TSLA is green

I just did a quick search on google finance for performance of other asset classes over 2022

Using ETFs as proxies:

GLD (gold) +0.8%

VNQ (reit) -28.3%

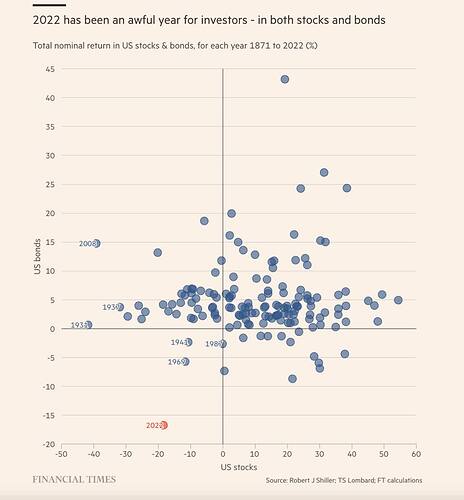

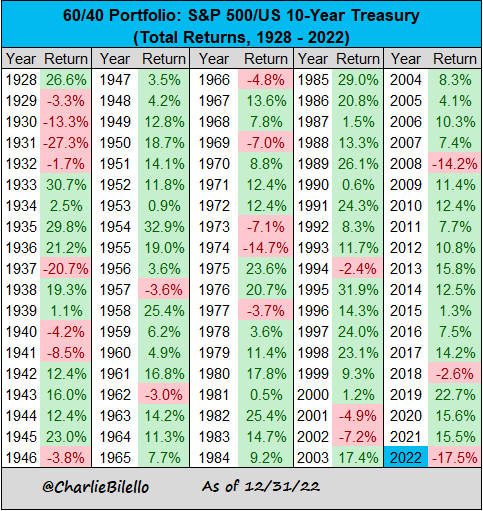

I guess @shinobi’s post aged well. Should have sold. Question is 2023 a repeat or another bad year for bonds AND stocks?

I think bonds will do ok, rates may rise a bit more than expected under the Fed but most of the move is already in so the yield will be more than any interest rate risk for short or medium term bonds and you’ll end up net. Not sure if it’s better to wait for further rises to become more expected or just buy some now, harder to say… so maybe half now and half later for bonds?

Not wild about equities even after this year. I think esp growth / speculative ones will do poorly as higher debt costs and tighter credit markets will push marginal companies into distress.

Wow, look at those returns! Years prior to 2022 had low inflation. The 2022 negative return should be decreased by the 10%+ inflation.

Since @shinbone is AWOL, I’ll answer in his words. The debt is big problem, and we’ll know the answer to your question in the fullness of time. ![]()

Yes only time will tell! Economy will probably get slightly better with new Congress.

I’m guessing shinobi has or had health problems. We all (myself) especially miss his thoughts popping up daily.  Thinking only the best for him.

Thinking only the best for him.

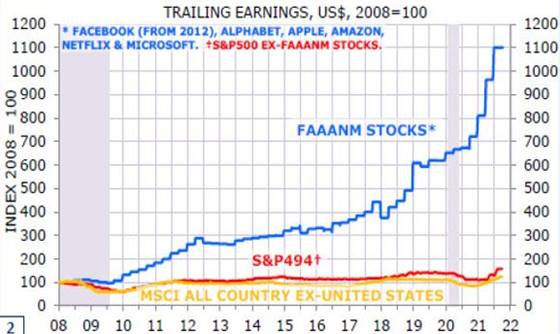

This ie earnings, not stock price, but interesting to see how the big tech companies have done vs everyone else.

Bearish, very reasonable take. Short interview

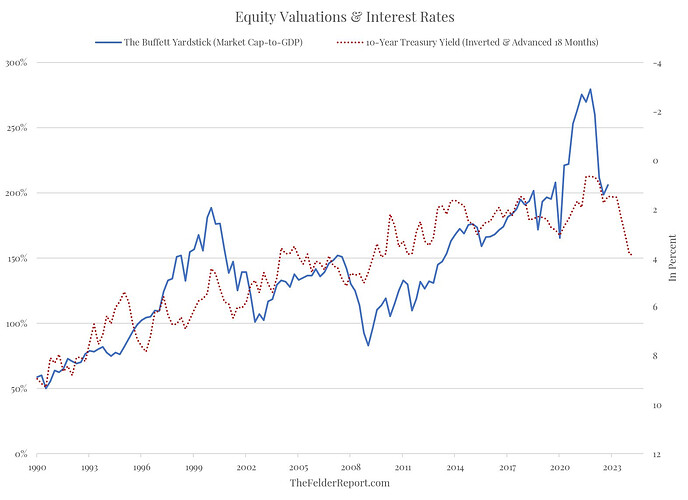

Rates are at historic highs, P/Es are medium, earnings look threatened by recession, where’s the upside?

claims equities move (opposite to) interest rates with a ~1-1.5 year lag. Had a nice chart which suggested this was not sufficiently done yet compared to the large rate hikes recently, and equities had further downside.

I don’t see the correlations. There was a huge run up in the stock market in 2020 and 2021 with almost no change in the ten year rate and a large drop in the stock market while the rate dropped about 80 basis points in the last few months.

enough liquidity, here from China and Japan, and maybe markets go up in spite of the Fed’s tightening efforts.

Liquidity = printing money. Question is, when to bail out and what to buy as shelter in the coming hyperinflation

ORLANDO, Fla., Feb 14 (Reuters) - The explanation for the whoosh higher in risk assets this year may be as simple as it is surprising: eye-popping liquidity from central banks.

Largely thanks to the Bank of Japan hoovering up domestic government bonds to keep its ‘yield curve control’ policy intact, and stimulus from the People’s Bank of China (PBOC), aggregate liquidity from the official sector has surged in recent months.

The answer is in the question – shelter!

Except that printing money is by other banks, not ours, so inflation risk is for their currency, not ours. And I wouldn’t buy shelter in China or Japan…

The United States certainly is printing money and will continue to do so.

Inflation in the United States is running much hotter than the fake narrative cooked up for the midterm elections. See the posts in the inflation/stagflation thread about the latest CPI and today’s producer price index numbers.

As a result, the equity markets are dropping today.

Recall the Wall Street saying that the little guys are always wrong? We shall see