Discover’s Overdraft Protection Service automatically transfers money, you don’t have to do it yourself within a certain amount of time:

Which has saved my bacon once, sort of. For some reason, Treasury Direct wanted access to my funds one day before they were supposed to take them. I got an email from Discover and transferred the funds from savings, saving what might have been a real mess.

Did you ever find out the reason? In my experience they’re supposed to withdraw on the issue date, some time around 10am Pacific.

It’s because they need to have the funds credited before selling you a bond, so the transfer starts the night before your scheduled purchase date. It’s the same reason why when you do a same day purchase request, it isnt executed until the following day. Treasury Direct doesnt sell bonds on credit.

I don’t have Discover overdraft protection; I was writing about a different benefit that Discover checking offers.

Neither do I.

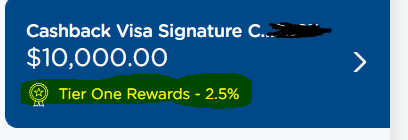

I noticed that Alliant added a new feature on their web site. It now shows if you are qualified to earn the max (2.5%) cashback on the Visa…

I’m not sure the penalties on the Discover side, but Treasury Direct’s site says they will only try to ACH once, and if it fails, your purchase just doesn’t happen, no penalties.

I notice that TD ACH’s show up on Alliants pending list a day or two before but they are dated for the date of settlement. Maybe Discover ignored that date. Alliant seems to carefully honor that date because we know they otherwise do near instant transfers…

With the bill pay software change, it appears all the historical check image data is gone. Has anyone been able to find them?

No but I haven’t looked very hard either.

Alliant would not let me mobile deopsit a check today. It said no eligible accounts. Super weird. I had to use BofA instead.

True… I’m disappointed ![]() with Alliant new bill pay system.

with Alliant new bill pay system.

Earlier this month I needed to pay my Citibank credit card. Luckily I didn’t wait until due date. I’ve used Alliant bill pay for eons. Didn’t work. After many attempts I finally called Alliant.

Alliant agent had me go online and he would walk me through bill pay. Nothing worked! After many attempts, he called another helper. Well long story but finally got my bill paid.

Why changes? “If it isn’t broke, why fix it?”…

Alliant Savings 2.35% → 2.5%

Had big problems with Alliant last week.

First, a scheduled transfer from checking to Alliant Visa apparently has been simply lost. I got an email that it was processed, it disappeared from the scheduled transfers list, but did not appear in the history of either account. Losing a transfer like that is pretty bad, but what’s even more upsetting is that I’m now on my 3rd message to them about it, and they haven’t even acknowledged the problem (No, this is not a normal posting delay. No, some other payments don’t make up for the lost payment.)

Then last Thursday I had another problem, this time scheduling an outgoing transfer to another bank - again looking like an issue on Alliant’s side, both on the web site and in the app. Sent them a message, got a response today, again totally useless.

Very disappointed.

Yes, seems Alliant CU new bill pay system has managed to flunk out. As I explained my problems with bill pay earlier, telephone complaints work better.

Even though I  managed to get my bill paid this month, who knows if Alliant’s new system will work when I need it next time.

managed to get my bill paid this month, who knows if Alliant’s new system will work when I need it next time.

I’ve never used bill pay. All my recurring payments are automatic, mostly on the credit card. I have just two items that don’t take a credit card, supplemental health insurance (paid from savings) and the power utility (paid from checking), although I’m able to pay half the electric bill on a credit card to the solar power operator.

How do you pay your credit card bills? That’s what the majority of my Bill Pay was. I decided to switch to auto debit to simplify it, but it’s annoying that Alliant “downgraded” the bill pay interface.

I don’t have credit cards on auto payment. I pay them before the statement date. Alliant is my main card so I transfer from savings to the credit card. For external cards, Amex lets me pay from savings. NFCU and Citi transfers from checking. I think I have Alliant set to pay the balance on the due date, but it’s never been used. I normally use just two cards, Alliant for most things, 1 of the other 3 for groceries, gas, restaurants, transit, etc.

FYI: Amex is 6% on groceries, Citi 5%, NFCU 3%.

Argyll. You omitted the fact that AMEX BCP has that 95.00 fee that limits the 6% to 6k which means a profit of 265.00 in grocery stores. I count my blessings that my family still has and use 3 OBC cards with 50k cap but 5% in groceries PLUS drugstores and gas stations. And fee free. When we got these OBC cards and also shut down way back, we were able to reapply for the same cards but with the cap. Ah the good old days of no cap and tons of WM MO. Shutdowns were back in 2006 or 2009? I was much younger back then. Now I’m an old fart but this stuff keeps my brain working, along with all the bank bonuses and Swagbucks. OBC can max out at 2400-2500 per year, on each card.

BTU - after chastising Argyll for omitting a mention of a $95 annual fee on his preferred credit card and then singing the praises of the AMEX OBC, you forgot to mention that for the first $6.5k spend each year on the OBC, you only receive 1% back max.