I can create a lot of things that have no value. And the governments don’t have bitcoin because you need a lot of electricity to create them. Funny thing is that you and I could buy bitcoins, just exchanging our hard earned dollar$ for them.

I am considering buying through ETFs . There’s more than usual hype about them such as this.

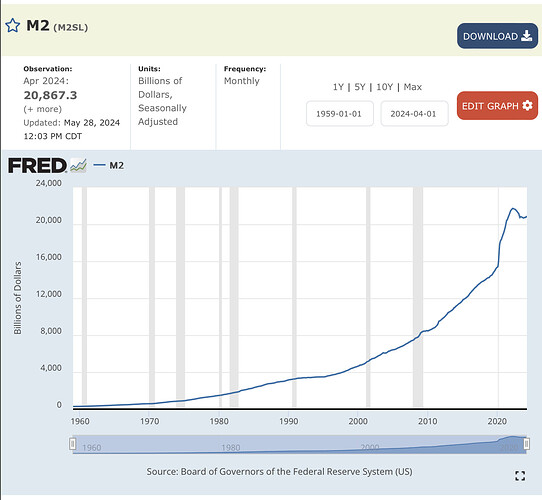

Also a lot of irresponsible printing of money. Here is the growth of the M2 money supply

Bitcoin is not an investment. It’s not the solution to the problem of government printing money, responsible or not. It’s a gamble on finding a greater fool in the future.

Still disagree on both, and I’m not long any BTC. The protocol enforces scarcity, kinda like the Secret Service anti counterfeiting group for USD, but without the politicians printing trillions of new dollars and causing inflation.

Whether or not it trades like a hedge against inflation, or the US dollar, much like gold, just depends on whether people think it will or not.

I agree that BTC is not the solution to government budget deficits. Just because it’s unsuitable as a country’s currency. And I’m not talking only from a volatility standpoint. Completely anonymous decentralized currency system seems also hard to reconcile with regulation, oversight, and enforcement.

It does however behave exactly like a speculation vehicle with people trading on geopolitical rumors, celebrity hype, and general FOMO. I’m not sure if fits the usual greater fool theory though. BTC valuation always far exceed its fundamental value (unlike equities during a bubble market) because it has none to start with.

It may be a hedge vs. inflation and at the same time positively correlated with market stability unlike gold which is usually negatively correlated with market stability. Personally I’ll stick to a less-volatile inflation hedge I understand (TIPS).

lucky or right. Better to be lucky…

The permanent portfolio fans, who advocate holding 1/4 of your assets in gold, are suspicious of TIPS. One of their gurus, Craig Reynolds, famously said.

why buy fire insurance from the arsonist?

If you read zerohedge or other skeptic finance sites around the time the CPI number comes out, you’ll see articles about the finagling that is going on.

See this article talking about seasonal adjustments. It was about the PPI and not the CPI, which is used in Tips, but there are similar adjustments there.

And then, reading a little further into the BLS press release we find this surprise: "the decline is attributable to the index for final demand energy, which moved down 1.6 percent."

Which then brings us to the absolute punchline, because in the very next sentence, Biden’s Bureau of Gaslighting Services writes that "leading the March decline in the index for final demand goods, prices for gasoline decreased 3.6 percent."

Hold on a second, didn’t we just show that gas prices - actual, real gas prices, which everyone across the country has to pay - rose by 6% in March?

Yes we did, but what we didn’t anticipate is the amount of BS Biden’s henchmen are willing to shove down our throats. And indeed, to understand how gasoline could possibly drop by 3.6% in a month where it rose over 6% we have to look at the category description, where we find the little trick beloved by propaganda ministries everywhere: "seasonally adjusted."

That’s right, as shown in the chart below, according to the BLS, the seasonally-adjusted gas price in March magically dropped by 3.6% even though the unadjusted, as in real, gas price rose by 6.3%, exactly what the AAA also reported in its daily summary of what gas prices across the US truly are.

A clear discussion of blockchains and cryptocurrency.

Crypto is selling off a lot, BTC -10%, ETH -20%. Markets are getting bad in a hurry, not just crypto.

Did everyone suddenly realize it’s not real? ![]()

^^^this^^^ matters more than this >>>

Academics on what moves crypto

—-

There was a time when people thought that crypto might be a new asset class that was uncorrelated to other assets, but that seems like mostly a mistake. Crypto is a volatile infinite-duration asset; it goes up when risk appetite goes up or when interest rates go down, and down when risk appetite goes down or rates go up.

In that vein, here is a new paper by Austin Adams, Markus Ibert and Gordon Liao, titled “What Drives Crypto Asset Prices?” Their answer is, roughly, a combination of (1) risk appetite, (2) interest rates and (3) idiosyncratic demand for crypto

We investigate the factors influencing cryptocurrency returns using a structural vector auto-regressive model. The model uses asset price co-movements to identify the impact of monetary policy and risk sentiment in conventional markets on crypto asset prices, with minimal reverse spillover. Specifically, we decompose daily Bitcoin returns into components reflecting conventional risk premia, monetary policy, and crypto-specific shocks…

Fun comment by a guy who follows the crypto bankruptcies closely:

https://twitter.com/ThomasBraziel/

Someone should create a satirical news outlet like The Onion specifically for the crypto. Imagine headlines like:

“Bitcoin Maximalists Declare Gold ‘Too Heavy to Carry,’ Demand Digital Rocks”

“Ethereum Developers Implement New Protocol to ‘End Gas Fees’… Again”

“New Crypto Startup Promises to Revolutionize How You Lose Your Money”

“NFT of a JPEG of a Receipt for an NFT Sale Auctioned for $1 Million”

FTX bankruptcy is over and people are getting paid.

Under the terms of the Plan, 98% of the creditors of FTX by number will receive approximately 119% of the amount of their allowed claims within 60 days after the effective date of the Plan

and the last few getting paid a bit later, also well. I guess these are “dollarized” claims, so I think you get paid in dollars and since crypto did well, the assets were worth more than at the start of the BK. Not sure if that’s as much as the crypto you thought you owned at FTX would have done.

FTX etc bet on the wrong party/ at the wrong time

This is a hard one for people who claim to be able to read the mind of the stock market

Bitb up 9.76%

Gld down 2.63%

Tsla up 8.62%

DOGE is for those who think BTC is speculative. We’re officially living in “Back to the Future”

![]()

![]()

![]()

MSTR is a stock that used to do (and still does) a little software work but gained notoriety by holding lots of bitcoins. Lately they have been raising $1-2B at the drop of a hat and ploughing those debt proceeds back into buying more BTC.

This appears to have the effect of both propping up BTC and raising the company’s value since they trade currently at 3x the value of their BTC holdings. I’m beginning to wonder if they’ll eventually corner the market on BTC and drive the price way up. Right now they have 300-400k BTC, out of about 20M total. However only maybe 2-3M of those trade so they’re up to 10-20% of the “float”.

The stock is now worth over $100B now and Saylor the ceo has (nearly) 10% of that so he’s doing well too.

As someone said, BTC’ll hit $100k when he wants it to, since he’s got $3B worth of buy orders on the bid.

Weird times.