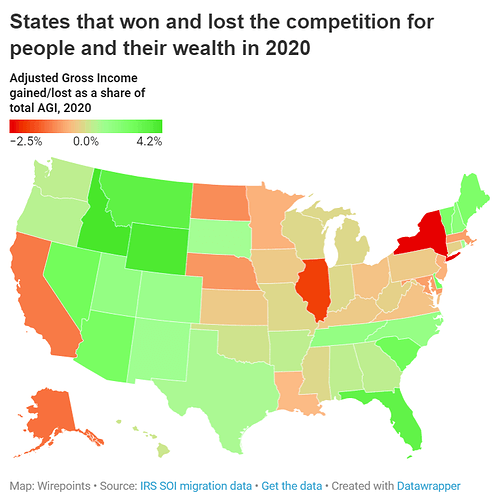

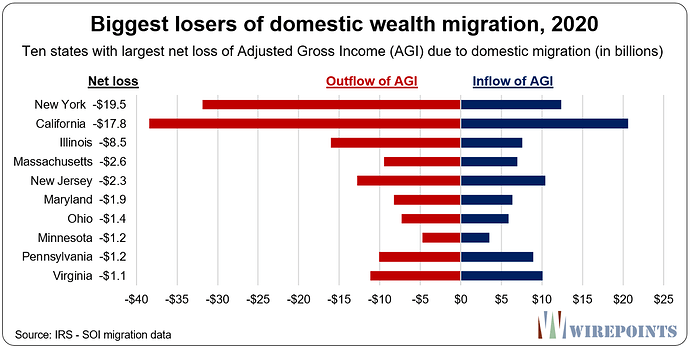

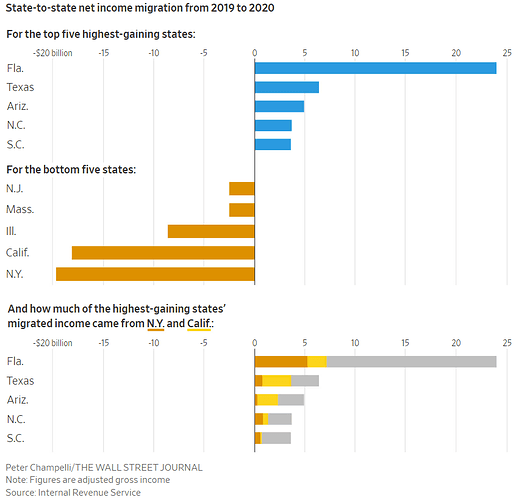

Vote with your feet, a nice recap on how income and skills flow to where they’re valued more and taxed less.

and the Bolt will be even cheaper.

This is about the so-called global corporate minimum tax. Again, the left-wing media claim that Manchin is stopping it single-handedly without mentioning there are also 50 Republican votes against it

https://news.yahoo.com/joe-manchin-left-global-tax-121128234.html

Yellen assured the minister, Paschal Donohoe, that the administration would be able to secure enough votes in Congress to ensure that the United States was in compliance with the pact, which was aimed at cracking down on companies evading taxes by shifting jobs and profits around the world.

It turns out that Yellen was overly optimistic. Late last week, Sen. Joe Manchin, D-W.Va., effectively scuttled the Biden administration’s tax agenda in Congress — at least for now — by saying he could not immediately support a climate, energy and tax package he had spent months negotiating with the Democratic leadership. He expressed deep misgivings about the international tax deal, which he had previously indicated he could support, saying it would put American companies at a disadvantage.

Big donors beware. Make sure you have all your paperwork from the charity or you could end up with nothing.

Looks like it’s just a Democrat talking point for the next election. Boob bait for the Bubba‘s

NEW MINIMUM TAX ON BIG BIZ: The proposal would create a new 15 percent minimum tax on big corporations. Details are still sketchy, but it’s aimed at companies that report big profits to Wall Street but appear to pay little or nothing to the IRS.

“It is commonsense that a domestic corporate minimum tax of 15 percent be applied only to billion-dollar companies,” said Manchin (D-W.Va.).

Here's what to know about the Manchin-Schumer tax deal - POLITICO

This proposal has taken a lot of fire from tax experts who view it more as a soundbite for politicians than a serious tax proposal. They say there are legitimate reasons why companies would tell investors one thing and the IRS another, not least of which is companies are required to use different accounting rules when reporting to the Securities and Exchange Commission and to the IRS.

The latest version catering to Sinema now features a 1% tax on stock buybacks, because discouraging efficient capital allocation is a Democrat priority. She gets enough private equity money that she prevented the carried interest PE/hedge fund tax benefit being killed and replaced it with this buyback tax, which is both dumb and hits everyone’s investments with worse returns.

The deal struck to get Sinema on board would pare back the original 15% corporate minimum tax proposal by creating an exemption for depreciation tax deductions. This change was urged by manufacturers.

The hole created by this new exemption as well as by nixing the carried interest provision would largely be made up for with the 1% excise tax on stock buybacks, according to people familiar with the talks.

It’s still got a lot of moving parts, but here’s a long summary of the details of the Build Back Smaller act as of today.

$3B for Climate Justice! Ask the EPA for your share if you’re an aggrieved minority.

Why are stock buybacks considered efficient capital allocation? I’ve always thought it’s the worst idea. In a closed-loop time-constrained system I could maybe see it being more efficient than dividends, which are taxable to the stockholders immediately, while buybacks may theoretically increase the value of each share and not taxable until sale. But stocks are priced at a multiple of annual earnings and have wild swings, so at the end of the day I’d rather get paid now than have the company waste money on their own stock at a 20 or 50 or worse multiple. And the reason is that I’ve owned some shares of a company that has been buying back shares for many years, but the share price hasn’t moved all that much (of course earnings have also varied and clearly there are other factors, but still). In my eyes they’re wasting money on the buybacks instead of growing the business, acquiring other businesses, paying their employees better, or even paying dividends.

It depends on the situation. If you have some unloved sector like coal or oil or shipping, you can have stocks that produce large profits / cashflows but trade at very depressed levels on a valuation basis. PE’s of 1-2x, market cap at ~1/3 of liquidation value, etc. In those cases, their own stock is almost always the best possible investment they can make, since it makes a huge return compared to a long term fair value or even a medium term liquidation value (for coal mining/depletion model). Dividends in this situation are better than nothing, but you would really increase their earnings/share a lot more by buying back cheap shares so the S gets smaller rather than working on the E getting bigger in the E/S.

As for your other uses of capital, acquisitions are difficult when your stock is undervalued - potential targets won’t want it or you would have to offer some many shares it would be unattractive. Stock based M&A wants buyers with highly valued stocks to use those as currency to buy companies with lower valued stocks. Furthermore, additional reinvestment in the biz or new projects, expansions, etc, are inherently risky and often unsuccessful. If you have a bad valuation now, just wait until you start making high risk, leveraged bets on new projects - the market will hate that and your stock will be priced even worse.

I’m sure they’re all paying their employees enough to keep them, not sure why paying them more than market rates should be a priority for a biz that’s owned by the shareholders and not the employees. If they want to profit from the profit of the company, buy some stock.

I have seen examples of companies that are just a box of cash with $3/share sitting in it, but yet they trade at $1.25. So they bought back stock at $1.50 and raised their value that way. If they buy back half the shares at $1.50, now the remaining shares get to split the excess $1.50 cash/share among them, making the new value of the company $4.50/share. This is exactly what you want the company to do in this situation - they raised the intrinsic value by 50% by taking advantage of the depressed price of their stock, while giving a better deal than the market was to shareholders looking to sell. No new project or whatever is going to guarantee a 50% risk free return in a month like this.

Anyway, that’s why disincentivizing buybacks is a bad idea.

Those are really edge cases, though, aren’t they? (in current real-world terms)

Maybe I’ve just read a lot of biased reporting on the matter, but it seems like the majority of the discussion around buybacks is how many companies are choosing to do them at fairly high earnings-multiples, with the effect being a lowering of their P/E ratio by spending borrowed money to do it.

That said, I would agree that the cases you’re describing are the “right move”, fundamentally, and shouldn’t be discouraged.

I understand that when the multiples are low. But it stops making sense when multiples are high, yet plenty of companies still do it – it’s just a waste of capital in those cases.

Also in case of coal and oil, they’re not just unloved, they may have dwindling reserves (of the underlying resource) and you have to dig deeper ( ) than the basics to figure out why the multiples are so low.

) than the basics to figure out why the multiples are so low.

Those high multiples are predicated on expected EPS growth. And the best/easiest way to grow your EPS - without needing to figure out how to grow the business - is to reduce the number of shares outstanding. Your year-over-year profits could actually fall, yet share buybacks still allow you to report EPS growth.

I mean, the company execs are supposed to be stewards of the shareholders’ capital. If they’re making too much money and don’t know what to do with it (ie in excess of cap ex requirements for sustaining the business, and beyond any growth prospects that are sufficiently attractive), they should either buy back stock if their stock is “cheap” or they should pay out dividends if their stock is “expensive”. Both are roughly equivalent in terms of aggregate capital returns to shareholders, but the buybacks are more voluntary, only paying those looking to sell at current market prices, while dividends return capital to everyone, most of whom perhaps didn’t want it right now and then have to go to extra trouble, bookkeeping, etc, to reinvest those dividends back into buying more stock.

I think there’s a pretty big middle ground between “stupidly cheap” and “clearly overpriced”, and in modern decades the default has been stock buybacks rather than dividends. A century ago, the default was dividends, but these days stock buybacks are favored. I suspect this has a lot to do with federal tax policy on dividends, since until the 1950s, dividends were not “double taxed”, ie taxed only at the corporate profits level but not also taxed at the personal income tax level.

| Time Period | Tax Rate on Dividends |

|---|---|

| 1913-1936 | Exempt |

| 1936-1939 | Individuals income tax rate (Max 79%) |

| 1939-1953 | Exempt |

| 1954-1985 | Individuals income tax rate (Max 90%) |

| 1985-2003 | Individuals income tax rate (Max 28-50%) |

| 2003-Present | 15% |

So I think corporate standard practice evolved to favor buybacks over dividends once the Feds discouraged dividends, and here we are with them trying to tax both. Maybe they should just spend a little less so they don’t have to raise quite as much tax revenue? But then they wouldn’t have billions to blow on “climate justice”.

On other general point against this buybacks tax is the argument against the income tax. If they get it at all at 1%, you know some overspending bill is gonna need more funding in the future and some progressive is going to say “we tax dividends at 24% on the Evil Rich and buybacks at only 1%, let’s hike that to 5%” and so forth. Don’t let them tax it at all or it’ll go from a tiny income tax to the main funding source for the government’s runaway spending.

I don’t want to derail the tax side of things with stock specific discussion, but here’s a link and an excerpt of hedge fund guys discussing energy stocks and how they fell so much recently in spite of the fairly strong futures market predictions for 1-3 year future commodity prices (which those companies can lock in via hedging if they want).

—-

Andrew: And I’ve written a few times on the blog about how the share prices of oil and gas and energy companies really perplexed me. I’m just looking like, the strip is like not current energy prices, which are obviously up a lot, but energy prices for 2023, 2024, 2025. So the future strip, since the beginning of the year for oil is up, like around 20%. And for that gas is up almost 50%. And yeah, a lot of these oil companies are up a good bit. But if you looked at the kind of Cash Flows implied by the strip, throughout, nowhere close to that, and I’ve been very perplexed by that…

Chris: I mean, my kind of oil and gas tourism that could get me in trouble is if you look at somebody who looks like say they’re going to have been or you predict that they’re going to return in capital like you can get some free oil and gas companies, none of the money they’re going to make in the next few years. And it just seems like it’s an amazing opportunity…

Andrew: Yeah, Just on your cash flow thing, I think it’s my buddy, Morris’s proposal on Twitter who said hey, one thing, and I’ve certainly had this beat into my head more than once like, you can’t buy back your way out of a terminal value question. If you’re generating a lot of cash flow and the markets putting a 7 times multiple on you, and you think you’re worth 10, you can take advantage of that but if the market thinks maybe you’re not, you don’t have a terminal value… I think about a lot of the legacy media companies, but the buybacks don’t really matter. Like, you need to just prove you’ve got a sustainable long-term future.

And I think a lot of people look at energy companies say, oh, well, maybe they don’t have renewables coming, they’re really ramping up and people are trying to eliminate carbon, maybe they don’t have a terminal value. And I kind of look at them like, yeah, but there’s trading so cheaply, like, the terminal value doesn’t matter. They’re gonna generate their whole market cap in the next year or 18 months. Either the strip is right, and we get all our cash back, or there’s something like completely wrong with the strip. This isn’t even a terminal value question anymore.

Beginner question: I looked it up and I read about strips for bonds but I did not see any reference to strips for share prices. What are these people talking about?

They’re talking about the futures curve for oil or nat gas prices.

Thanks Democrats /sarcasm

Progressives want Joe Biden to unleash what they call “beast mode” executive power, and the Schumer-Manchin tax bill supplies the cash to turn the Internal Revenue Service into Wolverine.

The bill includes $80 billion in new funding for the tax man. Democrats claim this “investment” will yield more than $200 billion in revenue. That estimate is highly speculative, but if it’s anywhere close to right IRS auditors will soon be coming after tens of millions of Americans.

The $80 billion is more than six times the current annual IRS budget of $12.6 billion. The money will be ladled out over nine years and comes with few strings attached. The main Democratic command is for the tax agency to bring the hammer down on taxpayers. The result will be far more audits, civil suits and criminal referrals.

Despite all this new money, Americans shouldn’t expect better IRS service. The agency in the 2022 filing season answered a mere 10% of its phone calls. The Taxpayer Advocate Service revealed in June that as of May 31 the IRS was still sitting on 21.3 million unprocessed paper tax returns, with millions of taxpayers “waiting six months or more to receive their refunds.” Yet the Schumer-Manchin bill devotes only $3.2 billion for “taxpayer services.”

Maybe it’ll save $200 billion in interest costs from catching up with delayed refunds…