Yeah, weird. Maybe they should start selling bitcoin and CBD oil in the stores. Yeah, that’s the ticket!

Here’s my new co bubble ticker CBDBTCGME. I can’t lose!!

Has Cramer’s success rate ever caught up with the monkey and a dartboard?

Overstock.com tried to make itself a crypto company.

GME should still sell stock at these levels even if it would have been better to do at 250. The stock might be worth $20-$30 so it is lucrative for them to issue at these inflated levels.

Analyst implies government should ban all OTM call options, it’s a sign of manipulation if anyone purchases OTM call options.

This aged well…

Earnings are 3/23 pm. Will they announce a capital raise, a pivot to being a crypto NFT marketplace, or launch their own EV fleet to deliver pot by drones? Tune in to find out.

But that would force all government contractors to sell their shares!

They are crazy for not issuing shares. If I was the CEO I would be dumping shares on these retail investors and raising billions in capital.

I wonder about the CFO leaving. Was it because he wasn’t getting the stock sale done or otherwise annoyed the big investor? Or was it because he had 500,000 shares worth some $100M+ at current prices that he couldn’t easily sell as an insider and by quitting he could accelerate the time before he could be in the clear on cashing out? He officially leaves 3 days after those earnings come out.

Ownership Information: Bell James A (fixed)

Maybe it’ll just look better if he sells after he’s not employed so he won’t have to file anything admitting he sold? My quick read on the form 4 disclosure and section 16 rules suggest he would be in the clear to sell as soon as he’s judged not to have any material non-public and if he did so after he was no longer CFO, he wouldn’t have to tell anyone either.

That is a totally valid point.

If my stock in a company I worked for went from a pit of being worth $1-2M to well over $100M, I’d do everything I legally could get a significant fraction liquidated.

If that means leaving a corporate position – that is ultimate f-you money, so it’s a no-brainer.

He probably decided he’d rather cash out and be retired on a beach drinking margaritas. That is much better than trying to deal with the stress of a failed mall retailer that is being wiped out from online sales by Walmart and Amazon.

I seem to remember someone in a similar situation (big money, but not this GME big) got divorced and in the settlement gave their stock to their spouse, who had no inside info but sure wanted to sell it. I suspect they stayed together afterwards…

AMC is the new GameStop.

https://www.wsj.com/articles/amc-other-meme-stocks-turn-options-market-upside-down-11623144602

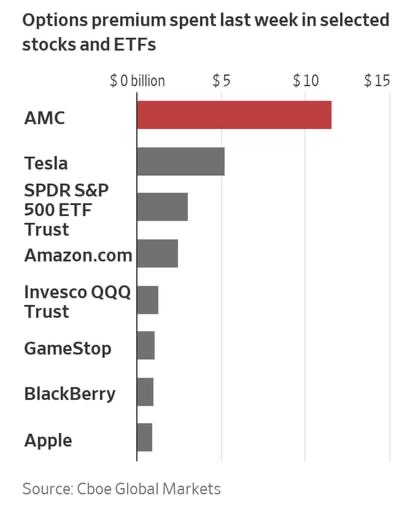

Traders last week spent $11.6 billion on options contracts tied to AMC, more than on the SPDR S&P 500 ETF Trust, Invesco QQQ Trust and Tesla Inc. combined, accord-ing to Cboe Global Markets data. Options on those stocks are typically among the market’s most popular.

I’m hoping! ![]()

GME if they ever get their earnings positive (by selling NFTs or something), they are big enough to be eligible for going back into SPY.

I’m still shockedd the stock has remained so high. It shoulda dropped down to $10-20 by now as far as I’d think. Shows what I know and why I stick to index funds mostly nowadays.

I’m with you entirely. I don’t understand how their business model can be successful now or going forward which I’d expect would weight down the stock valuation but that’s also why I don’t trade in individual stocks usually.

I believe the management took the good opportunity with their stock so high to raise capital. So thats allowed them to prop themselves up. I don’t think their business model was any kind of abject failure to begin with. There is still good market for used & physical video games and video games are a massive industry. Everytime I recall going to to Gamestop in person in teh past few months there have been a few people in the shop… I don’t see them going bankrupt and they’re probably much healthier now than before their fake bubble. But still real valuation still is nowhere near $200