One day? I thought 2 days was the standard for this feature (not that it matters much).

My employer is pretty consistently 1.5 days or so before the official post date.

My wife varies wildly. Sometimes it is the afternoon before, other times it is payday. I blame their payroll department which is something out of the 1960s. Up until 3 months ago, they had a “payroll lady” whose sole job was to manage everyone’s timesheets - on paper, mind you, even for salaried staff - and issue paper paystubs twice a month. That they offered direct deposit was a miracle.

They finally switched to an electronic system, only to realize that said payroll lady made a couple rookie mistakes when she generated W-2’s each year. We are expecting W-2C’s going back to 2020 and expect to owe about a grand in additional tax plus penalties.

Sorry for the off topic rant… needless to say the employer in question is public sector.

Ah! So your wife is who made me take an actual road test on my last license renewal. ![]()

I’m no financial advisor, but please read the article I linked. I don’t intend to keep even $2500 in the CMA, as you can purchase FZDXX (as @sullim4 mentioned) or some other mutual fund and it will be auto-liquidated as your CMA needs the funds.

ETA: You’re not limited to mutual funds, and I will also purchase CDs and Treasuries. The only additional effort is to make sure you’ll have the available cash necessary for your CMA needs.

haha! More like, she built the road you drove on. Close enough!

Since she’s married to you, I’m sure she’s not verifying the quality of I-12 in LA or I-40 between OKC and Tulsa - bumpity, bumpity, bump. ![]()

ETA: Those bumps are from 20 and 50 years ago, respectively.

No wonder you’re so cranky ![]()

![]() . I’d be pissed at the gov’mint too if I saw this level of incompetence my whole life.

. I’d be pissed at the gov’mint too if I saw this level of incompetence my whole life.

I wish that were my whole life. I’d have much further to go. ![]() FYI, it was easy to identify anyone on a CB radio on I-40 between Tulsa and OKC - They sounded like they were on an echo machine. Whoever got the bid for that stretch of I-40 cheaped out on the base. It failed miserably.

FYI, it was easy to identify anyone on a CB radio on I-40 between Tulsa and OKC - They sounded like they were on an echo machine. Whoever got the bid for that stretch of I-40 cheaped out on the base. It failed miserably.

Newtek Bank Savings was 5.15% now 5.25%

American First CU (via raisin) was 5.15% now 5.24%

Popular Direct Savings was 5.10% now 5.15%

CIBC Bank Savings was 4.67% now 4.76%

MyeBanc MM was 4.29% now 5.01%(above 100k)

FNBO Direct Savings was 4.15% now 5.15%

Smarty Pig Savings by Sallie Mae Bank was 4.00% now 4.25%

MyeBanc MM was 3.10% now 4.10%(belowe 100k)

Paramount Bank Interest Checking was 3.00% now 3.25%

National Cooperative Bank MM was 2.28% now 2.53%

New accounts(to me at least):

Modern Bank MM 5.20%(100k min balance required)

Modern Bank MM 4.40%(1k min balance required)

mph Bank Savings 5.00%(they also offer a 4.70% account through raisin)

Blue powered by Dime Bank Savings 5.10%(5k min balance required; not available to NY and CA residents)

Evergreen Bank Group Savings 5.25%($100 min required to open; no ongoing min; capped at 1M)

@sullim4, I’m going to change my CMA account on your advice. I just got off the phone talking with a Fidelity agent. We talked about 2 accounts FZDXX 5.15% and SPRXX 5.03%.

Your account is a Premium account that requires $100k to open. The other account requires less money to open. Since I already have $29k in the CMA account, I decided to open the SPRXX. After some time I may add more $$ to the account or I may change it over to the higher paying one.

Thanks ![]() .

.

Sounds good. Remember that FZDXX only requires 100k to open - once it’s opened, your balance can fall below that if you want. So if you do want the higher rate, you can move money over, open the account, and then transfer back.

Fidelity FDLXX is partially (around 90%?) state-tax exempt.

compare to FDRXX?

As @sullim4 said, once it’s open, you can let it drop to as low as $10k. IIRC, the main advantage of FZDXX is a lower expense ratio that SPRXX or most other Fidelity money funds.

FDRXX: 4.98%

SPRXX: 5.03%

FZDXX: 5.15%

FDLXX: 4.89% * 1.06 = 5.18%

So, if you can save at least 6% because of the state tax, FDLXX is actually better than FZDXX.

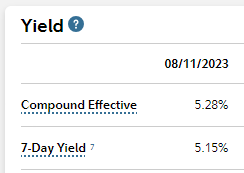

BTW, most money market fund yields are quoted in terms of their 7-day SEC yield, which is NOT directly comparable to the APY from a bank savings account. To compare the the savings account APY, you need to use the “compound yield”. For example, the following is for FZDXX as of 8/11/23

A bank savings account would need 5.28% APY to match FZDXX.

Here’s an article that explains it

For those with an Etrade brokerage account and live in a state with income taxes, consider using GABXX (a treasury money market fund). I use this fund for my liquid cash, and it consistently has the best yield, beating even the Vanguard funds. It’s expense ratio is 0.08%, which is lower than Vanguard’s retail money market funds.

GABXX’s current 7-day yield is 5.23%, with a compound yield of 5.37% (state and local income tax free). If your state income tax bracket is say 8%, the bank savings account would need to have an APY more than 5.8% to match this.

Thanks for the link. I follow that blog and had no idea it’s been around that long. Impressive.

Thanks ![]() so much for this valuable information. I appreciate the follow up. I’m probably going to change my Fidelity to the premium FZDXX, after these various remarks.

so much for this valuable information. I appreciate the follow up. I’m probably going to change my Fidelity to the premium FZDXX, after these various remarks. ![]()