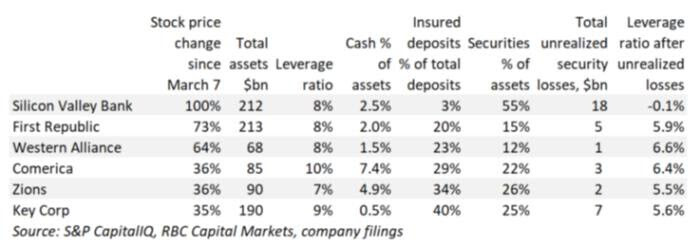

Other regional banks seem a lot better

Recaps on SIVB causes

https://us13.campaign-archive.com/?u=6dc62f307511d466ff78a94fe&id=f674156951

SBNY predicts their future

“In five years a number of banks will not be around because of blockchain technology.”

-Joseph DiPaolo, Signature Bank CEO, 2018

From the article

SVB is a casualty of the narrative that money printing does not cause inflation and can continue forever. They embraced it wholeheartedly, and now they are gone.

Fed considers stricter rules for larger regional banks.

the Feds who took over SIVB sold a chunk of their assets, about $25B of book value, to Goldman Sachs for nearly a $2B loss.

How much of that was profit to GS vs an already incurred loss on the holdings relative to book value isn’t said.

Matt Levine is excellent on the SIVB blowup, their risks, and the moral hazards and approaches to regulation that make sense now.

https://www.bloomberg.com/opinion/articles/2023-03-14/svb-took-the-wrong-risks

https://archive.is/PABDC

—-

they took duration risk, as banks generally do, but their real sin was having a concentrated set of depositors who were uninsured, quick-moving, well-informed, herd-like and very rates-sensitive in their own businesses: If all of your money is demand deposits from tech startups who will withdraw it at the slightest sign of trouble and/or higher rates, you should not be investing it in long-term bonds. This is a more subtle answer than “just hedge your rate risk bro,” and it is arguably more understandable that SVB’s executives would get it wrong, 2 but in any case it certainly ended up being a bad risk.

you should probably draw two related conclusions from SVB:

1.Regulators and supervisors probably should have stopped SVB from taking dumb risks, they missed something, and changes should be made so they don’t miss those same things again.

2.The regulators’ response to SVB — guaranteeing all depositors, but also the Fed’s Bank Term Funding Program to finance other banks’ bond portfolios at par 7 — increases the value of other banks’ optionality, which encourages them to take more risk, because their deposits are safer. (I suppose this is the real moral hazard concern.) And so there should be more regulatory and supervisory changes to tamp down the other banks’ risks.

one way to put it is that the post-SVB actions have made bank deposits a lot safer, which is a nice windfall for the shareholders of every other regional bank that has a lot of losses on held-to-maturity securities. And so in exchange for that windfall the regulators should regulate those banks much more strictly, which will make them actually safer (and reduce the government’s exposure to their risks), but will also reduce their profitability.

Another way to put it is:

As a matter of moral hazard, rescuing SVB’s depositors is fine;

As a matter of moral hazard, zeroing SVB’s shareholders is good; but

As a matter of moral hazard, the right thing to do now is to punish other risky banks’ shareholders.

jurisdiction issues around a full guarantee of all bank deposits. FDIC can’t do it under their mandate, needs to be Congress.

https://twitter.com/modestproposal1/status/1636075207222861827?s=46&t=aLnNvXf94c3vT5yA0Tuuhw

But will that stop them from doing it anyways?

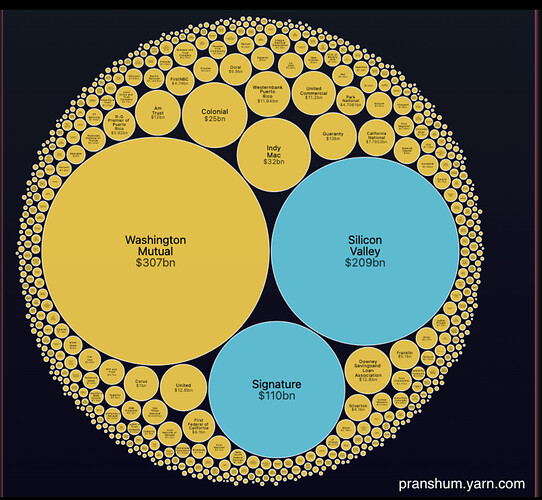

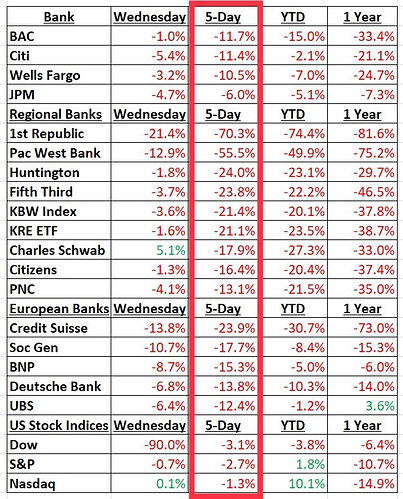

Carnage in the banking sector. Regionals and Credit Suisse especially hard hit.

Meanwhile, short term treasuries rallied to an extraordinary extent, pushing back up the underwater investment holdings of banks like SIVB.

collapse of Silicon Valley Bank and subsequent government backstop of the banking system. The rush sent Treasury yields tumbling. The yield on the 2-year Treasury was at 4.02%, down 57 basis points. The yield fell around 100 basis points, since Wednesday, marking the largest three-day decline since Oct. 22, 1987, when the yield fell 117 basis points**. The volatility continued Tuesday and Wednesday before the 2-year settled at 3.90 or 114bps from last week’s highs**

Criticism of the bailout of the rich, uninsured SIVB depositors.

—-

critics noted that while depositors including top-tier venture capital firms like Andreesen Horowitz and Sequoia Capital were bailed out, equity and bondholders lost everything because unsecured investors were denied protection under Sunday’s rescue plan.

The losers include big mutual funds that operate retirement accounts for ordinary working Americans.

Vanguard Group owned nearly 11% of SVB shares, followed by Alecta Pension Insurance Mutual with about 4.5% and Franklin Mutual Advisers with almost 2%, according to public filings.

On the other side of the ledger, 98% of all political contributions from tech workers went to Democrats, according to the Center for Responsive Politics.

A GovPredict analysis of FEC data estimated people living in Silicon Valley gave nearly $200 million to Democrats.

“You’ve saved the Democratic donors but who are the equity holders?” one tech insider said. “Retirement funds bought into this…many are policemen, teachers, firemen just trying to retire.”

Another tech insider said that although most in the industry felt the feds did the right thing, “This is a bailout… and the account holders they bailed out are Democrats.”

“Silicon Valley Bank is the bank of the Democrats…they’re looking after their own,” the source said. “If it was the Bank of MAGA, what are the chances it would be bailed out?

—-

In a similar p vein,

Silicon Valley Bank might have been able to make good on $74 million promised to customers had it not pledged the money to leftist causes.

According to a new database by the conservative Claremont Institute, the collapsed bank donated or pledged to donate nearly $74 million to groups related to the Black Lives Matter movement.

…” another indication that SVB was focused on woke virtue signaling instead of protecting their customers’ deposits.”

The bank’s promotion of ESG also includes climate activism. Last year, the SVB Financial Group pledged $5 billion in loans to support anti-emissions efforts by 2027. The project “aims to support companies that are working to decarbonize the energy and infrastructure industries

The thing here is that their collapse wasn’t due to having a woke agenda. Instead they believed inflation was going to be much lower and purchased large amounts of US government debt.

None of that argument holds any water. All the rabblerousing does is highlight a fundamental lack of understanding of the terms “depositor” and “investor”. I dont know if politics played a role in the depositor bailout, but there is a very clear line between the depositors and equity holders.

If there truly isnt anything at all left for equity and bondholders, their investment in this bank wasnt worth much of anything to begin with.

I think the point they were making is that the uninsured depositor base was very left leaning, regardless of who owned the stock. The guys over $250k knew the risks and took their chances, and when it went bad, the Feds bailed them out.

Yeah, they were blaming politics. But it was mostly complaining that they helped one group but not the other. There are very distinct reasons why there would be different treatment, that has nothing to do with politics. So the depositor bailout may or may not have been Democrats scratching each other’s backs, but that is unrelated to why it wasnt extended to the other group. Despite the attempt to rationalize why it should’ve.

Someone put the decimal in the wrong place for Dow ![]()