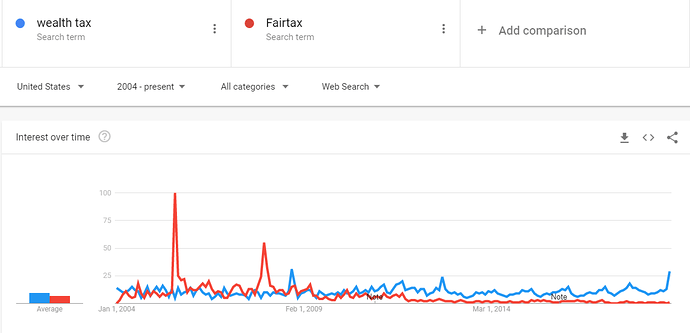

Looks like the Democrats are going to be competing for who can try to soak the Evil Rich the most to fund their 2020 vote buying efforts. Warran wants a wealth tax, which in some ways sets an even worse precedent than Cortez’s 70% income tax.

Regarding the income tax,

While the proposal is unlikely to go anywhere, it could provide a blueprint for what some liberal Democrats might try to accomplish if the party regains power in the Senate and White House.

Sounds like a Democratic victory would be a boon for Puerto Rican real estate, if nothing else.

Lots of details on the new 20% QBI deduction for things like REITs, MLPs, and certain individual businesses.

One highlight is that while there is an income limit (around $300k) for this phasing out for business income, the deduction for REIT income is not capped the way it would be for directly held real estate.

I think this is strictly noise and campaigning garbage. Neither proposal is going anywhere. I think there are cleverer (and a lot less flashy) ways to increase tax revenues to make the code a bit more progressive than it currently is. But it’s probably not gonna make good campaign material for either party.

Things like unrealized appreciation hardly ever gets mentioned as reason why wage slaves are taxed more in proportion than Buffets. Wealth tax may be popular buzz word but it has many issues. From double taxation argument to how effective it’d be if it’s not crippling and leading to either massive tax evasion schemes (look back how that went when tax rates were up to 90%) or massive capital evasion with rich people moving their money to other shores. What you hardly ever hear proposed is something like a shift from income tax to a progressive consumption tax.

And of course, all of this campaigning fodder is much more important to keep in headlines than trying to touch entitlements, no matter how much much more badly that reform needs to happen sooner than later. It’s just so much easier to talk about taxing the rich more than talking about not being able to have your cake (low taxes) and eat it too (high level of entitlements).

Tax increase is coming regardless. Anybody can talk about raising or lower tax or walk on water. In the end, s*it will have to balance out more or the less. I can always cut the hell out the tax and leave the problem to the next administration. I thought we learned that lesson by now.

I wouldn’t be so sure. From recent events, it seems to me that kicking the can is still alive and well.

You’d think. But they’ve been doubling down on the opposite for decades now.

Slashing the interest rates we pay on our debt down to 2% then refinancing all that debt has helped a lot too though. Now the cost to service the national debt now is less than half of what it was in the 90’s.

I don’t follow, as that was not Buffet’s argument. The reason why wage slaves are taxed more in proportion is because of favorable tax rates for dividends and long term capital gains (that’s realized appreciation, not unrealized).

I never heard of this so I glanced at it. It’s not clear tome how consumption would be calculated (for the purposes of making it progressive). Expecting me to provide my SSN with every purchase or keeping every purchase receipt and tallying them up at the end of the year sounds burdensome. One idea I read was to subtract savings from wages to calculate consumption, but monetary gifts and cash savings makes it complicated. Do you have a link for a good (but brief) primer on this subject?

I think the point is that over time you get asset price inflation from general monetary/CPI type inflation and taxing people on those phantom gains is basically unfair when they didn’t make any money. Some tax systems explicitly recognize this and your basis is inflation-adjusted, but for ours they tax you on these non-gains but do so at a lower rate - an imperfect trade off for simplicity, but not an unreasonable one.

Dividends are taxed at a lower rate since they were already taxed at the corporate level as profits, so arguably they shouldn’t be taxed to the individual at all. To do so, discourages rational corporate behavior to realize shareholder value by paying out excess capital. The alternative is that companies try for growth and reinvestment perhaps more than they should due to the tax drag on paying their shareholders (which should really be their main priority most of the time).

Of course these are all rational arguments about sensible tax policy, which is very different than the political pandering that underlies most of the arguments made about these situations.

That’s pretty close. As I understand it, the premise is that income can only be spent or saved so Income = Consumption + Savings. But the main difference is that debt would be taking into account as well. If you own stock like Buffet or Gates, you don’t really pay tax until you realize your gains. But meanwhile, you can obtain relatively cheap debt against your massive assets (what bank would not lend millions to Buffet for personal expenses?).

To make it progressive, it’d be a flat consumption tax (which we know is regressive) but with rebating (say instead of having tax estimated and withheld, people would get an estimated rebate on their paychecks). So you’d not really have to give your SSN when making purchases, you’d basically be taxed say a flat 15% on every purchase/expense and get some/all of it back (or possibly owe more when you file for wealthy filers).

I don’t have a very brief summary of it but here’s a detailed look at what it could be like [here].(Print Issue Archive - Boston Review)

It still leaves many questions to be answered about exact implementation especially with regard to currently tax-advantaged saving vehicles, and also projected tax revenues from such a scheme. I’m also a bit skeptical on how it would really save people from filing taxes (how would they know how much to rebate people otherwise?). But apparently there were tax reform proposals in the 90s that were based on something like that so some people must have gone beyond just academics on the idea.

By unrealized gains, I mean for example you hold on to a stock. Its value may have gained 10% in the past year but you do not get taxed on that gain unless you sell some of it. But it may be more advantageous to borrow money against your assets at favorable interest rates than paying 20% tax on capital gains if you sold the assets.

Consumption is just a measure, a consumption tax is not inherently progressive or regressive. There are many theories on methods to accomplish a progressive consumption tax. For instance, we know that poorer people spend a higher percentage of their income on necessities. So right off the bat you say - no tax on necessities. You can also impose luxury type taxes. If you buy a car, you pay tax at 5% of the amount over 15k, 10% of the amount over 25k, etc. Impose higher taxes on country club memberships, first class travel, etc.

You’ll notice that many states actually try to make their sales tax a little bit less regressive by doing things like taxing food from restaurants, but not food from grocery stores. To make it actually progressive, you just have to take it further.

None of this would require individual tracking. Although, as pointed out above, there are other formulas you can use as well that would take into account individual tracking.