Meanwhile…

No thanks to …

https://www.wsj.com/articles/the-dumbest-tax-increase-11619384611

Backup link

The last resort of progressives is that raising the capital-gains tax will raise revenue. They are wrong on that too. As former Federal Reserve Governor Larry Lindsey explains nearby, a 43.4% federal rate will cost the government money. The Congressional Budget Office says the revenue-maximizing rate for capital gains is about 28%. Other economists say it’s lower, and many think the ideal rate is zero. No one outside the fever swamps thinks it is more than 40%, much less the 55% or more that would apply in high-tax states if the Biden proposal becomes law.

So why raise a tax rate that would reduce investment, reduce wage growth and reduce revenue for the government? Temporary economic insanity is one possible explanation. Mr. Lindsey suggests another: punishment for its own sake. Without a rational basis for the tax increase, this sounds right. This is what happens when you turn your economic policy over to Bernie Sanders and Elizabeth Warren. Envy is in the political saddle, and Joe Biden is going along for the ride.

Sure, if they’re otherwise committing tax fraud then it reduces revenue. Which is why Trump gutted the IRS staff further.

Hopefully it gets fixed. Remove loopholes, and enforce fairly rather than only enforce on poor people.

No, capital gains tax hikes reduce revenue because people don’t sell and so don’t realize a taxable gain. Turnover gets much lower, both reducing government revenues and worsening capital allocation efficiency to help the economy grow.

It’s very hard to cheat on your capital gains taxes when your broker reports everything to the IRS in your 1099.

Stocks are not the only capital gains. Real estate is where most of the loopholes are.

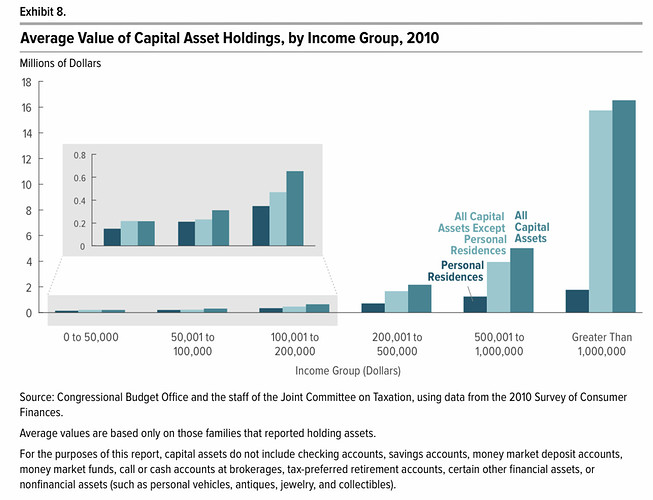

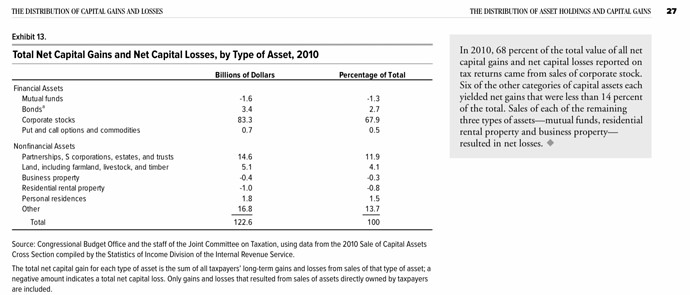

Maybe, but it’s not where the money is, both because the gains are lower compared to stocks, and because people don’t hold that much in real estate compared to equities. Here’s a CBO report on this stuff.

The bar chart only shows primary residence, not all real estate.

The table only looks at realized capital gains with the existing loopholes where the vast majority are deferred indefinitely through exchanges and/or transferred with fraudulent valuations. Even so, that minority portion of capital gains from non- stocks that are accounted for still showed up as 1/3 of the total… and as the bar chart showed, these are primarily owned by the ultra rich, top 0.3% of taxpayers with 1M+ income, not the other 997 of 1000.

If you read the report, non-primary residence real estate is about 1.5x bigger in terms of value. Yes, there are more tax breaks for them, but with primary residence generating only 1.5% of all capital gains, the most you might hope to get from all of RE is 4% or something. The whole thing is a pretty small fraction of gains in the big picture.

I suspect if you want to get any tax revenue out of property, aside from property tax, you have to get rid of step up on death. Lots of properties just don’t get bought and sold that often due to inefficiencies in those markets, so you don’t see many trades and correspondingly very few realization events for taxable capital gains.

I didn’t. But the table you posted already exceeds 4% in the current system. It shows 1.5% personal residences, 4.1% land. And a negative percent for residential rentals (because of the depreciation. Which, as you point out, makes no sense to give out if it will not be recaptured at death transfer. Depreciation when the basis is later stepped up and is never recaptured is in effect a direct cash

Agreed.

However, even if bought and sold with the current loopholes they still avoid being taxed.

I heard a podcast with a discussion that touched on why the democrat party is able to be the party of the educated and rich while they are also the party of raising taxes on the rich. It made a great point I hadn’t really thought of. Democrats say they are the party of raising taxes, but in practice, democrats haven’t really raised taxes that much in the past 40+ years. The ultra-rich celebrities have so much money that they don’t care how much they are taxed - so they are Democrats for their brand and image. The regular rich see the tradeoff of supporting the people and agenda on the right side of history as worth slightly higher taxes. They were fine with the rates under the last couple democrat presidents. Yeah, they were higher than under Bush and Trump, but they weren’t that high. Most people that are rich today didn’t have much money the last time there was a democrat party that taxed the s*** out of us. In fact, the last great tax stand the democrat party took was to fight against a tax hike for the rich in the SALT limit that Trump imposed. Why vote republican and lose all your friends when it’s so affordable to vote democrat and keep all those friends while looking down on the unwashed MAGA plebs?

Biden is risking that group with his current proposals. If the rich actually get the amount of money taken from them that Bernie, AOC, and the far left want to take from them, you will see a very quiet, but very large exodus from the democrat party. You could even see Virginia turn red again as all the well off folks in northern Virginia quietly start voting with their wallets.

No kidding. I know more than a few well paid and good Democrat professionals who were suddenly looking at their tax bracket and adding up the 39.6% on their wages, an extra 13% on most of their wages from new uncapped FICA, their progressive state raising income taxes to 12-13%, and seeing marginal tax rates upwards of 65% and a 30% hit to their after-tax take home. It’s almost enough to make a conservative out of you.

Speaking of spending other people’s money, the Biden-Harris spending blowout continues, with another $2T proposal for education, child care, and paid leave. Must include a lot to progressive educators to tell us how getting paid to not work will somehow still allow the economy to function while we take most of the money from those dumb enough to do so.

Meanwhile, they’re pitching paying for this with the 39.6% top rate on capital gains, ending estate step-up basis, and a few other things to soak the rich like screwing carried interest for investment managers.

And here’s the full pitch and the taxes are even worse than I thought. Real estate, estate taxes, capital gains, S corps, tax brackets, and many deductions getting much worse. But oh, they found however many billions to throw at their rich friends in blue states with the SALT deduction coming back.

From what I’ve read, an egregious strategy that should have never been allowed. Is it not?

Don’t fall for the rhetoric. The basic idea is that an investment manager in a hedge fund or private equity fund or similar vehicle will be paid based on performance, and this payment often takes the form of a small % of their clients’ interest in the fund. Think getting paid in vesting company stock vs cash.

So for example, if a client pays a 5% fee for a year in which results are good, 5% of their investment in the fund is transferred to the manager, who now holds indirectly the stocks or whatever assets are held in the fund, and the client now owns 5% fewer shares as before. Eventually when this holding is sold 3+ years later, it’s a long term capital gain because the capital has been at risk and not available, often subject to vesting and/or “high watermark” claw backs should future losses offset prior gains. If it’s sold prior to that 3 year timeframe, it would not qualify and would not benefit from any favorable tax rates.

I suppose there could be some analogy to vesting / deferred compensation (RSU or phantom stock plans or similar), as well as to contributing labor to build equity in your business. But I don’t know the details of those tax situations well enough to compare them. A simple version might be a startup where you’re trying to build your business and not getting paid (or not much) because there is no money, but eventually if you sell out, that’s a capital gain. In particular, it is not implied ordinary income every year on the marked appreciation of the value of your business.

Of course for the vast majority of dollars at stake, if they change the top bracket to charging LTCGs at ordinary income rates, the treatment of carried interest won’t matter anyway.

Would no longer have to worry about whether the taxation of a private equity general partner is fair vs. that of an investment banker. Assuming that they tier the LTCG taxation rates properly, that does not sound like an unfair taxation scheme to me. Regardless of where the money comes from, at a specific income level, does it sound unfair that taxation would be somewhat uniform?

Well the banker gets a cash bonus at the end of the year, which is very different than owning some illiquid venture investments for the next 5 years and hoping they work out, but having to pay 1/2 their value in taxes now. Who would take that deal?

In any event, once they get rid of favorable capital gain rates, our fearless leaders can move on to increasing inflation a lot to raise capital gain revenues and wondering whether bankers or private equity partners have a right to exist at all.

More on the latest spending blowout and how the taxes they claim to pay for it are nowhere close (realized capital gains will fall with higher rates, their permanent family credits are only billed for a few years, etc), so there would be more taxes needed down the road too (or more inflation, or both).

https://www.wsj.com/articles/bidens-cradle-to-grave-government-11619650937?mod=opinion_lead_pos1

backup link

We’d call the price tag breathtaking, but by now what’s another $2 trillion? Add $2 trillion or so each for the Covid and green energy (“infrastructure”) bills, and that’s $6 trillion of new spending in 100 days. That doesn’t include the regular federal budget of more than $4 trillion a year. No worries, mate, the Federal Reserve will monetize the debt.

IMO this is wrong. If a client pays a fund manager 5% fee for the year, then that fee should be treated as a payment for services rendered (i.e., shares sold, cash value paid to the manager). And taxed as ordinary income for that year. If the manager wants to invest that money, he can do that just like you and I can invest our after-tax money in a brokerage account.

IIRC, RSUs are taxed as ordinary income once vested, and capital gains or loss timeframe starts at vesting and stops at disposition, so that’s not really what’s happening with carried interest, right? None of it is treated as ordinary income.

That’s a reasonable view, although it doesn’t align very well with the practicalities of private equity investing, where people put up money up front and then own illiquid, hard-to-value assets for years until hopefully someone else buys them out, they IPO, or they go bust. In your model, you’d have to either 1) keep bugging investors for extra money every year for your fee, which annoys them, or 2) take a stake in this basket of holdings which can’t be sold easily if at all and fund the taxes on that out of your own pocket (which might not even be possible if you’re running a high performing big fund relative to the size of your personal wealth).

Those practicalities end up looking and sounding like tax evasion. I’m sure someone smarter than me could come up with something more reasonable. Because what’s happening now is not reasonable – you should not be able to just avoid FICA+FUTA+FED+State and pretend that everything is LTCG.