That’s supposedly old, unless they are only letting sales not buys like the other brokers are

Robinhood said “limited buying” for tomorrow and a bunch of those stocks ran up on it. How dumb is it that the price of the stock depends on the ever changing regulations instead of supply and demand?

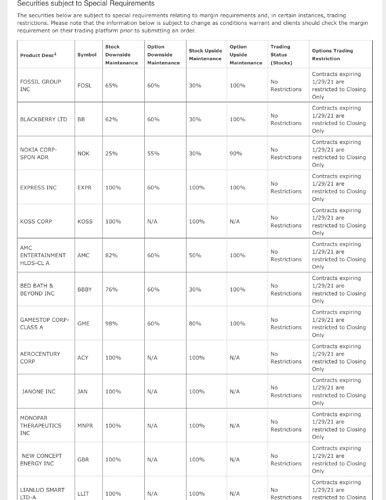

TDA gets is right. If you’re going to have restrictions, these are a lot more sensible. Basically 100% margin / limited risk options where you’ve got the cash are fine, covered calls, etc.

AMC, CVM, EXPR, FOSL, GME, NOK, BB, BBBY, FIZZ, GSX, IRBT, NCMI, TR, UONE, VIR, NAK, NAKD, DDS, KOSS

The following restrictions are in place:

Stocks - 100% holding requirement (not marginable)

Long calls and puts are allowed

Covered call and short put orders may only be placed with a broker. Please be aware that wait times to speak with a broker may be longer than normal due to current market conditions.

Covered calls only allowed if your account currently has the shares

Short puts only if you have the maintenance/cash to cover the entire exercise amount of the short puts

All other complex options orders will not be accepted

Saw the CEO of Robinhood just now on CNBC. Not impressed with his explanations.

I don’t use that platform – but users of it have a right to be FURIOUS right now.

What are the odds they follow suit tomorrow?

Or will they try to attract customers with the policy?

Which “they” do you mean?

TDA

If that’s TDAs current policy, I doubt it gets worse. Usually brokers’ risk dept overreacts up front and then walk it back over time. Given the TDA policy is pretty reasonable already, I doubt they do anything worse later.

I heard Fidelity wasn’t restricting trading either, so good on them.

Received an evening email from Schwab claiming that any disruptions of their service were due to the “unprecedented volume”.

Msm distortion, headline titles don’t match content at all.

The “not going to end well” is in reference to overvalued market in general… driven by existing and ongoing economic ZIRP.

(Paraphrase)“Funds shorting know the risk better than the little guy, don’t feel bad about them at all.”

(Direct quote, after repeatedly baiting to try to trick him into saying it was “bad”, and related direct refusals)“The only surprise to me, to be honest with you: Why they have not used this ridiculous price to raise some cheap capital as Elon Musk did in Tesla”

In fairness there seems to be a lot of intros with the same guy (Cooperman) where he is just throwing a tantrum… it’s strange theres like a concerted hit job on him with some spliced cuts of the video and text articles not matching the content??

Here’s another distorted “article” with the same source interview:

He said nothing at all in the interview about Gamestop prices to return to an artificially low “normal” level… nor did he say anything about “Reddit speculators” except that he saw nothing wrong with the retail traders.

And another:

And what is clearly a cut and spliced clip that is repeated across many articles, which cuts talking about stimulus payments and pastes it with a rant against raising taxes to make it look like he was cursing poor people wanting a fair share:

Is this all a couple hedge funds and their media partners just trying to drive misinformation or I’m missing something?

I’m not taking up for the guy (on any other things, I’m not familiar with him, and from very superficial research he looks like a “bad citizen” billionaire rather than a philanthropist…) but there seems to be a disconnect in all the “articles”.

Hmm I have a Fidelity account (never funded) that was required to attach my login to be responsible for a group ownership account with them. Maybe wire in (or “immediate transfer” if they still do that) a few $k tomorrow…

The ongoing shenanigans have surprised me, and converted my ![]()

![]() to

to ![]()

![]()

I would be up 28% on this trade if they had allowed me to make it.

I also keep a small balance in Fidelity ($4500). My reasoning is Fidelity works as Direct Deposit with CU $ Banks when needed.

I haven’t gone with stock for several years. My son keeps working on me in that money aspect. I used his advice & played around with $50k some time ago. Did alright, In the couple months I made $5000.

I know that the stock mkt is probably the way to go, but it makes nervous. ![]()

E*Trade Restricts Purchases of GameStop, AMC Shares - Bloomberg

Schwab clarifies ‘confusion’ over response to trading activity in stocks like GameStop, AMC and Express - MarketWatch

[Schwab clarifies 'confusion' over response to trading activity in stocks like GameStop, AMC and Express - MarketWatch]

The discount broker said that given the “confusion” about what it and its recently acquired TD Ameritrade have done in response to the recent trading activity, Schwab said: “Neither Charles Schwab & Co. nor TD Ameritrade halted buying or selling of ANY stocks this week. Neither firm restricted buying or selling basic options. Both firms did adjust margin requirements on select stocks to ensure clients had sufficient assets to pay for stock purchases. Both firms also restricted certain advanced options strategies.” For example, Schwab said it began on Jan. 13 the process of changing the margin requirement for GameStop’s stock to 100%, which means Schwab’s clients were restricted from using GameStop shares as collateral for a margin loan. Schwab’s stock dropped 4.9% in morning trading Friday. It has lost 3.6% year to date, while the S&P 500 SPX, -1.91% has edged up 0.2%.

Robinhood went from allowing 5 shares GME max position to 2 shares to a single share.

I hear you can short it at E*TRADE now, putting up 8x the current market price as margin requirement (800%).

Makes sense if they used up their new capital as collateral. Yesterday’s trade should all settle Monday, right, freeing up all the previous collateral?

51 securities. It’s funny though people can buy deep ITM calls and exercise…

An example of the type of clearing risks that potentially can happen. This is Nasdaq in Scandinavia not the US.

More on IB restrictions

Edit since deleted but included below, also with the below footnote missed in the screenshot

“ Note that all of the securities in the table are subject to a 100% Initial Margin Requirement. Short stock positions are subject to a 300% Initial Margin Requirement.”