My knowledge comes from my days at creditboards, back when it was first getting going and well into the new design. What you’re saying is just an additional point to mine. I was simply stating that CK are “FAKO” scores and other sources are FICO. I’m not comparing CK to anything else, but StatGren was saying their CK scores were within an allowable tolerance to FICO scores, as if CK scores were a reliable indicator, relative to where their true FICO (lender used) scores were. Correct me if I’m wrong.

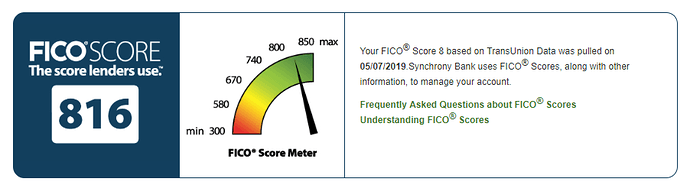

Even if a source claims to provide “FICO” scores, you really have no idea which FICO score is being used. FICO offers numerous equations geared towards slightly different purposes, and multiple versions of those equations.

In general, if your FAKO score goes up 15-20 points, your FICO went up similarly. It is a pretty reliable indicator, since the whole purpose of a FAKO score is to mimic FICO’s scoring.

And to note, an “indicator” is merely a good ballpark of where things stand and are heading, not a specific number you can bet on being correct. You cant look at a FAKO score and know exactly what your FICO score is.

Yet you weren’t making any references to the utility of looking at Vantage scores vs. FICO? Oh well.

The point that I’ve now made in many posts is that knowing your exact credit score, whether modeled by FICO 8 or Vantage, simply isn’t useful information. I do assert that given the exact same set of data at the same point in time, the two models are going to be fairly close within any tolerances that actually makes a difference. Scores are a snapshot and will vary considerably (sometimes even 20-25 points) depending on where in your billing cycles the snapshots are taken. Differences between the two models are responsible for less variation than simply the moment in time the data is taken.

But once again, no lender or credit card issuer will look at you differently at 821 versus 806 versus 832. They don’t care. If it drops to, say, 730 overnight, then something is afoot. And whether that is a FICO or Vantage … the same applies.

I think glitch99 makes a good point here . . . one with which I agree.

What is important to me is the currency of the free scores I obtain. This over how one service’s score relates to another from a different source. Case in point:

I posted the two services I did in the OP because I find them quite informative and reasonably current. Then it occurred to me that perhaps I had overlooked something important. Discover, after all, touts its free score service highly. And I had forgotten Discover when I did the OP.

Went into my Discover account and accessed my score. They showed me my score from over three weeks ago!! Worthless, at least to me. Stuff moves too fast for three week old score data, regardless which score they show me, to be of any interest whatsoever.

So I’ll stand by the providers mentioned in the OP, especially Credit Sense with its daily updates. That is the best service I’m able to access.

What utility is there, exactly, in comparing the two? I was never, ever comparing them. You did. I simply stated that CK scores aren’t reliable, IME, with regard to trying to get a feel for what lenders will see if they pull your credit.

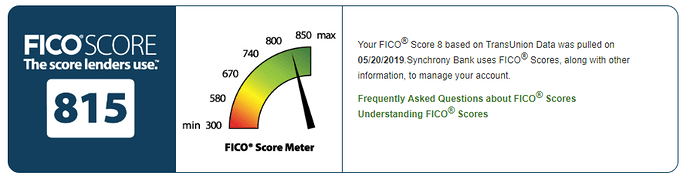

You can manually refresh this data from various providers. Synchrony being one of them. Not all, though. Top screenshot is from 5/7 and bottom is from today. Both using Synchrony.

This has happened with my CK scores numerous times, where FICO moves a few points from an inquiry or new account, CK will drop drastically. YMMV. I’m not saying CK’s scores are entirely useless, but in my experience, there have been some wide variations which make me uncomfortable using them as any sort of useful information. I have FICO scores available to me, so why wouldn’t I use those?

Merely updating here the OP in the interests of full disclosure. The two services I touted there might not be as good as stated. To wit:

As reported on another thread I experienced unfortunate “credit events” roughly two weeks ago. At that time three of my cards were closed down resulting in a bit less than $50k of credit line loss overall. Obviously I have been monitoring closely the services mentioned in the OP in effort to ascertain impact, if any. Outcome:

So far neither service is even aware of the account closures. I assume the guillotine will descend sooner or later and these services will duly report the events. But it has been a while. So neither service, it seems to me, is as up to date as claimed.

The data that the two services show you is an up to the minute reflection of your report at the credit bureau (assuming that it has been x days since you last requested a report, where x >= their allowed frequency). That is, I pull my CK every Saturday, and the data is up to the minute at the time it is pulled. But if I were to go to CK on the following Thursday, it would be five days old. But you know that part.

What isn’t up to the minute is the credit report at the bureau. It isn’t necessarily the case that the credit card provider reports closed accounts immediately. I keep a spreadsheet of my credit cards including date actually closed and the date reported closed and there is sometimes significant delay.

Perhaps the next time you pull a free report directly from the bureau, you can compare dates as a data point.

No monitoring service can report information that has yet to be provided. Pull your free credit report directly from the credit bureau right now, and you’ll find it doesnt have the closures reported yet, either.

The cards normally report once every 30 days.

^^^ Right, but new accounts and closures are sometimes reported sooner than that.

Thanks, guys, for all of your replies. I agree the credit bureau might not as yet know about my closed accounts, despite two weeks having elapsed. Or it could be something else. Whatever the reason, the impression I left in the OP regarding daily (or weekly) updating appears to me now not to be the case. Not all participants here are as sophisticated credit wise as you guys and I did not want to mislead anyone regarding timeliness of the reports.

It’s humorous at Chase. I log in and of course there is the bold, stark, warning “This account is closed”. Then I go into the Chase credit report service and my Chase account shows as open and good. There is not a dull moment in this life.

Only it is the case. What you got as your “new” report today is exactly what anyone else would get when pulling your report today. You’re being misleading by implying anything else.

Hopefully the other shoe doesn’t drop on some of your other credit lines once the closures do end up showing on your credit reports.

All right maybe I expressed that poorly. I agree the services cannot report information not available to them. As now reported on the other thread, where you participated, it appears there was (what I consider) a large amount of delay in release of public notice of my negative events. This is all new to me. I never got shut down before in my life, no less three cards all at once. Just hope the damage stops at three cards. We shall see what happens now that other credit grantors finally have access to my transgressions.

Yes, that is the concern now. News hit my report yesterday, at least at Experian. Anything could ensue going forward. My previously pristine credit record is now tarnished as never before.

Consider it a badge of honor. Remember, you aren’t inventing the wheel, plenty here deal with such things on a regular basis. Nothing’s tarnished, there is no other shoe to drop, no one cares about your supposed “transgressions”. Take the affected cards out of the rotation, and carry on. Your risk next month is no more than it was last month.

On another note: some cards DO report weekly, or before the statement closes. I believe Discover and Capital One report weekly, at least according to the CPB folks I work with.

Elan reports the end of month account status/balance, regardless of when the statement cycles.

What are the laws on reporting? I believe it’s pretty simple in that the requirement is to report ACCURATE information, not necessarily anything to do with timing or frequency, right?