I have funds coming free in two weeks, and plan to do the same. I think after Wednesday the top rates will clear 5%, but I get the feeling they will not stay there for too long. Treasuries have a steady downhill yield as you go from 1 year to 10 year timeframes, which I take to be a clear indication that rates are not expected to continue rising or to even hold steady.

I agree. The best longer term CDs are besting treasury yields.

Currently Fidelity has run out of the Discover 4.9% 5-yr CD but it is still available at E*trade. Make sure you select the non-callable option.

Discover has been putting out new issues every couple weeks (I bought some at 4.5% about a month ago). And Capital One and Synchrony have been available with similar rates too. I dont think getting something around 5% will be an issue for me. But if my money was available today, I probably wouldnt wait either.

Ameritrade still shows some of those Discover CDs available, along with a lot of 4.9% Cap1 options on the secondary market.

Brokered 5-yr CDs hit 5% today.

Banesco USA has a 12mo BaneSmart CD at 4.30% APY, $1.5k minimum deposit online, new money required. Available nationwide through online application.

Andrews FCU 5% 7 month CD

https://www.andrewsfcu.org/Learn/Resources/Rates/Share-Certificate-Rates

Going to guess you were referencing Numerica Credit Union with the comment you made back in September.

They are now at 5% APY for 48-59mo CDs: Checking & Savings Rates | Numerica Credit Union

I feel like the appeal of 1-2 year CDs is low at this point given where treasuries are… 4-5 year seems like the smart play, especially given the uncertainty around where rates will go as a result of a recession.

Shinobi, wherever he is, will be pleased to know that Numerica has an A- rating from Weiss, which heaps praise on Numerica’s 10/10 rating for asset quality.

Yeah, too bad it’s a local credit union for a defined membership area, However, even if I lived there, I wouldn’t buy this CD. I would say the odds are very high we are going to be looking at higher rates in January or February, so why pull the trigger now. I am going to be patient.

I agree with you on short term rates… but I’m not so sure about longer term CDs seeing significant rate hikes.

There has to be some belief that rates will stick around in this range for some time to see increases to the longer term CDs… and I have to believe there will be political pressure on the fed to halt hikes or lower rates if we slip further into a recession. That’s especially true with a Presidential election coming in 2024.

There might be a few financial institutions that take that risk and offer something like a 5.5% 5-year CD to get a lock on capital for a longer term, but I feel like we’ll see the leaders coalesce around 5% for the time being on 5-yr CDs.

You raise some good points that I don’t necessarily disagree with, however, I think the Fed can’t just pivot unless they see concrete evidence that core inflation is coming down. I don’t think it will for the foreseeable future because it has now become embedded in the economy due to a reinforcing wage price cycle. Labor markets are still tight even after 400 basis points of rate increases. No, it’s going to take a lot more work by the Fed to get this under control. If you were old enough in the 1970’s you would know what I am talking about.

If the terminal rate is north of 5%, which even the Fed admits will happen, there will be 5-yr CDs at around 6%. I think they are too optimistic. I wouldn’t be surprised to see a 6% federal funds rate early next year.

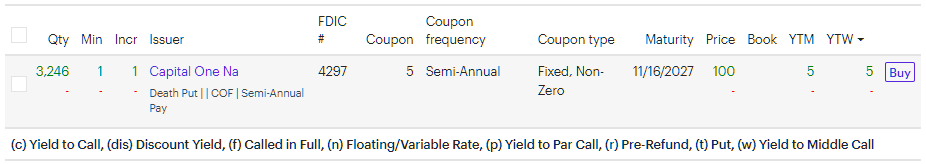

Those 5% brokered CDs (Discover, Capital One) have ticket a hair above par, lowering the yield to maturity below 5%. This doesnt exactly scream continued expectations of higher rates coming down the pipeline.

Maybe more patience will pay off, but maybe the early bird will have gotten the best worms…

Brokered CDs are not priced based on future expectations of CPI. They are priced on what market rates are today for a given CD.

Ken is featuring nationally available 3,4, 5, and 7 year CD’s paying 4.99% at Kansas State Bank. Interest is compounded and credited quarterly; earned interest can be withdrawn without penalty.

4.99% - LOL, they couldn’t bring themselves to make it 5%.

Well, yeah, but the market isnt overpaying for a 5% rate when they expect rates to go even higher in the near future. You can put whatever weight in it as you want (and I agree it’s just one anecdotal datapoint), but it’s still a counter-indication of higher rates to come.

Even more of a premium for brokered 5 year 5% CDs today pushing the YTM down to 4.8%, and Treasury rates are close to 4% for terms greater than 2 years and well under 4% for 5+ year durations. That’s quite a difference from just a week ago.

Interestingly, the 5% CapOne non-callable 5-yr CD is still listed on Etrade, but not available on Fidelity.

I don’t know how the market for brokered CDs works, but if I had to guess, there’s probably no central clearing house and each bank just allocates a certain amount to each brokerage. That would explain why one brokerage ran out before another.

SkyOne Federal Credit Union has a 22-month CD at 5.00% APY. Minimum opening deposit of 1K. Flexible penalty and fee-free one-time withdrawal up to 50% of initial deposit. Add up to 50% of the initial deposit and receive a one-time fixed rate bump of 0.25% APY (CD must be open for 9-months first). Easy membership w/ACC (and others).

hmmm this or TBills? (- AZ 2.5% tax)