Interesting…looks like EBSB once again discontinued their 2.5% savings account for new customers.

The $50k you have to cough up to play is darn steep.

But way things are unfolding I DO like that six month rate guarantee a whole lot!

Discover Savings up from 2.0% to 2.10% Apy as of today!

I have it (along with their Checking and also the CIT Bank Savings Builder which gets 2.45%)

Permissible purpose to pull your credit report is defined by the Fair Credit Reporting Act, and it is very much NOT limited to borrowing money.

Looks like you are a bit confused. The discussion that you were replying to was not about obtaining someone’s credit report. Yes, insurance companies, credit card issuers who want to make you a pre-approval offer, etc. can get your credit report in the absence of an application for credit. This is a “soft pull” and doesn’t affect your credit.

On the other hand, when someone obtains your credit report for the purposes of evaluating your request for credit (e.g. for a credit card, loan, but also where you are asking someone to take a financial risk with you such as a landlord), then this is a “hard pull” and is a factor in your credit.

The distinction between a soft and hard pull was the topic, and we should let it rest since it is off-topic in this thread.

I am very much not confused.

Your statement was incorrect.

“A hard pull should only be done when someone is requesting to borrow money. If a credit union does it for any other reason, they are not following the rules and should be avoided.”

FCRA defines the rules. You do not.

And I’m familiar with the difference between a hard and a soft inquiry.

StatGren was only stating what should or should not be a hard pull, and described one CRA’s rules as an example in this post, not disputing what is or isn’t legal under FCRA. S/he advocated for avoiding the credit union, not suing them for breaking the law (which they did not break).

I was (and am) only attempting to clarify and not to argue. I promise.

The linked Equifax blog article states: " Hard inquiries occur when a potential lender reviews your credit history because you have applied for a loan or a new credit card.".

This is true.

But it doesn’t say that this is the only activity that will result in a hard inquiry, nor does it state that there is any sort of a limitation spelled out in an Equifax guideline or rule, as has been suggested.

“Eating too much cheese will make you fat,” doesn’t mean that eating too much baklava will not.

Sorry for derailing the thread, but some of the statements that are presented as facts simply aren’t right.

Exactly and I admit the sentence Trism quoted is sloppy and too specific with the words “borrow money”. So let me try again …

If a financial institution pulls your credit report and states that the purpose of the inquiry is that you have initiated a desire for credit of some kind, then they are misrepresenting the business relationship you have initiated unless you are actually asking for a line of credit, overdraft protection, etc. which constitutes credit. I would avoid a CU that had a reputation for doing this.

I never said it didn’t happen, although I suspect data points on it happening could be inflated by those not reading the fine print and inadvertently asking for line of credit/overdraft/etc.

As a side note, I don’t believe FCRA covers the concept of “hard pull” versus “soft pull”. I believe that concept comes from those that do scoring models. Please point to specifics if it is covered there.

The issue of someone doing a surprise hard pull against someone’s credit report should be less frequent now that everyone can freely block hard pulls unless they have temporarily allowed it. If a credit union where I was opening a CD told me I needed to thaw my credit, I’d know something was up and go elsewhere. That’s all I’m saying.

That’s a worthy clarification. Thanks.

Thank you also for this thread. I consult it from time to time, and get value from the discussion… even when I’m just sitting here silent and grateful.

Citizen’s Access Savingsup to 2.35%

You might as well use the Vanguard Treasury Money Market, it’s exempt from state tax.

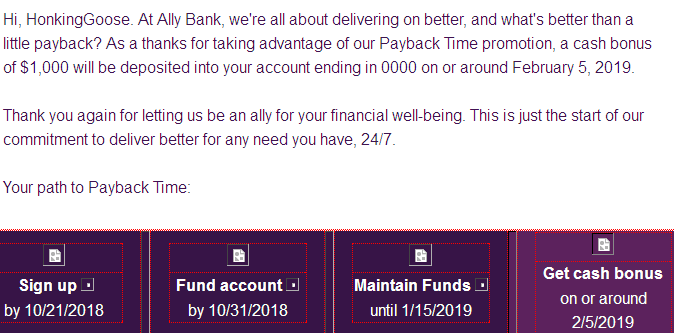

The Ally 1% bonus payments are secure, although they want be paid out until February. Funds are now liquid without endangering the bonus.

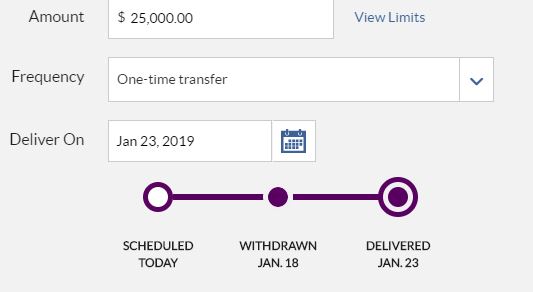

I assume that was email … I look forward to seeing mine show up soon. I’ve scheduled a transfer out for next Tuesday. Any time before that and there were as many as five days without any interest from anyone. I didn’t see any better way to play that.

Dang, I didn’t think about a pull from external being better than a push from Ally. I was going by the Ally timeline which shows that the debit at Ally would occur as many as five days before the funds are actually deposited elsewhere.

Update: I was able to enable pull from my external account instantly (i.e. no trial deposits) and initiate a pull for tomorrow. Thanks for the wakeup call, Shinobi!

Sure no bigee. I actually posted that several day ago.

The beauty using PurePoint, of course, is four days of DOUBLE interest. I’m a huge fan of double interest, aka, free money.![]()

The PurePoint policy of paying interest on money before they even have the money is so darn sweet. But never more so than when you have a Federal holiday to boost your joy.

Ally Online Savings now at 2.20%. But they are a couple of tenths short and two days late to keep my money. That’s their Ally oops, I guess.

Humor in the BNAHAPYLA. Starting 2019 off right.

For the Vanguard idea, if you use the brokerage account do you have an option of sweep account? The advantage of the brokerage account as I see it is that you get to have no minimum (and use as a de facto checking account as well as brokerage) but I think you are made to be in VMFXX.

This seems like a good option for those that are already in the Vanguard ecosystem.