Anyone have a pro membership? Time to lock in?

The auction results are in. Enna says the rate was lower than the prevailing rates on the secondary market. That’s the chance you take when you participate in the auction. The rate is still higher than his post 4 days ago quoted here.

The TIPS I bought last month have gained nearly 10%, as yield-to-maturity rates fell off a small cliff.

These were long term hold-til-maturity purchases, but I’m tempted to cash out and wait for the next swing down (meaning rates go up) to repurchase.

TIPS earned 2.44% per the previous article, I saw them as high as 2.6% on the secondary market, and now they’re below 2.3%. Treasuries were as high as 5.36%, but are now below 4.5% a month later.

I am also tempted to time the market. If you look at the display of this website, the short term rates have dropped 6 to 15 basis points for 3 and 6 month bills while the five year rate dropped 50 basis points.

I have some long-term tips in a retirement account that are underwater but a lot less so than they were a month ago. On Monday I think I’ll sell them and use the proceeds to buy tbills.

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

The bond market expects rates to go back to “normal”. But what does that mean? This article argues, correctly I think, that the last 15 years have been abnormal with the fed printing up huge amounts of money for quantitative easing.

Hampton: You’ve written that current bond yields are normal and lower rates before now were the anomalies. Talk about that.

Hansen: It’s kind of counterintuitive. During the pandemic, a lot of attention was paid, the Fed brought rates down very, very dramatically and then raised them very, very dramatically up from about zero to over 5% today. And that was a big change in a very short period of time. And a lot of people wondered when we would normalize and drop back to our prepandemic levels. But actually, strategists have pointed out that the years between the 2008 crisis and the pandemic were themselves abnormal. It has to do with a policy called quantitative easing, which is what the Fed used during that time to stimulate growth, and strategists say that it kept rates artificially suppressed. Over the past 60 years or so, if you take a much longer time horizon, yields have averaged about 5.9%-6.0%, which is actually higher than we are today. So, long story short, the last 15 years were the exception rather than the rule when it comes to rates and yields.

The problem with that argument is that the Fed didn’t have as good of a grip on inflation “over the past 60 years or so.” IIRC, the whole idea of targeting a 2% annual inflation as an “unspoken rule” wasn’t a thing until some time in the early 2000s. That’s when many leading economies became more stable. The Fed’s goal is 2-2.5%, and it’s not a secret. Unless some other, better theory comes along or proves this number wrong, they’re going to aim for that number. And since they’re telling us what they’ll do, and they’ll do what they say, we should expect long-term inflation in that range, and the long and short-term yields not too much above that.

EVERYTHING else being equal. Just two things that aren’t remaining equal - our deficit and debt.

Doesn’t everyone else with a sizeable and relatively stable economy also have the same problems? What’s a sovereign wealth fund gonna invest in, Rubles? Yuan? Doge?

If the Fed brings down the rates fast enough, that should reduce the deficit (lower interest payments).

There are many alternatives, such as investing in equities in their national economy and assets such as gold or commodities.

The interest payments on the US national debt are roughly $700 billion and the deficit is $1.7 trillion. So even with zero interest, the deficit is $1 trillion or roughly 4% of the US $26 trillion GDP.

I sure hope they arent using the deficit as the basis for setting monetary policy…

Long-term tips have recently had a real rate of about 2%. But they have been much lower and higher in the last 20 years. The question is whether the Fed will return to quantitative easing?

What are you saying? What do you think the interest rate on the 10 year treasury note will be in 2024?

IIRC TIPs have never been much higher than 2.4%…?

The real rate was close to 4% in the early 2000s. I own some of those.

I wasn’t making any predictions for any specific year, only saying that we should expect inflation to eventually be close to 2%.

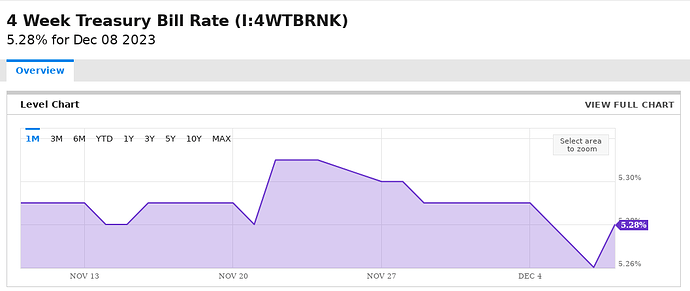

The 4, 8, 26 week TBills are drifting ever so slightly downward.

No they aren’t, not in any noticeable way more than daily fluctuations.

Not sure why I didn’t notice this before, but your style is very similar to Trump - make a declarative, and then add qualifiers. In this case, your qualifiers were immediately after the declarative, whereas with Trump, the qualifiers may come days or weeks later, usually after someone accuses him of saying something that he didn’t say.

Wow, thank you for pointing this out. I didn’t notice either. I shall try to better myself.

In this case I reacted this way because you made a declarative that wasn’t worth being made. The 1 & 2 month yields have been steady since July. I’ll grant you that the 6 mo is ever so slightly less than it was July-October, but it has been steady for a month now, so I don’t know what you were trying to imply with your declaration.

This chart appears to show auction results, not daily market par yields, such as the ones you can find here: https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202312

Even your graph only shows fluctuation between 5.26 and 5.32. Are you saying that’s not steady?