I took some of the ideas from my Roth Conversion thread into account with a few other ideas. Starting a new thread since this isn’t Roth Conversion specific and I want other people to be able to discuss Roth Conversion strategies in the other thread. Also, this will be a discussion based around optimizing for another variable social security (SS) credits.

It appears I will have 5 reasonable options for my 2017 taxes. I don’t have much self employed income this year since I took time off to create some IP to leverage in future years. It’s relatively easy to legally decide whether to take up to a few thousand dollars in business expenses by Dec 31 or not so once I pick my desired path, I can make sure the end of year numbers line up, legally.

Please do not assume I can shift expenses into 2018 when I may be in a higher marginal tax rate. In most of my specific cases, I am simply choosing to forgo taking a tax deduction in some of these options. It may be beneficial to declare more income than I need to, in order to qualify for certain things. I am not a lawyer, but there’s many things a self-employed person deducts such as a laptop that could be a business expenses, or personal, and I don’t think the IRS will find me guilty of overpaying my taxes by failing to deduct a laptop I bought in 2017. Not even sure what the penalty for overpayment would be.

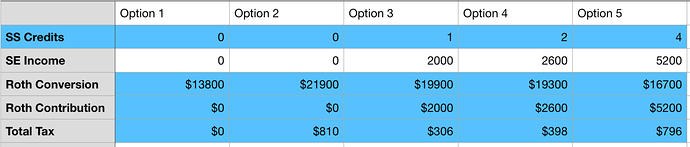

The image below is just the key numbers from my spreadsheet that matter in the analysis.

OPTION 1 - I declare no SE income. I can convert ~$14k of 401k money into Roth IRA, tax-free. I earn zero SS credits and contribute nothing into a Roth IRA (since I have no income and am not allowed to contribute).

OPTION 2 - I declare no SE income. I decide to covert more money into the IRA and pay some taxes, up to the 10% tier. I can convert ~$22k and pay ~$800 in taxes. Thus, I am paying $800 to convert an extra $8k versus option 1.

OPTION 3 - I declare $2k SE income. This allows me to contribute $2k into a Roth IRA for the year and earns me a single SS credit. I can convert ~$20k and pay ~$300 in taxes. This is because I now able to use the Savers Credit. Comparing this to Option 2, it’s costing me $500 more to perform Option 2 and convert $2k more in taxes, or 25%. So relative to this Option, Option 2 is crap, because the last $2k is at the 25% tax bracket.

OPTION 4 - I declare $2.6k of SE income. This allows a $2.6k Roth IRA contribution and earns 2 SS credits. Each SS credit in 2017 requires $1300 of earned income, and it might be worthwhile to declare an extra $600 in income to get one more credit. However, this comes at a cost of an extra $100 in taxes because 15.3% SE tax. So the question becomes - if I compare Option 3 and 4, is $100 worth buying 1 SS credit. I currently have 53 credits, which is more than the 40 needed for Disability coverage, but 20 of these credits have to be within the last 10 years.

I plan to early retire and I like the idea of SSDI (I am a libertarian, but I have been paying for it and wasn’t able to opt out, so yes, I plan to use if it I become legitimately disabled). Once I stop working, my SSDI coverage effectively can only extend a maximum of 5 years because SS Credits are capped at 4 per year. So in the best case scenario, once I stop working, I’ll have 20 credits in the most recent 5 years, which then extends Social Security Disability Insurance (SSDI) coverage another 5 years.

So effectively, each credit of SS is worth ~1/4 year SSDI coverage. Or 4 credits is a full year’s worth. Framing Option 4 in this way, is $400 worth one year premium of SSDI coverage. That seems pretty expensive, but only since I don’t plan on becoming disabled. If I do become disabled, I would currently qualify for $2k per month, for the rest of my life.

I have even considered continuing to do very part time work in retirement, just to qualify for the 4 SS credits each year, to keep my SSDI benefits in place. Perhaps every other year. Or perhaps I simply earn 2 per year, because the marginal cost of the second credit is much lower than the marginal cost of the 3rd and 4th, given the Savers Credit. I need a minimum of $2k of income to qualify for $1k savers credit annually, so I only need an extra $600 more for the second SS credit, versus $1300 more for each of the 3rd and 4th credits. SS credits will keep going up each year in cost, so the sooner I earn them the better, which brings us to the next option:

OPTION 5 - Declare $5,200 in income - earn the full 4 SS credits. Extend my SSDI coverage by a full year. Put $5200 into a Roth IRA. Convert $16.7k into the Roth. Pay $800 in taxes.

One final consideration - my SSDI benefits of $24k per year appear to be calculated based on my salaries of recent years. If I wind up shifting into early retirement and just declaring a few thousand dollars in income each year to keep my SSDI coverage active, it’s possible the annual benefit payout will be significantly reduced. I imagine there must be some bare minimum payout they give, but I have been unable to find exact numbers. I did reverse engineer the exact estimated SSDI payout I am currently eligible for, per my most recent SS statement online, and annual salaries do appear to be included in the calculation

Y’all correct me if my understanding of all this is incorrect.

Y’all correct me if my understanding of all this is incorrect.