That explains why the big brokerage firms have a habit of scooping up math majors from MIT. Do I think I can compete with those guys? No… no I do not.

I don’t agree that anybody day trading without a super computer is “good” at it. They may be luckier than the other 98%, but that only makes you lucky not skilled. Just like the coin flipper at the end of a contest with 100,000 people – the one who flipped more heads than anybody else.

You don’t have to believe me but don’t blind yourself to the possibilities by hanging out too much with the indexing crowd.

https://seekingalpha.com/article/2265943-do-day-traders-evidence-skill

The upside of being a successful trader is that you don’t need a boss and can do very well for yourself. The downside is most people won’t believe you, claiming you’re either lucky or taking big risks that just didn’t show up. You learn pretty soon to ignore the latter.

“But even the most skilled stock pickers in these studies are unable to deliver a return that covers a reasonable accounting for transaction costs. Thus, it remains an open question whether some individual investors can profit from speculative trading.”

That tidbit plus “Perhaps day traders profit by serving as liquidity providers on the Taiwan Stock Exchange, which is a pure electronic limit order market.“

Suggest to me that not only do most day traders suck, though some are obviously better than others, but that they don’t outperform the indexing crowd. And, also, that the “good ones” are benefitting from a market unlike the market in the US.

Well that is certainly true. Most active traders don’t beat the indexes either, but some do and do so persistently, like Renaissance Technologies and HFT hedge funds, maybe top traders like Buffet, Soros, etc.

I added another link to a discussion of the article (repeated below, as well as added to my post just above).

https://seekingalpha.com/article/2265943-do-day-traders-evidence-skill

There was persistence in performance among the top performers. This allowed them to conclude that there were some traders with skill (either that or they had inside information, or received information ahead of the general public). The top 500 day traders (based on prior year ranking) earn net abnormal returns of between 14 and 38 basis points per day (depending on the assumptions about the size of commissions) on their day trading portfolio.

That’s something like 65% annual returns, or better given their methodology doesn’t count margin or intraday reuse of capital. The good ones do very well, and while 17% beat costs in any given year, likely due to luck, 1% were consistently profitable from year to year.

In any event, what less than 1% of the Taiwanese day traders can accomplish on the Taiwan stock exchange is less meaningful to me than nearly anything I can think of related to personal finance.

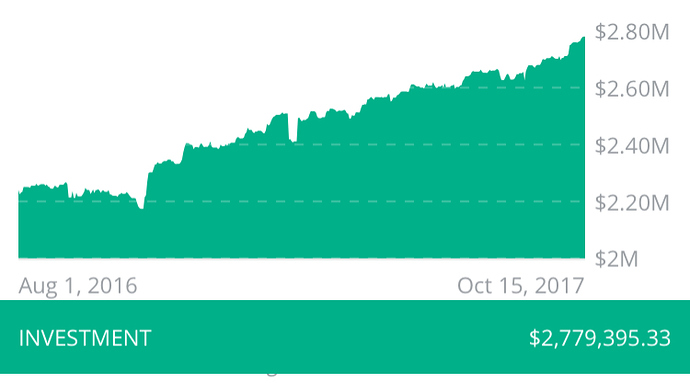

I have day traded in Apple and no doubt beat the market doing so. But, I don’t have $2.8 million invested in individual stocks, nor have I accumulated that by day trading. I am sure when you’ve been trading as long as I have you will no doubt accumulate a pile larger than that since you are very good at what you do.

I bought it mid 11/2016 and am up 29%. Complete speculation based on the POTUS.

Why not just invest most in BRK.b and buy few aggressive stocks in this bull market? I am not aware of any index funds that have consistently beaten BRK for past 10 years.

Any opinion on $TMUS? I’ve buying as it kept going lower. Finally, today buying momentum has started for $TMUS.

Hi all,

Is this thread dead? Can we move past the indexing vs not discussions and get back to stocks again?

Anyhow, I was just checking the fin sites and saw that chipotle is down 15% on bad news. Feeling tempted to enter into chipotle at below 280. I was eyeing this back in the mid to high 300s not many months ago and the traffic at the local chipotle seems to haave picked up to where I see lines again. Too early and still to high a multiple?

Also, T which is my dividened play is down to lows I have not seen in a while. Still producing 5%+ div.

Anyone? Hello. …elllo…llo…lo…o?

I’ve reviewed my past years’ portfolio performance and will continue to gradually convert out of individual stocks. 2015 and 2016 were less than stellar. My retirement accounts have almost caught up to my taxable. Watching F, tomorrow AM ER. Still my biggest holding. But it’s become more and more options and less and less stock, which I don’t like (more expensive transaction fees and carry cost). Planning to reduce F by 30-50% over next 3-12 months.

I’m bullish on the restaurant as a whole, but something stinks about the coordinated attack on the stock. I’m avoiding it personally because I can’t trust that all the players are acting transparently.

As a restaurant I enjoy their burritos over Qdoba but the general sentiment on the internet is the new queso sucks. It’s bland and gritty.

That combined with what feels like a non-stop food safety problem would put me off from investing in the company at all.

I bought 100 contracts of AMZN 1007.5 calls earlier today at $8 each. In my paper trading account. I stand to gain about $250k tomorrow.

way to go!

So if I had just dumped all my money into tech around the election I would be filthy rich in a few months

Twitter up %20

Goog - to the moon

Amazon - to the moon

Gild - Into the toilet

Bitcoin - to the moon

I have a pair of 11/3 AMZN 1000 calls in my real trading account, so I’m happy about the current price movement. I also hold a bit of GOOG.

At this point, I find it hard to invest out of big tech. They are massive, growing faster than any other industry, and vacuuming up the profits.

Maybe this is how people thought right before the tech bust but even looking at the fundamentals, it supports a lot of the gains in the past few years.