Amazon has been somewhat infamous until recently for spending almost exactly as much as they earn on expansion, until the revenue from cloud computing got so big they couldn’t blow it all anymore. And as discussed above, businesses are taxed on profit not income, so no profit = no taxes. Bezos’ motives may not be altruistic.

Here are some objective pre-pandemic measures for the corporate tax cuts and their impact.

https://www.wsj.com/articles/biden-aims-at-profit-hits-workers-11617747500

Backup link

The Biden administration has proposed an array of corporate tax increases with a goal of raising some $1.33 trillion over the next 10 years. That’s three times the $409 billion that the Congressional Budget Office estimated was the cost of the 2017 corporate tax cut. To get a clear picture of who will pay these new taxes, Americans need to understand who benefited from the 2017 corporate tax cut.

Economic growth is generally viewed as some abstract concept, but when gross domestic product, which was projected in 2016 to grow by only 2.1% on average over the next three years, instead rose 3% in 2018, that small increase in growth made a huge difference to a lot of Americans. The CBO responded to the increase in economic growth by adding $6.2 trillion to its 10-year GDP estimate—an extra $1,900 of annual income on average for every man, woman and child in America.

2019 census data showing that real median household income hit its highest level ever for African-American, Hispanic and Asian-American workers and retirees? Or that the 2019 poverty rate was the lowest in more than 50 years for children, at 14.4%, and the lowest ever for individuals (10.5%), for families (8.5%), and for households headed by unmarried women (22.2%).

More impressive is that, even after 10 years of economic expansion, the 2019 gains shattered all records as real household income leapt $4,379 in 2019 alone, 13 times the average annual gain since data were first collected, almost half again more than the next highest annual income gain, and a quarter more in 2019 alone than in the eight years between 2009 and 2016. Black household incomes in 2019 surged by a record $3,328. Hispanic incomes leapt $3,731—a third higher than their next best year ever recorded—and Asian-American incomes surged $9,400, about two-thirds more than the previous high.

Record income gains, especially among lower-income Americans, caused the poverty rate to plummet 11% in 2019, the most in 53 years. The poverty rate fell the most for Asians since records began in 1987 and for children the most in over half a century. The poverty rate for blacks and Hispanics hit historic lows. This cornucopia, shown so vividly in the 2019 census data, was the product of a reduction in the American corporate tax rate from the highest rate in the world to roughly the average rate among developed countries, and a concentrated effort to reduce regulatory burdens.

How much of the benefits of the corporate tax-rate reduction went to workers? A CBO study estimated that 70% of the corporate income-tax burden falls on workers. A 2011 study by Matt Jensen and Aparna Mathur of the American Enterprise Institute made a strong case that workers bear more than 50% of the corporate tax burden. But the record income gains in 2019 provide the strongest evidence yet that the corporate tax is a hidden tax on workers.

Great arguments. That could be the basis for a shift in portfolio holdings in preparation for such - or at least attempt to do so before the market finishes to price the tax hike in.

Where do you live? Do you not have any contact with the outside world? I know a lot of people that skew statistics all the time to make their points, but I’ve never heard from someone as lazy as you that just spouts something so all-encompassing that it’s nearly impossible to support and then doesn’t even follow it up with an attempt to support it.

The charts show clearly there was no huge surge in business investment as Trump claimed.

Private residential fixed investment/gross domestic product went up slightly after Trump took office, then down again to where it started, before the pandemic started.

There was no huge surge in business investment as Trump claimed.

Ignoring the facts and insulting other people is not a rational argument.

Moving the goalposts now are we? May I remind you of your original claim?

My statements to you are in response to that exact quote. You didn’t say “worse than it otherwise would have been.” Read @xerty’s last post and show me where in those numbers you can find an objective measure of “worse.”

Yes, it made the economy worse. It stopped growing, where previously it had been growing. Not only that, it established a new system where the economy was likely to continue not growing unless with massive stimulation.

Trump promised there would be a massive business surge. There wasn’t. He was wrong. He lied.

And he changed the economy from one that was growing to one that was not, continuing into the future .

One needs to look at the pattern, the big picture, not just search for minor facts that might validate one’s preconceived notion.

Where exactly are you getting this from?

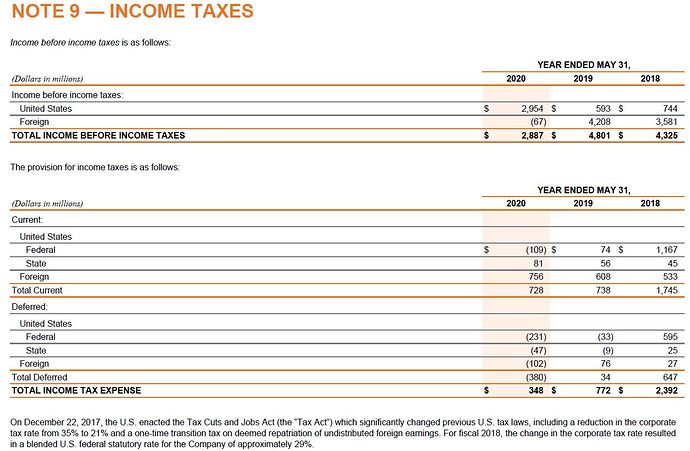

That’s not true. See page 77 of their 2020 10k filing.

https://investors.nike.com/investors/news-events-and-reports/default.aspx

Show me Phil Knight’s personal tax returns and I’ll show you a man that has paid more in federal income tax everyone on this board, plus all their friends and family combined has ever and will ever pay in their lives. Not to mention he has also given away more than any of us will ever earn cumulatively.

Because you’re the one repeating it here. The ITEP, which we already have established is a leftist think tank, claims they get this information from the SEC filings (that’s the 10K, which I linked to). The claim that Nike had a $109 million rebate for 2020 matches their 10K. The claimed income doesn’t match exactly, but it’s close ($2.873 billion vs. $2.887 billion), so maybe ITEP was adding quarterly filings and not looking at the annual filing, I don’t know. But either way, I don’t know where they are getting the claim that Nike hasn’t paid anything in 3 years. The same line that shows a $109 million federal income tax rebate for 2020 shows that they paid $74 million in 2019 and $1.167 BILLION in federal income tax in 2018.

Since I can’t depend on you to actually show me the courtesy of clicking on my link even though I clicked on both of yours and followed them all the way through to ITEP’s full report, here is a screenshot:

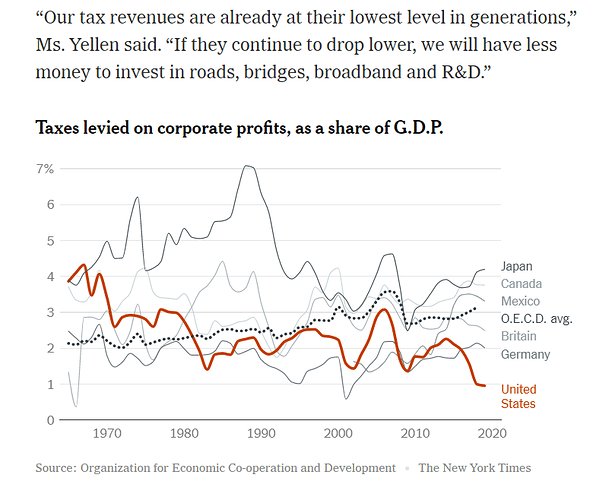

Tax revenue/GDP seems like a dumb metric. Is that implying the government has a right to grow and increase its bloat as the economy grows? It’s not like you need 10% more bureaucrats just because the tech sector sells more virtual widgets this year. Plus GDP has been going up 2% a year for a long time, although it was down a similar amount last year with all the covid lockdowns.

Besides if you produce goods, sell them, and break even, you can have an arbitrarily high GDP with no corporate income and hence no taxes due.

The fact is the US corporate tax rate was uncompetitively high in the international arena back when it was 35% and Biden’s 28% would still be clearly high. At 21% we would be similar to Europe for example. Plus, wouldn’t it be better if foreign companies started relocating to the US for our lower taxes, employing our people instead of those dern foreigners?

- The worldwide average statutory corporate income tax rate, measured across 177 jurisdictions, is 23.85 percent. When weighted by GDP, the average statutory rate is 25.85 percent.

- Europe has the lowest regional average rate, at 19.99 percent (24.61 percent when weighted by GDP).

@bender re: bezos wanting higher corp taxes

I don’t know why you think Bezos wanting a higher corp tax rate is a good argument for one. Amazon is one of the largest companies in the world. A higher corporate tax rate will only help them retain that title. Amazon could withstand a higher tax rate better than anyone (mostly because of what @psychoslowmatic said, but even if that weren’t true, it still could because, well, it’s amazon). So it is in amazon’s best interest to advocate for something that might only hurt it a little (if at all), but will have a much bigger effect on its competitors. It’s the same reason bezos an amazon advocate for a higher minimum wage. They can afford to pay their lowest level warehouse clerks $15/hr because they are amazon and they can set the rock bottom price. Who could come along and set a lower price while also paying their clerks $15/hr and make money? A higher minimum wage and corporate tax hike are just competition insurance for them.

In the 1950s, corporate taxes accounted for 35 percent of all federal revenue. Now, they account for 7 percent. Yet Republicans still think corporations pay too much in taxes?

And the top personal income tax bracket was 90%+ due to WW2 government funding. Should we go back to 90% top tax brackets, or is that not enough for the Evil Rich to pay their Fair Share?

No one actually pays that. There are too many loopholes. But, yes, probably a 100% rate is needed because there are so many loopholes and ways to avoid taxes.

But, really, do you not understand how much corporate taxes have been reduced? 7% of all federal revenue comes from corporate taxes where most of America’s wealth resides. Do you want to reduce it to zero, or do you think maybe they should pay a fair share to support America and our troops?

Were there a lot of American manufacturers with plants in SE Asia in the 1950s? I’ll give you two guesses.

Wait. I thought the wealth resided with the 1%. Now it’s not the 1%? Now it’s corporations? You gotta get your talking points straight.

You need to stop accusing me of talking points. When you resort to personal attacks, you lose all credibility.

Just because you are promulgating propaganda doesn’t mean others are.