Medical tech startup using SVB - a first hand account of the bank run.

A bit more to the politics. CA governor pushed for the bailout - when several of his companies held uninsured deposits there. The bank had also donated six figures to his related charity.

Of course, it’s all Trump’s fault!

Actually, the article does a fairly decent job of calling out a lot of contributing factors, and [surprisingly] not pinning the blame on their favorite red herring.

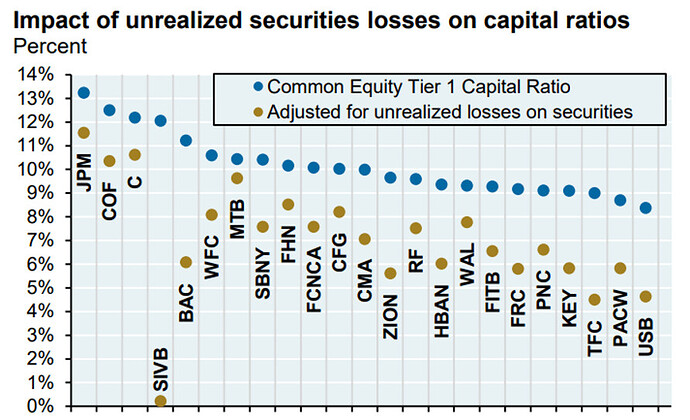

Dodd Frank laws, which were post 2008 to keep banks from being so risky, were rolled back in small part on smaller banks (including SIVB). I know the MSM and Dems are trying to pin this mess on Trump (or anyone but themselves, on their watch), but Dodd himself was in favor of this relaxing of the rules!

Here’s an interview with Dodd, who was on the board of the crypto related and now seized SBNY, and how it looks very much like NY regulators shut them down just because they didn’t like crypto (esp in the wake of SI getting liquidated) rather than because of some material banking issue.

The Biden regime had a white list of presumably sufficiently Woke banks that they would allow to take over Silicon Valley Bank

https://twitter.com/tomselliott/status/1635403691736854529?ref_src=

Kevin Hassett reveals “there were buyers who were willing to step in & buy [SVB, but] the radicals at the FDIC basically weren’t going to allow that to happen … the Biden Admin had a whitelist of companies that were allowed to buy the failed bank & companies that weren’t.”

I heard they weren’t allowing PE VC hedge fund type bids on these banks, only other banks.

A bunch of big banks are supporting FRC by depositing $5B each (JPM, C, etc) and keeping them there, uninsured, for at least 4 months. No word was given by what back room deal was cut with these banks to “voluntarily” do this. But it looks a whole lot better for FRC so I bought some more,

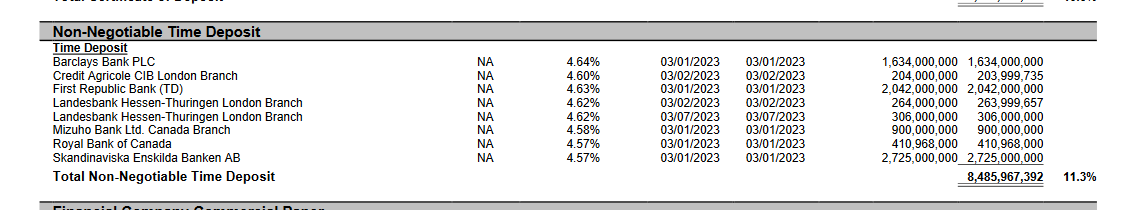

I will bet some of these institutions have money market funds or other exposure to FRC. I was looking at FZDXX’s composition this morning, and this popped up:

Total net assets on that fund are $75B. So about 2.7% of the fund is sitting at First Republic.

Presumably this is also the case for SPRXX? Since FZDXX is just the lower cost version of SPRXX.

It too has exposure to First Republic.

Perhaps I have too much faith in Fidelity’s fund managers, but I really doubt they “break the buck” on any of their funds unless conditions deteriorate significantly. AFAIK they’ve never had to do that.

Read on Yahoo Finance…Several major banks like Bank of America Citi Chase Wells Fargo amongst them just infused First Republic with 30 Billion Dollars…so i don’t think there will be a run on them ![]()

The Feds aren’t being exactly forthcoming on the SIVB troubles.

-

THE FEDERAL RESERVE HAS BARRED THE MENTION OF REGULATORY FLAWS IN THE SILICON VALLEY BANK RESCUE - NEW YORK TIMES.

-

OFFICIALS FROM THE FEDERAL GOVERNMENT WANTED THE JOINT STATEMENT TO MENTION REGULATORY FLAWS THAT THEY BELIEVE CONTRIBUTED TO THE BANK’S DEMISE - NEW YORK TIMES.

Bank humor

There are moments in history when our nation’s elected leaders have had to truly prove their worth during trying times. Today, just such a moment occurred, when members of Congress somberly paused sending all of our tax dollars to Ukraine so they could send them to Silicon Valley Bank instead.

“Think of the poor billionaire tech entrepreneurs,” said one member of Congress while replacing his lapel’s Ukraine pin with a Google logo pin. “We ask that our brothers-in-arms at Lockheed-Martin bear with us until we push this tax hike through while acting like we don’t want to push it through.”

“This is a tough lesson to learn — the school of hard knocks,” said SVB CEO Greg Becker. “After years of investing in woke tech startups that had terrible products, bloated staff, and no conceivable value whatsoever, it’s time to pay the piper by experiencing no consequences or accountability whatsoever. Thanks, Biden!”

“SVB performs an indispensable function in society,” Becker continued. “Without us, how would we fund wonderful start-ups pioneering Chinese facial recognition software, or dating apps for queer Communist paraplegics of color? We’re grateful for this difficult lesson we’ve learned and look forward to learning it again in a few years.”

Not my watch!

-

BIDEN HAS ASKED CONGRESS TO IMPOSE HARSHER PENALTIES ON SENIOR BANK EXECUTIVES WHO CONTRIBUTE TO THE FAILURE OF BANKS.

-

BIDEN ASKS CONGRESS TO EXPAND FDIC’S AUTHORITY ON COMPENSATION CLAWBACKS, INCLUDING FROM STOCK SALES, FOR BANKERS LIKE SIGNATURE & SILICON VALLEY EXECUTIVES.

-

BIDEN BELIEVES THAT IT SHOULD BE EASIER TO PUNISH BANK EXECUTIVES FOR MISMANAGEMENT AND TO RECOUP COMPENSATION - STATEMENT.

-

BIDEN ASKS CONGRESS TO GIVE FDIC MORE AUTHORITY TO FINE BANKERS FROM FAILED BANKS, AND BAR THEM FROM THE INDUSTRY.

SIVB bankrupt

No guarantee over $250k, so she says.

Under questioning, however, Yellen admitted that not all depositors will be protected over the FDIC insurance limits of $250,000 per account as they did for customers of the two failed banks.

No guarantee if your bank is not in Silicon Valley or New York City. See this exchange between Yellen and Senator Lankford of Oklahoma.

https://twitter.com/unusual_whales/status/1636675744767291393?s=20

He asks, “Will every community bank … get the same treatment as SVB?”

Yellen: “Banks only get the treatment if … the failure to protected uninsured depositors would create systemic risk.”

hmm so is there any REAL risk in Fido MMA?

OY VEY!!! Apparently only 10% of the buck stops at this guy’s pocket, and 0% at his desk. Alternatives …

-

CONGRESS HAS ASKED BIDEN TO START REGULATING BANKS / CONGRESS HAS ASKED BIDEN TO START LOOKING AT BANKS’ BOOKS/REPORTS.

-

CONGRESS HAS ASKED BIDEN TO INVESTIGATE/PROSECUTE BANKERS WHO DO NOT REPORT THE BANK’S ACTIVITIES.

-

CONGRESS BELIEVES THAT BIDEN SHOULD BE WILLING TO WORK, INSTEAD OF ASKING FOR THINGS TO BE EASIER FOR HIM.

-

CONGRESS TELLS BIDEN HE DOESN’T NEED MORE AUTHORITY, BUT IF HE NEEDS AMMO, TO QUIT GIVING IT ALL TO THE UKRAINIANS.