Where’s the state contribution to federal budget per resident rankings? Can’t talk about who is subsidizing who without those.

When states like Florida need assistance to deal with natural disasters, which states are the ones providing assistance?

Although I agree, the legal argument seems pretty weak and not sure why they’re wasting money and time. It’s like taxi companies suing uber instead of developing better ways to compete.

How?

I’d agree with all that. This lawsuit is really just politics and has little chance of succeeding.

But it caters to the constituency in the states in question …

I think state level arguments like this are misleading and usually deliberately politically divisive rather than constructive (not that you’re making that case). A particular state’s residents that pay more federal taxes, in aggregate or per capita, do so because, for whatever reason, their federal AGIs are higher. A state that pays less federal taxes does so because their residents earn less. In short, states with higher average incomes pay more federal taxes, which is the intention of our progressive income tax scheme. No one would complain about this at an individual level, i.e. That high earners pay more than low earners, and yet these tribal appeals at the state level about “we’re paying more than our ‘fair share’, unlike those states over there”, is basically arguing we should have a flat tax. Ironically, in the current environment, it is the people most in favor of heavily progressive taxation that are making those arguments.

Regarding the SALT deduction change, here’s a rough outline of the case for a rich person living in a high tax state before the tax change.

Federal tax 35%

State tax 10%

SALT deduction 3.5% (35% of 10%)

Marginal / net state tax rate 6.5%

Total tax 41.5%

And after with no SALT,

Federal tax 35%

State tax 10%

Marginal / net state tax 10%

Total tax 45%

The way I see this, the Feds were subsidizing those high tax states by allowing their high earners to pay 10% less (3.5% absolute) in federal taxes than the same rich person in a state without income tax. This allowed those states to charge higher income tax rates than people would otherwise tolerate since the Feds were footing a big chunk of the bill. This is/was a huge effect since the state in this example was able to charge 10% to residents who only had to pay 6.5% net, so the state was able to get 50% more revenues at the expense of the Feds.

Now that these high tax residents see their state taxes hitting at full face value, they’re not so keen on it being 10% or 13% or whatever. Property values are falling and pressures are mounting on their state politicians to reign in spending and run the state government closer to within their means.

Or, the rich ones can just leave since viewed another way, the high tax states just became a fair bit less economically competitive than they were before. If a high earner keeps 55% of his income after (35%+10%) taxes and instead moves to a no tax state where he keeps 65%, that’s an 18% bump in takehome pay. Sure, before this he could have moved and gotten 65%, but he was keeping 58.5% before so that would have only been a 11% bump and maybe the perceived advantages or economic opportunities were breakeven before.

but you had said:

So you were talking about the federal government subsidizing states.

Then when someone counters that the states in question don’t get as much back from the fed as they send it you say this discussion is misleading and political.

??

I think we should acknowledge that both arguments are legitimate. Neither are misleading or solely (or even primarily) made for the purpose of political divisiveness.

The first issue is the Feds subsidizing the states based on how and how much they collect in their revenue, what services they pay for at a state level vs a personal level etc, which seems weird and economically distorting.

The second issue is really about the Feds redistributing money to poor people from rich people, which they do nationwide but of course there are variations if you want to break it down to the state / local / personal level.

But arguing something like “CA pays more to the Feds than they get back, unlike TX” (not claiming this is true) isn’t a good argument in my mind for more federal subsidies of CA or less for TX. You need to look at the reason why that might be happening. if it’s because more people get welfare or Medicaid or something in one place, or there are more high income people in some other place paying more taxes, or there are more natural disasters getting federal aid recently, well, those are all high level policy decisions we’ve agreed on as a society to implement. So whining about the “disparate impact” at a state level (to borrow an offensive phrase from our last president), isn’t the same thing unless they’re proposing actually getting rid of the underlying policy that causes the difference, i.e. “we in CA don’t get as much in food stamps as those lazy Texans so we should cancel the whole program so they stop stealing from us indirectly via the Feds”.

At least that would be a reasonable (if self-centered) argument rather than just looking at differences in outcome and deciding they must be removed. Then again, maybe I shouldn’t be surprised some people think this way since a lot of left wing social justice these days is about noticing differences, ignoring the reasons behind them, and demanding policies to remove them.

Exactly.

deliberately politically divisive

The reason is because, on average, people in California make more than people in Texas. The primary reason for that is because California has a much higher cost of living, so employers must pay more. A significant driver of that is because more people want to live there.

When people make more money, the federal government gets more money. So higher cost of living increases the revenue of the federal government. There’s nothing sneaky or suspicious.

So when people leave California due to the removal of the federal subsidy (which it is certainly a federal subsidy), the cost of living will go down, housing prices will go down, and the federal government gets less money. Therefore, the subsidy does not cost the federal government 35% of the state tax rate.

You are not wrong. But you used a “state debt/resident rankings” to argue that some states can’t run a balanced budget. Using the same logic you presented in the quoted post, that chart should have been adjusted for the fact that those states have higher income populations and bigger economies, so the debt should probably be ranked as a percentage of that state’s economy or as DTI, not straight up dollars per capita.

Further, since society “collectively decided” (more likely it was decided for us) that education, healthcare, law enforcement and corrections should be funded by state and local revenues (that’s what almost all of the tax money is spent on), I’m not so sure that the redistribution of wealth by the federal government has a straight-forward math. In a way it picks winners and losers, i.e. not only do the states have to take care of their own poor with local taxes, they also have to take care of the poor in other states. I fully understand the argument about progressive taxation, and I’m going through this as a thought experiment. California may have more poorer people than Texas (as a percentage of the population), so it needs to collect more taxes (than Texas) from residents with higher income. So if Californians are taking care of a larger proportion of their own poor, why shouldn’t they get a break from the federal government?

Important to note that California has had a balanced budget AND a “rainy day fund” for a few years now.

I think we should acknowledge that neither argument is legitimate.

I think the argument that our complicated system of tax deductions and credits was created with special interests in mind and not the interests of the American people is much more legitimate.

GASP!

I agree with that.

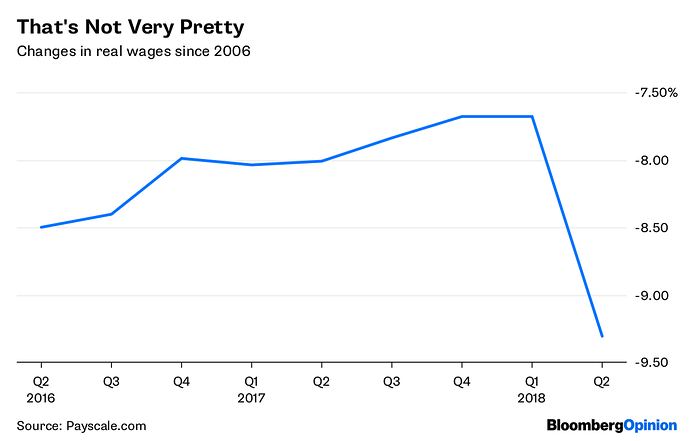

![]()

So much for the GOP’s promise that their tax cut bill (enacted at the end of 2017) would raise the wages of workers:

I don’t take issue with this chart. It’s important to note changes in wages. But I do take issue with your conclusion. Do you have any data that suggest the new tax law is responsible for a drop in wages? The tax law isn’t the only change that has occurred. Most of your other posts are about the trade war that this admin has started. Couldn’t that be a factor?

To be fair, however, it was dangerous for the GOP to promise that the tax cut would result in higher wages across the board. There are so many other factors that go into wages that they should have considered that this could happen. Especially with so much growth over the past 9 years. That’s a long time to go without a drop. Anyone that understands how cyclical the economy is should know that it is dangerous to promise growth after 9 years of growth.

Too bad for you I never made any such Straw Man claim which you ginned-up out of thin air.

But they DID !

That’s what I posted about. The GOP claimed it would increase the wages of workers, but not only did they not, they declined. Could not be any simpler.

I think you misunderstood part of my post as I did yours. I wasn’t denying that the GOP made that claim. I was calling them dumb for making that claim and not realizing it could come back and bite them in the ass. We’re essentially in agreement on that.

If I misconstrued your comment about the tax cut lowering wages and that’s not what you meant, I apologize. I read too far into it. My fault on that one.

Oh no, yet another broken promise.

The GOP had promised that despite massive tax cuts to corporations, no worries, corporate tax revenues would actually increase as a result of the GOP tax bill.

Ah, nope.

Corporate income tax receipts dropped by nearly a third in the first three months of 2018, the first quarter under the new GOP tax cut that slashed tax rates for companies.

According to the Treasury Department’s ‘Fiscal Service Bureau’, corporate tax collections were $16.6 billion from January to March. That’s down $7.9 billion from the same period of time in 2017, prior to the GOP tax legislation.

The U.S. federal debt has increased by more than a HALF A TRILLION DOLLARS in less than six months. The debt rose to an all-time high of $21.4 trillion. That’s more than $500 billion above the $20.88 trillion seen March 7, just a bit more than five months ago.