That is almost the exact opposite of what she is saying … unless you believe her, so far, perfectly inept omniscience.

Credit Suisse buyout / bailout in progress as trust in the investment bank collapses

You know it was part of the problem when the NYT has to run a “fact check” of the failed bank’s leftist ESG and DIE policies.

Silicon Valley Bank also was not an outlier in its diversity goals or its E.S.G. investments.

Clearly the conclusion is that these policies are widespread and pose a systemic risk to our banking sector and national security ![]()

maybe if they’d had a chief risk officer last year they might not have lost $15B in risky interest rate bets, but they couldn’t find a qualified black queer woman candidate for the position so they just kept looking.

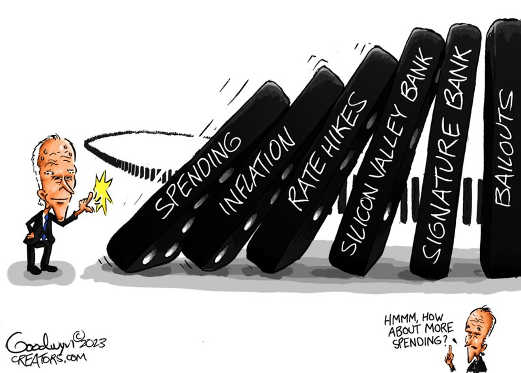

SIVB knew their risk mgmt sucked and did nothing, leveraging up their balance sheet for higher profits which worked until it didn’t. But by then, the execs cashed out millions in stock and the taxpayer is footing the bailout bill.

BlackRock’s consulting arm warned Silicon Valley Bank, the California-based lender whose failure helped spark a banking crisis, that its risk controls were “substantially below” its peers in early 2022, several people with direct knowledge of the assessment said.

The January 2022 risk control report gave the bank a “gentleman’s C”, finding that SVB lagged behind similar banks on 11 of 11 factors considered and was “substantially below” them on 10 out of 11, the people said.

The manoeuvre bolstered SVB’s earnings. Its return on equity, a closely watched profitability measure, increased from 12.4 per cent in 2017 to more than 16 per cent in every year from 2018 through 2021.

But the decision failed to account for the risk that rising interest rates would both lower the value of its bond portfolio and lead to substantial deposit outflows, said insiders, exposing the bank to financial pressures that would later lead to its downfall.

“Dan [Beck]’s focus was on net interest income,” said one person familiar with the matter, adding, “it worked out until it didn’t”.

the San Francisco Fed, which has oversight over SVB, also did nothing. Their president is also a queer woman-in this case white.

More on the regulators

—-

Just over a year before Silicon Valley Bank’s collapse threatened a generation of technology startups and their backers, the Federal Reserve Bank of San Francisco appointed a more senior team of examiners to assess the firm. They started calling out problem after problem.

As the upgraded crew took over, it fired off a series of formal warnings to the bank’s leaders, pressing them to fix serious weaknesses in operations and technology, according to people with knowledge of the matter.

Then late last year they flagged a critical problem: The bank needed to improve how it tracked interest-rate risks, one of the people said, an issue at the heart of its abrupt downfall this month.

The San Francisco Fed has a program for overseeing community and regional institutions, as well as a group trained to monitor big banks. As that one prepared to formally watch Silicon Valley Bank at the start of last year, examiners began sending the firm two types of warnings: matters requiring attention, or MRAs, and matters requiring immediate attention, or MRIAs.

While not disclosed to the public, MRAs and MRIAs are supposed to seize executives’ attention, requiring they fix problems to avoid more severe sanctions, known as consent orders. Those more stringent directives, once public, can send stocks tumbling by forcing banks to make costly improvements, pull back from certain activities or, in the extreme, stop growing.

The Biden administration found out about the full extent of SVB’s stack of MRAs and MRIAs on March 10, the day the firm was seized by regulators, according to people familiar with the matter.

—-

So the low level guys did their job and called out interest rate risk, flagged it as an immediate problem, and The Big Guy or whoever was supposed to make them fo something about it… didn’t. Blame Trump!

More on the Frisco Fed President

moral hazard strikes again:

-

BREAKING: MIDSIZE US BANKS ASK FDIC TO INSURE ALL DEPOSITS FOR 2 YEARS.

-

MID-SIZE BANK COALITION OF AMERICA IN A LETTER TO REGULATORS: DESPITE THE GENERAL HEALTH AND SAFETY OF THE BANKING INDUSTRY, CONFIDENCE HAS BEEN UNDERMINED IN ALL BUT THE LARGEST BANKS.

-

MID-SIZE BANK COALITION OF AMERICA IN A LETTER TO REGULATORS: CONFIDENCE IN OUR BANKING SYSTEM AS A WHOLE MUST BE SWIFTLY RESTORED.

-

MID-SIZE BANK COALITION OF AMERICA IN A LETTER TO REGULATORS: IF ANOTHER BANK FAILS, THE DEPOSIT FLIGHT WOULD ACCELERATE.

Thanks. Even the leftists politicians are throwing her under the bus to avoid any responsibility themselves.

- US SENATOR WARREN, WHEN ASKED IF SHE HAS FAITH IN SAN FRANCISCO FEDERAL RESERVE PRESIDENT MARY DALY IN WAKE OF SILICON VALLEY BANK’S COLLAPSE: “NO, I DO NOT” - CBS INTERVIEW

Shotgun marriage, Swiss style. CS was worth $8B in market cap last week - buyout talks of $1-2B, including many generous Swiss govt guarantees, would be a take-under -75% lower than its recent price. Sounds like I’m not short enough CS.

UBS will pay about SFr0.76 a share in its own stock, worth SFr3bn, up from a bid of SFr0.25 earlier on Sunday worth around $1bn that was rejected by the Credit Suisse board. However, the offer remains far below Credit Suisse’s closing price of SFr1.86 on Friday.

-

SWISS PRESIDENT BERSET: IT’S NOT POSSIBLE TO RESTORE CONFIDENCE IN CREDIT SUISSE.

-

CREDIT SUISSE: MERGER WILL BE DONE WITHOUT THE APPROVAL OF SHAREHOLDERS.

CS is also hosing some of their bond holders, who will get nothing despite the equity getting some UBS stock.

Bank humor

That’s only because Daly is from a different tribe. ![]()

A pretty easy read that semi-blames Dodd-Franky …

https://www.wsj.com/articles/another-banking-crisis-was-predictable-thomas-hoenig-fdic-interest-rate-duration-risk-bailout-svb-64e2cdac?mod=hp_trending_now_opn_pos5

The Fed knew the duration-risk problem was developing long before SVB hit the panic button. A second-quarter 2022 report from the Kansas City Fed notes that “since year-end 2019, U.S. commercial banks increased securities holdings by $2.0 trillion. . . . The increased holdings were in longer-dated maturities, extending portfolio duration and exposing banks to heightened interest rate risk.” The report notes that rising interest rates have “led to historically high unrealized losses on banks’ available-for-sale (AFS) securities portfolios.”

But thanks to regulatory capital rules crafted in Washington, there was a fix. Losses in securities that are designated “held to maturity,” or HTM, according to the rule, don’t need to be recognized when totaling regulatory capital. Those assets are counted by their value at maturity, not in the current market. “To mitigate the impact on regulatory capital,” the report says, the biggest banks “shifted the composition of their securities portfolio away from AFS” and toward HTM.

SBNY’s depositors are being taken over by NYCB, NY Community Bancorp. They bought some of the “normal” assets (loans, etc) along with the deposits, and at a nice discount it seems. The weird crypto stuff is being left behind for the FDIC to clean up.

“The deal included the purchase of about $38.4 billion of Signature Bridge Bank North American assets, including loans of $12.9 billion purchased at a discount of $2.7 billion. Approximately $60 billion in loans will remain in the receivership for later disposition by the FDIC.”

Broadly this is good for banking continuity of SBNY customers and bad for SBNY shareholders or creditors, since value is being given away to incentivize these transitions in the lowball asset sale prices. I’m more optimistic my short SBNY will be a zero in due course.

Post was deleted by the author.

HTM seems to be shady. Isn’t history littered with shenanigans regarding marks on assets? Like Enron marking to model instead of actual? Seems like it eventually catches up with you.

You get a bailout, and you get a bailout and you get a bailout!

US officials are studying ways they might temporarily expand Federal Deposit Insurance Corp. coverage to all deposits, a move sought by a coalition of banks arguing that it’s needed to head off a potential financial crisis.

Treasury Department staff are reviewing whether federal regulators have enough emergency authority to temporarily insure deposits greater than the current $250,000 cap on most accounts without formal consent from a deeply divided Congress, according to people.

Lotta bagholders whining about how their “alternative tier 1 capital” CS investments got wiped out. This was exactly the point of these AT1s / CoCo’s - when the bank gets in trouble, these high yield junior bond-like things get wiped out thereby raising the equity level in the bank and avoiding the need for a bailout. You got paid a fat yield for this risk and now it showed up. From a top fund manager:

It is absolutely clear. Low-trigger AT1s are further down the capital stack than equity capital. They clearly ranked below equity capital.

If you invested in AT1s thinking they were an ordinary preference share you were wrong. And you were wrong because you did not read the documents. The documents were readily available and spelled out the order of creditors in plain English.

What is not healthy for a fund manager is being wrong and blaming it on someone else. If you think the Swiss Government stepped in to muck up the order of creditors and thus inflict losses on you then you are delusional.

If you are a client of a fund manager that is blaming the Swiss Government for their loss then do not go into denial yourself. Respond appropriately. Fill in a redemption request now and redeem your full investment. It is your money. Do not leave your money in the hands of the reckless and deluded.

What did ex banks CS and SIVB have in common? More focus on climate change and DIE politics than actual banking risks, and we see where that got them.

Banking is an inherently very risky business. It takes a high degree of competence and focus to manage those risks. If you see a bank veering off into focus on “climate change” risk and Diversity, Equity and Inclusion, you know immediately that they have lost their way. The same applies to many other businesses as well.

Good coverage on the CS forced takeunder, half way down.

https://www.bloomberg.com/opinion/articles/2023-03-21/jpmorgan-had-some-fake-nickel

—-

If you are a national bank regulator and one of your biggest banks seems to be teetering on the edge of an uncontrolled failure, here are some things that are generally true:

1.You know that an uncontrolled failure would be bad for that bank, for its shareholders and creditors and depositors and other stakeholders.

2.You know that they know it.

3.You know that an uncontrolled failure would be bad for the rest of your banking system, and your economy, and the world’s banking system.

4. You are not inclined to run a risk of that happening at, you know, a 30% or 40% probability. “Ehh let’s see what happens, maybe it won’t fail, maybe everything will be fine”: not usually the position of the national bank regulator.

5. You will want to arrange some sort of rescue, preferably one where the struggling bank is acquired by a bigger and more solid bank, not-preferably-but-inevitably one where the national regulator and central bank provide some guarantees to the acquirer to further reassure the market.

6. You know that the bigger and more solid bank can’t really say no to doing the rescue: It also knows that an uncontrolled failure of the struggling bank would be very bad for the rest of the banking system, and for itself, and that you can make things particularly bad for it if it says no.

7. You pretty much have to do any rescue between the close of US markets on Friday and the opening in Asia on Monday: Doing it during market hours is too chaotic, and doing it overnight on a weekday doesn’t give you enough time.

8. Between the time that you start getting nervous and the time that you actually do the rescue, you have to put a brave face on things. “Struggling Bank is doing just great, its capital and liquidity are strong, it has access to very large but not at all panicky central bank liquidity facilities, what are you even talking about, why would anyone worry,” you say at the press conference on Wednesday, and then you go back to your office to continue arranging a rescue for the weekend.

This is all a pretty standard playbook for, you know, once-a-decade-or-two banking crises, but it is not really written down anywhere, except eventually in the memoirs of central bankers and regulators. Mostly for good reasons, there will not be a law saying, like, “if the national bank regulator is worried about a 20% probability of an uncontrolled bank failure, she can pick a different bank and force it to buy the struggling bank over a weekend, and name her own price.” It’s just, if you are the regulator, you kind of know you can do that, and you know that you should, and you know that the relevant bankers also know it.

And so if you meet with the chief executive officer of the struggling bank on Thursday and say “hey your biggest rival is gonna buy you this weekend at a 90% discount to your closing stock price tomorrow,” and he says “what, no, what gives you the right to do that,” you can just sort of stare at him for a minute and he’ll say “oh right” and agree to the deal.