I am supposed to get a buyer’s agent rebate for the first time and my agent is telling me they can’t do it because I’m already getting the max 2% closing costs from the seller. Doesn’t seem right to me but I’m not able to find much about it online. They swear it has to be on the HUD. Anyone know?

This is an automatically-generated Wiki post for this new topic. Any member can edit this post and use it as a summary of the topic’s highlights.

It should be on the hud. There’s no 2% limit but your lender may have a limit. If your seller/theiragent is not unreasonable, you should be able to modify the contract with an amendment. They have to choose to agree to it and basic math explanations need to go through (my broker said he had to walk the other agent through the math, but then was no problem. Yes most people are really stupid.) I can dig up mine for an example later today.

There were not enough prepaids to use up both loan credit and commission rebate and cash from close was not allowed. So, my broker had no problems with putting through a contract amendment reducing his commissions from closing and lower the purchase price an equal amount. I also moved “seller towards closing cost” to the price at the same time.

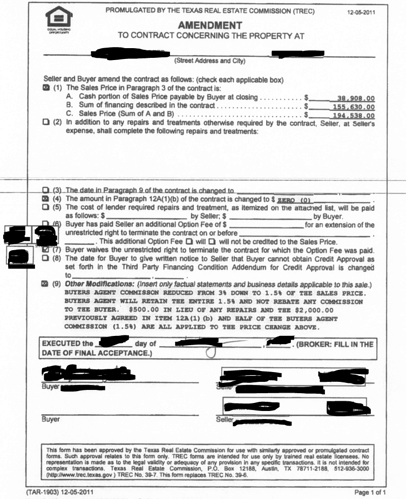

As promised, here is the amendment used on my contract to do something similar.

Details/Explanations:

Prior contract:

Sales Price: 200k

Seller to Closing (12A1b): $2,000

Repair adjustment: $500* (Well, not really “prior” in the contract, but was finalized here…)

House sales Contract doesn’t technically reference Buyer Agent Rebate, but that’s in the contract with my broker that I had for this one offer, at 1/2 up to 1.5%.

Lender adjusted origination charge (HUD-1): -$2100

With amendment (see image):

Sales Price: $194,538

Seller to Closing: $0

Buyer Agent Rebate: $0

Buyer’s agent commission from closing reduced: to 1.5% (vs original 3%) in this case.

Lender adjusted origination charge (HUD-1): -$2100

The math as my broker did it:

Old Net to Seller = ($200000 - $500) - 6% ($11,970) - $2000 = $185,530

New Net to Seller = $194538 - 4.5% = $185,784

How he figured out what to set the new sales price to make it work out = (200-2.5k) - 1.5% (the commission rebate) = $194,538

These are the steps he had to walk the other agent through. They should have no issue with it as the net is the same, it’s equivalent – the seller gets the same amount, both brokers do technically lose 1.5% of the “rebate” you’re moving to the purchase price so I wouldn’t bring that up specifically. Your agent should have no issues unless trying to scam you out of the rebate he already agreed to, if it was accurately defined in your contract with him. It’s not impossible that your agent is seeing $$$$ as an opportunity to double their pay from what you both agreed to, but I would NOT jump to those conclusions immediately. The title company had no issues adjusting things at closing. My lender had no issues when I forwarded them the contract amendment.

(The new net to seller is slightly larger because commissions paid are based on a lower sales price. But it was close enough for me and my broker figured it all out readily by himself, so I was fine with paying $250 extra and didn’t even bring that up. Could have came to an exactly “equal” net to seller if instead had set new sales price at $185,530/(100% - 4.5%) = $194,272.) Bonus for the first year is you may be able to get your tax authority to lower the assessed value to the purchase price for that first time without much fight, so you reduce your property taxes slightly as well (by ~$200 in taxes in my example).

EDIT: Additionally, if he/they don’t want to amend the contract. You could change your mortgage to a lower rate and pay points with the buyer’s agent rebate. I would guess your lender would have NO problem with the money going to the points/closing costs. There are just rules about the down payment not being refunded directly as money to the buyer at closing.

Thanks. I guess now they are saying I can take it off the purchase price with an addendum, but my lender won’t allow more than 2% closing cost credit (investment) and won’t allow the rebate to be applied to points. So I can’t get it as a cash rebate which is the whole point- if it’s off the purchase price it’s worth a lot less to me.

Depending on the state, a buyer’s agent’s rebate may be sent to you directly after the sale is completed, but I think it still needs to be approved by the lender. If your state allows it, but your lender does not, perhaps you need to find a better lender.