I hope they keep them up until mid-April as I’m kinda tapped out of funds I could invest in their 5-yr CDs.

Salem Bank now has a 12-month eCD Special at 5.55% APY w/10k minimum/$500k maximum deposit.

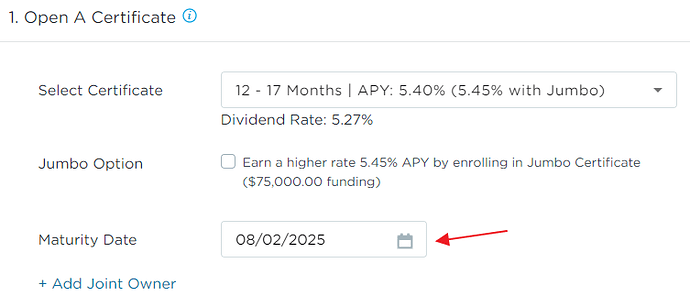

I’ve been trying to open a 17 month CD online at Alliant. It says 12-17 months but I have to click submit without seeing a specific term.

Click on “Maturity Date” to select a specific maturity date.

This is nice because you can avoid Saturdays, Sundays and holidays.

If I may ask, what’s the reasoning for locking in for a 17 month term now? I know my own thoughts, but like to see alternate perspectives as well.

Note that you can go as long as 18 months minus 1 day, so it is effectively 18 months.

Thanks.

As for glitch who asked why, if one wants a longer term CD, the 12-17 month one has the highest rate, i.e. 17 months, 29 days has a higher APR than the 18 month CD.

Right, but my question applies as much to an 18 month term as to a 17 month term, or to any intermediate term.

Looking for the highest rate for the longest period.

Something odd with Alliant. When I go to a CD I opened months ago and go to “Dividend and Maturity Options” and then edit the “Dividend Option,” it looks like it will let me change the maturity date another two months out. I initially did the maximum minus a few days.

Interesting. I see the same thing. But I didn’t try it out to see what happens. ![]()

I think what you’re getting at, is why get an N month CD now when there might be evidence of better rates in the future for N months? I don’t think anybody has a definitive answer to that. I personally opened up 3 CDs with Alliant at the highest available rates between 18 and 24 months. It’s very possible there will be better deals, but certainly things could get worse. And FWIW they have dropped slightly from Alliant. The 18 month jumbo was previously at 5.35% last week, but is now 5.20%.

What I’m getting at is that if there are better rates in the future, they’ll come well before 18 months is up. And if only gets worse from here, you’ll want to be locked in much longer than 18 months. In my mind, less than a year, or 3+ years, are the two plays for those two expectations. While the 18-24 month range only leaves you stuck in no man’s land, too long to take advantage of any additional increases yet not long enough to outlast a downturn.

If you think higher rates are coming, why wouldn’t you just wait it out in the 5% money market funds?

In my mind the short term rates are going to come down as soon as the Fed decides, so money market or very short T-Bills is also a slightly risky play. The longer-term rates might go up, but it could be a few months before that happens. You could try to thread this needle with something in the 4-12 mo range to protect both, the downside in the short-run and the potential upside in the long-run.

I agree with this. I do have some maturing in the middle range, just because I may need the funds. The last few times rates were expected to fall, there were plenty of good add-on CDs, so there was less risk of getting stuck in “no man’s land.”

This time, Mountain America seems to have the only decent add-on rates for mid to long term CDs and they’re 4.2-4.5%, which are quite a bit lower than regular CDs and have the restriction of $100K max across all their add-ons. Still, those rates might look good in the future, so they’re worth sitting on, imo.

Sure, that’s fair. My point was just that your question wasn’t direct enough, as I was just as confused as Agryll on what you were asking, hence his response.

Up to $50k at 6% for 8 months. Edit - Oops - appears expired.

Securityplus deal appears to be expired:

Online Only: November 20-30, 2023

I bought a 4.75% 49mo NASA CD in December last year. I redeemed the CD earlier this week, paying an EWP of about 40 days of interest and moved the money into the 5.4% 60mo Advancial CD.

NASA’s EWP does not eat into principal and that’s why I only had to pay an EWP in the amount of accrued interest so far. In contrast, know that Advancial’s EWP for the 60mo CD is harsher, 365d of interest which eats into your principal if you do not have sufficient accrued interest.