a fool and his money, or a fool and his crypto…

A fool and his ponzi are running into “withdrawal delays”

Due to extreme market conditions, today we are announcing that Celsius is pausing all withdrawals, Swap, and transfers between accounts… to protect and preserve assets to meet our obligations to customers.

I don’t know what half the words around this Celsius crypto thing mean, but I know the translation - “no bueno”.

I didn’t follow the link, but after an hour of “focus” time, I appreciate the laugh.

Flake deterrence: I was not laughing as someone’s misfortune. I was laughing at fools.

I am completely out of Voyager. Voyager had a relationship with Celsius several years ago, but is clear in their filings and postings online that they have no funds with Celsius now and haven’t for some time. But now, after seeing Celsius freeze deposits, I can’t see how Voyager’s payouts are sustainable long term. Maybe they will weather whatever storm is going on in crypto right now, but I don’t want to have anything “stable” in their system if/when the the storm gets too bad and they have to freeze deposits as well.

Decided to check my account :

oh well I guess the $100 or whatever I put into that account won’t make me a billionaire afterall.

HODL!!! ![]()

![]()

![]()

Congrats on having the risk tolerance to invest in Voyager, and the foresight to prudently withdraw.

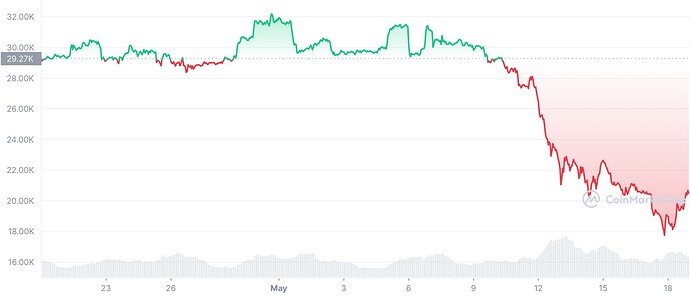

Things are difficult out there right now for the crypto folks. That includes even Bitcoin.

Oh man, it’s bad when you bring in the bankruptcy lawyers.

some bankruptcy enthusiasts commenting -

the latest in a string of recent disasters is Celsius — a “decentralized finance” platform that serves as custodian and manager of crypto for heaps of

suckers… uh …unsecured creditors… uh … investors. We’re very pumped for the imminent battles over what monies constitute “property of the estate” in those situations.

And he’s been anti-crypto since the beginning. I wonder what his opinion would be if he could sell adds on it.

Obviously if you could sell ads on it (i.e., there is a market, people willing to buy ads), then its value would not be based on nothing, it’d be based on ad revenue.

Oy! HM, it was just a joke. Sorry that it flew too high.

and it would be called Facebook.

Three Arrow, a crypto hedge fund into lending / DeFi, is blowing up. Margin calls from the crypto decline.

Three Arrows Capital failed to meet demands from lenders to stump up extra funds after its digital currency bets turned sour, tipping the prominent crypto hedge fund into a crisis that comes as a credit crunch grips the industry.

Lenders have sharply tightened up how much credit is on offer following tremors over the past month. Celsius, a major crypto financial services company, blocked withdrawals last week, while a pair of major tokens collapsed in May.

The troubles at Three Arrows ricocheted to Finblox, a platform that offers traders 90 per cent annualised yields to lend out their crypto. Finblox, which is backed by venture capitalist firm Sequoia Capital and received an investment from Three Arrows, reduced its withdrawal limits by two-thirds late on Thursday London time, citing the situation at the hedge fund.

90%? That doesn’t sound right… and yet it is. WTF.

Finblox also paused those rewards (in addition to imposing the w/d cap).

Another freezing…

Celsius woes

https://www.wsj.com/articles/a-crypto-bankruptcy-could-be-an-investors-nightmare-11655469655?tpl=br

If a cryptocurrency company goes bust, its users’ digital assets will likely go into the bankruptcy estate that lawyers, financial advisers, lenders and other creditors divvy up. Customer assets could be repaid at a loss, rather than simply returned to the users

A bankruptcy judge may also have to decide whether Celsius’s depositors would even be considered unsecured creditors or merely investors, which rank even lower, said Jim Van Horn, bankruptcy lawyer at Barnes & Thornburg LLP.

Lawsuits in the horizon…